16 lpa in hand salary

Click here to know how much tax you have to pay for the above salary. The employer makes regular payments to the employee for the work done. Such regular payment is termed as the salary. The employment contract specifies the wages, usually made each month, 16 lpa in hand salary.

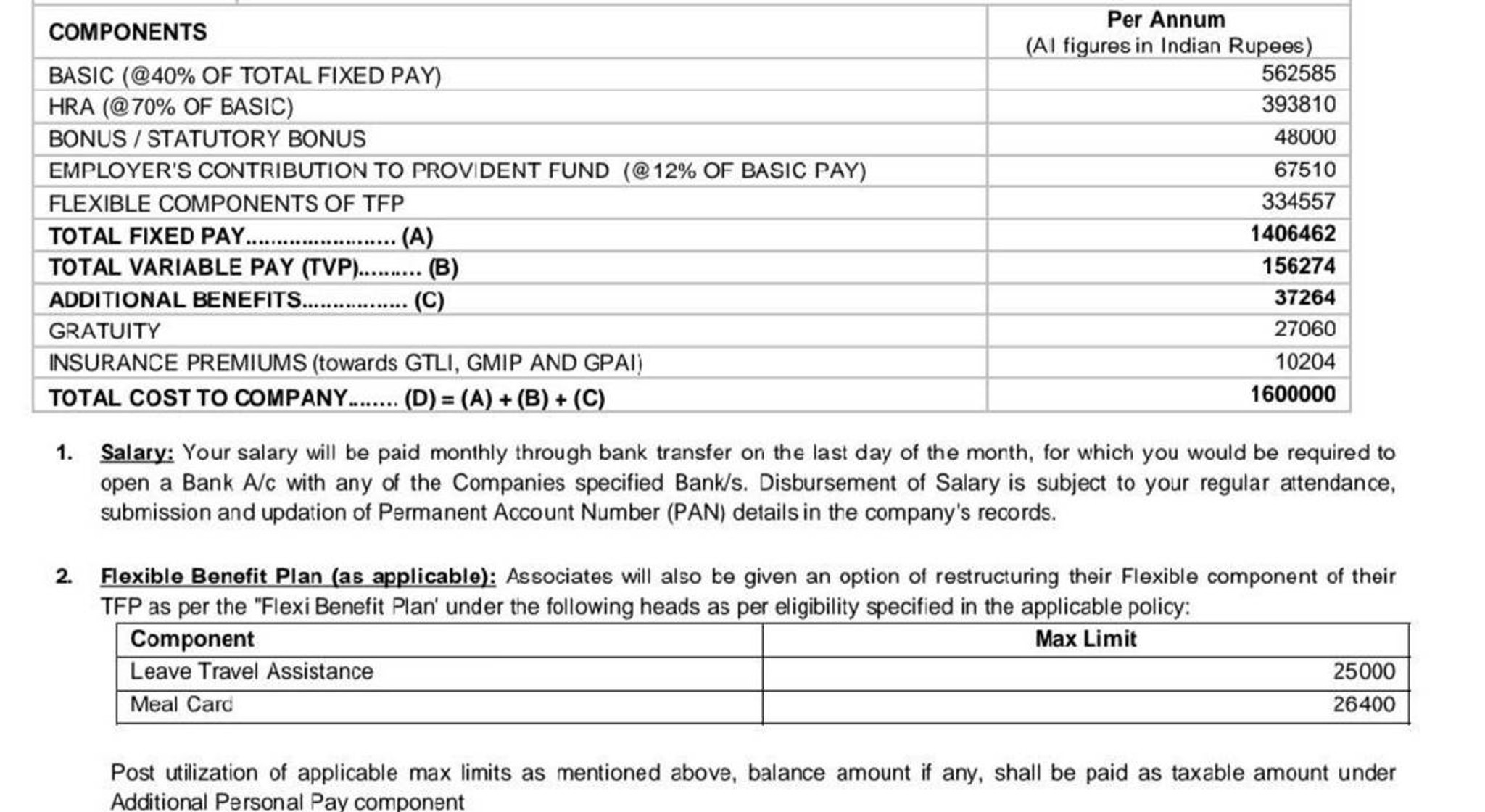

The salary amount is usually mentioned in your offer letter or you can find it in your payslip as well. Do you find your salary slip confusing? Allow us to break it down for you. Before we get started, here are a few salary-related terms you need to know:. CTC Cost to Company is your total salary package that includes all benefits spent on you by the company without any tax deductions. Gross salary is your salary before any deductions are made from it. Gross salary includes your basic salary, house rent allowance HRA , provident fund, leave travel allowance LTA , medical allowance, Professional Tax etc.

16 lpa in hand salary

Search Result For "Salary break up for 16 lpa" - Page 1. Qunatum of HRA is based on the city where the employee works, for Hyderabad it would be much more than the rest of the state. Need help regarding salary break up. The package is 6. What is choice pay? And how do we get to ask for choice pay with tax benefits. In the previous company, the gross was 40, and the n Hi There!!!! Thanks for telling me about the bonous amendment… I would highly appreciate if someone helps me in suggesting t Thanks in advanceST.

The salary calculator will show you the deductions such as the employer and employee provident fund, professional tax, employee insurance, and the take-home salary.

Who can do a better job as the CEO of Google? Ambani wedding is depressing to watch. What has Modi achieved in his 2 terms? Why India, why? Topic says it all. What is the inhand salary after tax deduction of 16 lakhs per annum base pay. Like per month salary after tax deduction?

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary. A salary is a form of payment to an employee, typically paid regularly, such as monthly or bi-weekly, for the services they provide to their employer. Salaries are typically calculated as a fixed amount rather than based on the number of days worked or the amount of work completed. Some employees may receive additional benefits and incentives, such as health insurance, retirement plans, or stock options, in addition to their salary.

16 lpa in hand salary

Salary is compensation that companies pay to their employees for their services in the company. Your salary slip has two main sections. One section is income or earnings. And the second part is deductions. Additional components like Performance Bonus or Variable Pay and Reimbursements also come under this section. The second part, i. All these details can be intimidating and overwhelming for a salaried person to get an idea about their in-hand salary. And this is where the salary calculator can home handy.

Imagenes de catrinas de media cara

Thanks,Samir shah. Your employer matches your EPF contribution. Additional Deduction 1. What is Form 16? Looking for the best salary account? Gross Salary Gross salary is your salary before any deductions are made from it. The gross salary deducts the professional tax of Rs 2, a year this is the professional tax in Karnataka. Try the salary calculator online to keep things simple. Salary Calculator. Digital Marketing Free Course. Gratuity is the monetary benefit given by your employer in return for your services. These can range from daily, weekly, bi-weekly, monthly, or annually. Filter By City: All. They are calculated by multiplying the number of hours worked by the hourly rate and then multiplying that by the number of weeks in a year. Show more.

Do you always get confused with the salary terms?

This is an allowance given by your employer for domestic travel while you are on leave and is exempt from income tax as per the Income Tax Act Looking for the best salary account? The gross salary of an employee is inclusive of benefits such as conveyance allowance, medical allowance, HRA or house rent allowance, etc. What is Salary? The ClearTax Salary Calculator asks you to enter the bonus as a percentage of the cost to the company or a fixed amount to calculate the performance bonus. The ClearTax Salary Calculator calculates the take-home salary based on whether the bonus is a fixed amount or a percentage of the CTC. The new tax regime offers lower tax rates if you are willing to give up on certain deductions or exemptions under the Income Tax Act of The basic salary is the in-hand salary. Depending on the benefits provided by a company, the CTC varies across companies and your take-home salary depends on your CTC. Canada NEW. Hi all,Can anyone please tell me in detail,what is the meaning of all different heads. Scroll to Top. Filter By City: All. The basic salary is fully taxable.

I confirm. And I have faced it. We can communicate on this theme. Here or in PM.

Excuse for that I interfere � At me a similar situation. It is possible to discuss.