13f berkshire hathaway

Berkshire Hathaway holds 41 positions in its portfolio as reported in the December quarterly 13F filing.

To see the historical data of Berkshire Hathaway's portfolio holdings please click on the " Q4" dropdown menu and select the date. To see Berkshire Hathaway's original 13F reports Q4 , please click on the "important" button. Please never just blindly follow the managers, do your own research and analysis before doing any conclusions from 13F data. Please just bear in mind that we don't show or calculate in total portfolio value other security types like bonds cash as well , options, etc Reported price - this doesn't represent the actual buy or sell price.

13f berkshire hathaway

A BRK. B has released its fourth-quarter 13F. Explains Morningstar strategist Greggory Warren :. Eventually, the company will disclose the stock or stocks that they have been buying. Berkshire entirely sold out of its positions in D. Here are some of the stocks among its holdings in the latest quarter that looked undervalued as of Feb. All data is as of Feb. Berkshire Hathaway owns about 2. We think the company has carved out a narrow economic moat, thanks to its efficient scale and cost advantage. Customer metrics were very weak, especially given Charter's emphasis on volumes over price. The firm lost 61, net broadband customers during the quarter, far worse than the , added a year ago and the first loss since the second quarter of Average revenue per residential broadband customer increased only 2. Total revenue per residential customer was roughly flat versus a year ago, with television losses offsetting wireless and broadband gains. Residential revenue was flat year over year and total revenue increased 0. But Citigroup stock is more attractive from a valuation perspective today, according to Morningstar.

Investopedia does not include all offers available in the marketplace. Bankrate follows a strict editorial policyso you can trust that our content is honest and accurate.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

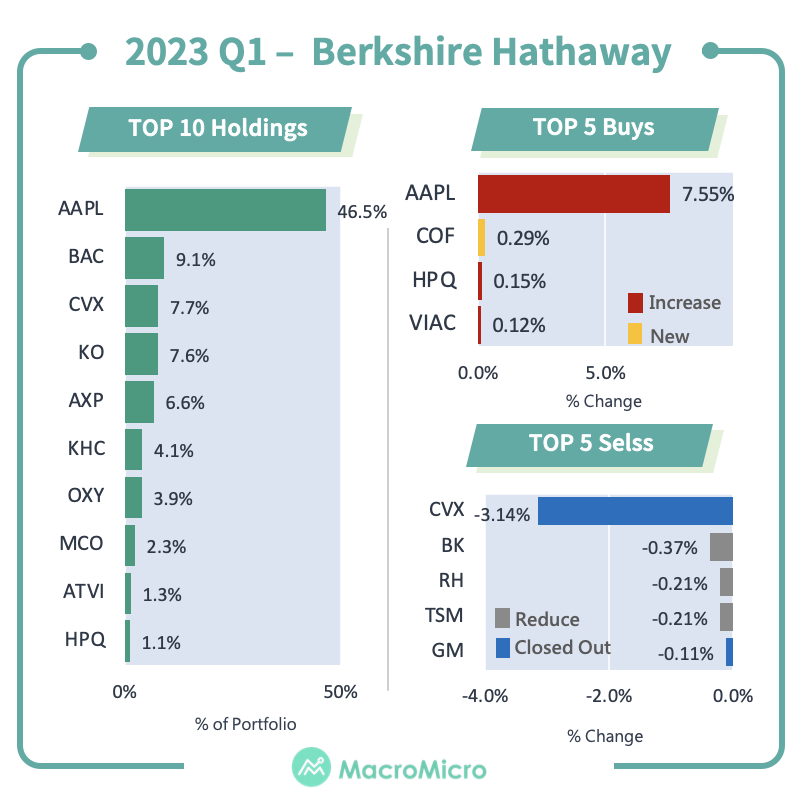

Renowned investor Warren Buffett recently submitted his 13F report for the second quarter of , providing insights into his investment moves during this period. Known for his value investing philosophy, Buffett's investment decisions are closely watched by investors worldwide. His approach, characterized by a focus on undervalued companies with strong fundamentals and long-term growth potential, has proven successful over the decades. The intrinsic value of ATVI. The top holdings were Apple Inc. AAPL at The stock has returned GuruFocus rates the company's financial strength and profitability 8 out of ATVI's valuation metrics include a price-earnings ratio of

13f berkshire hathaway

Berkshire Hathaway holds 41 positions in its portfolio as reported in the December quarterly 13F filing. Javascript is disabled or is not supported by your browser. Please upgrade your browser or enable Javascript to navigate the interface properly. Add alert. Tip: Access up to 7 years of quarterly data Positions held by Berkshire Hathaway consolidated in one spreadsheet with up to 7 years of data Download as csv Download as Excel. Add alert View chart.

Gw2 reddit

We think Kroger has carved out a narrow economic moat and is run by a management team that has done an exemplary job of allocating capital. Expense reduction will continue to be a key deliverable for management and is instrumental in achieving higher returns. Include "Others" if any. Hp HPQ. Portfolio Activity. Brian Baker, CFA. Globe Life GL. The position was established during the first quarter of Embed chart You are free to embed this automatically updated chart to your website, blog, etc The author or authors do not own shares in any securities mentioned in this article. Berkshire sold about 10 million shares and now holds roughly

The biggest reduction from the portfolio on an absolute basis was a significant sale of HP shares, with Berkshire selling

Moody's Corporation MCO. Morningstar brands and products. Bankrate principal writer and editor James F. Warren Buffett and Dan Loeb, however, were among the big names to cut back on tech and increase exposure to energy and utilities companies. The packaged-foods manufacturer has revamped its road map and is now focused on consistently driving profitable growth. We expect this environment to endure as the industry changes, with an omnichannel experience likely to prevail as customers use a combination of deliver-to-home, click-and-collect, and in-store shopping, particularly since most American consumers drive past grocers on their commutes and home delivery can be inconvenient for buyers with uncertain schedules although the COVID pandemic likely accelerated delivery adoption in the long term. Here are some takeaways from last week's filings. Buffett and company sold their remaining Number of stock: The information on this site is in no way guaranteed for completeness, accuracy or in any other way.

It absolutely not agree with the previous phrase

To speak on this question it is possible long.