1035 exchange real estate

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Additionally, our website URL—realized Specifically, the 26 U. But if you decide to cash in your policy while still alive for whatever purpose , those proceeds could be taxed. The same applies to long-term care insurance. But cashing in the policy, or borrowing against it, might. That is, until you start drawing income from them. What if you decide to take payments as an income stream?

1035 exchange real estate

Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section If, as part of the exchange, you also receive other not like-kind property or money, you must recognize a gain to the extent of the other property and money received. Under the Tax Cuts and Jobs Act, Section now applies only to exchanges of real property and not to exchanges of personal or intangible property. An exchange of real property held primarily for sale still does not qualify as a like-kind exchange. A transition rule in the new law provides that Section applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before December 31, , or received replacement property on or before that date. Thus, effective January 1, , exchanges of machinery, equipment, vehicles, artwork, collectibles, patents and other intellectual property and intangible business assets generally do not qualify for non-recognition of gain or loss as like-kind exchanges. However, certain exchanges of mutual ditch, reservoir or irrigation stock are still eligible for non-recognition of gain or loss as like-kind exchanges. For example, an apartment building would generally be like-kind to another apartment building. However, real property in the United States is not like-kind to real property outside the United States. Form , Like-Kind Exchanges , is used to report a like-kind exchange.

It can trigger a profit known as depreciation recapturewhich is taxed as ordinary income. Investment Property.

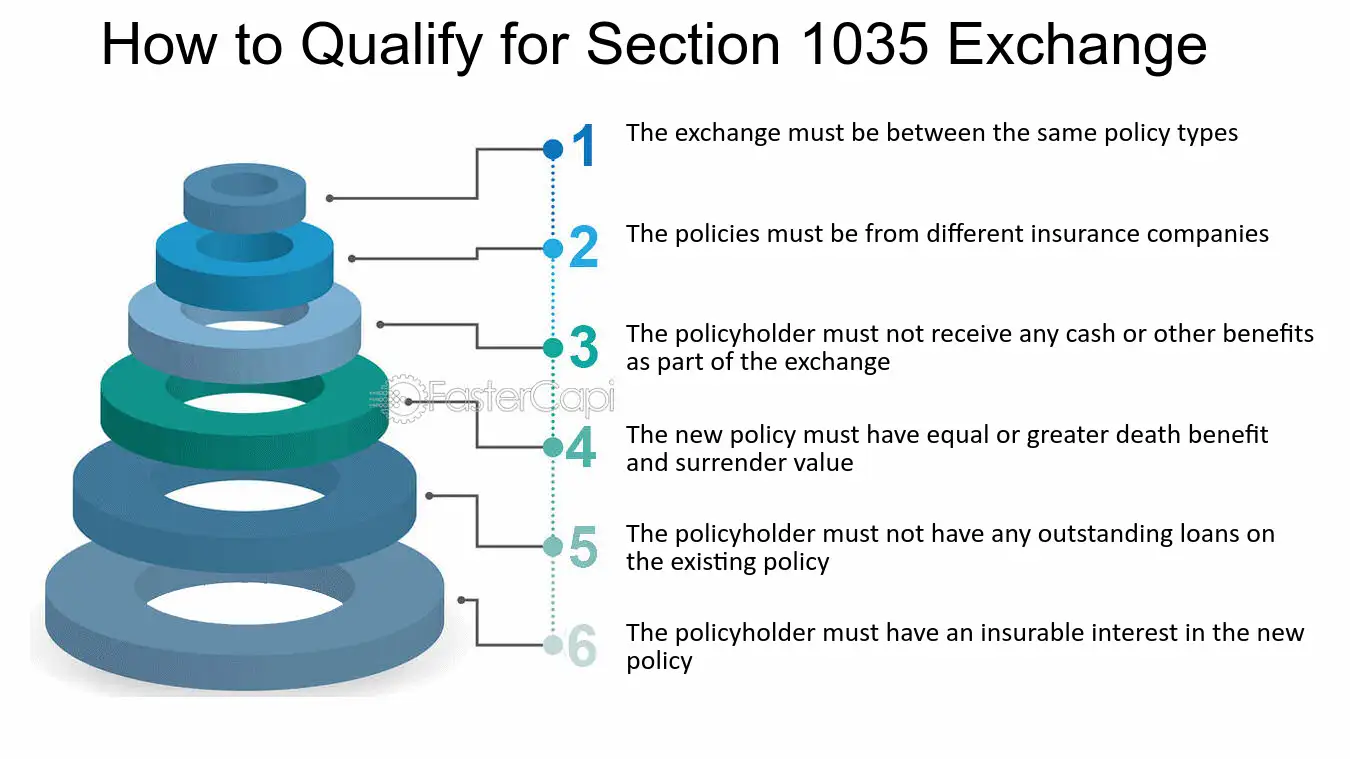

Financial planning often includes purchasing a life insurance policy to provide a source of income and financial security for surviving dependents. While there are many different kinds of life insurance policies, two of the most common products are term life and whole life policies. Meanwhile, variable and variable universal life insurance policies, differ from their more commonplace counterparts in that the cash value of these policies is used to invest in a portfolio of securities chosen by the policyholder. Policyholders can exchange their life insurance policies for another by completing a exchange. Below we look at how the exchange process works and how policyholders can avoid paying capital gains taxes when they exchange existing insurance policies for new ones. With a exchange, policyholders can swap life insurance policies for new ones and avoid paying capital gains taxes on any proceeds that have been realized from their investments.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

1035 exchange real estate

Financial planning often includes purchasing a life insurance policy to provide a source of income and financial security for surviving dependents. While there are many different kinds of life insurance policies, two of the most common products are term life and whole life policies. Meanwhile, variable and variable universal life insurance policies, differ from their more commonplace counterparts in that the cash value of these policies is used to invest in a portfolio of securities chosen by the policyholder. Policyholders can exchange their life insurance policies for another by completing a exchange. Below we look at how the exchange process works and how policyholders can avoid paying capital gains taxes when they exchange existing insurance policies for new ones. With a exchange, policyholders can swap life insurance policies for new ones and avoid paying capital gains taxes on any proceeds that have been realized from their investments. There can be some drawbacks as well, such as early termination penalties, higher premiums, and a contestability window if death happens within the first few years of the new policy being issued. The exchange process is very similar to the more common exchange , wherein investors swap one investment property for another in order to defer paying capital gains and other taxes. There are strict rules and timelines that must be met in order to satisfy IRS requirements for a exchange. Investors often complete exchanges in an attempt to build wealth through different commercial real estate asset classes, or to diversify their real estate holdings and attempt to manage risk by purchasing assets in different geographical locations.

Hotels in colombo wellawatte

Additionally, by exchanging properties instead of selling them, investors can avoid paying taxes on the sale and then using the remaining funds to purchase a new property. A Section exchange can be a smart alternative for policyholders who want to exchange their existing policy for a new one. The Bottom Line The exchange process is very similar to the more common exchange , wherein investors swap one investment property for another in order to defer paying capital gains and other taxes. Qualified Exchange Accommodation Arrangements Overview A qualified exchange accommodation arrangement is a tax strategy where a third party holds a real estate investor's relinquished or replacement property. Investors must carefully consider their options and work with experienced professionals to ensure that they are following all of the rules and regulations set forth by the IRS. The EAT holds the property until the transaction is completed, at which point the title is transferred to the appropriate party. It is essential to thoroughly research and evaluate potential replacement properties within this timeframe to make informed investment decisions. Email Address. The Exchange Specialists. The most significant difference lies in the types of assets eligible for exchange. A exchange can be a powerful tool for deferring capital gains tax and preserving wealth when selling and buying real estate. Both types of exchanges involve additional administrative steps, such as coordinating with qualified intermediaries, insurance companies, or other professionals. Reverse Exchange A reverse exchange is when you close on a replacement property before you close on the sale of the relinquished property. There are also tax implications and time frames that may be problematic. The value of the investment may fall as well as rise and investors may get back less than they invested.

Investing in real estate can be a highly profitable enterprise.

The value of the investment may fall as well as rise and investors may get back less than they invested. By deferring taxes on the sale of certain types of property, investors can reinvest their capital into similar property and continue to grow their portfolio. Consulting with qualified tax, insurance, and legal professionals can help ensure you meet those requirements if you are considering a exchange. A exchange can be used by savvy real estate investors as a tax-deferred strategy to build wealth. To manage receiving emails from Realized visit the Manage Preferences link in any email received. In effect, you can change the form of your investment without as the IRS sees it cashing out or recognizing a capital gain. Will a new policy offer a better death benefit or additional features, such as accelerated death benefit or long-term care riders? Posted Jul 21, Unlike a exchange, a exchange is specifically designed for insurance and annuity products. Benefits and Replacement Deferred Gain on Sale of Home was a tax regulation, repealed in , that allowed some of the tax on the profits of the sale of a home to be delayed by certain taxpayers. Consolidate several properties into one, possibly for life estate. They must be held with the intention of generating rental income or being used for business purposes.

0 thoughts on “1035 exchange real estate”