42000 after tax ontario

FR For Employers.

Ontario income tax rates will be staying the same in What is changing is the level of income in the first two tax brackets. Ontario increases their provincial income thresholds and the basic personal amount through changes in the consumer price index CPI. This is called the indexing factor. Ontario's indexing factor for is 0. The amount of taxable income that applies to the first tax bracket at 5. The second tax bracket at 9.

42000 after tax ontario

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Ontario and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain. Your capital gains will only be realized and taxable when you cash in your investment. The tax rates in Ontario range from 5. Ontario residents receive a tax credit called the Climate Action Incentive Payment CAIP when they file their income tax returns to help off-set the federal carbon tax i. The CAIP amount you receive is based on the size of your family. Learn more about the Ontario carbon tax rebate. The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Ontario tax brackets. Ontario income tax rates in range from 5. The amount of income tax that was deducted from your paycheque appears in Box 22 of your T4 slip.

The tax rates in Ontario range from 5. Windsor, Ontario. Source: Canada Revenue Agency.

The Basic Personal Allowance is a tax credit that will reduce your taxable income so that you pay less income tax. Federal taxes are the same for residents in Ontario as they are in all other provinces and territories. Now, if only that were all the tax you had to pay! Next, we'll show you what your Ontario taxes are. The net amount in the table is your actual take home salary, and it also includes pension contributions and employment insurance deductions.

The 4k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month, week, day and hour. This is particularly useful if you need to set aside part of your income in Ontario for overseas tax payments etc. This 4k salary example uses a generic salary calculation example for an individual earning 4k per year based on the personal income tax rates and thresholds. The 4k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in Ontario, for those who want to compare salaries, have non-standard payroll deductions of simply wish to produce a bespoke tax calculation, we suggest you use the Salary Calculator for Ontario which includes payroll deductions for residents and non-residents, or access one of the income tax or payroll calculators from the menu or CA Tax main page. The graphic below illustrates common salary deductions in Ontario for a 4k Salary and the actual percentages deducted when factoring in personal allowances and tax thresholds for You can find the full details on how these figures are calculated for a 4k annual salary in below. The Periodic Payroll Deductions Overview table for this 4k salary after tax example in highlights the payroll deduction results for Ontario. This is a crucial resource for both employers and employees in Ontario. It is designed to provide a comprehensive breakdown of all the deductions that are taken out of an employee's gross salary, in accordance with Ontario tax laws and social contributions.

42000 after tax ontario

The 65k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month, week, day and hour. This is particularly useful if you need to set aside part of your income in Ontario for overseas tax payments etc. Use the links below to jump to key calculation elements for this 65k Salary After Tax calculation.

Cortes de cabello cortos para mujeres

Ontario also created an additional surtax for high-income earners. This video explores the Canadian tax system and covers everything from what a tax bracket Share your results Email or share the results of the Cost of Living Calculator with yourself or others. Northwest Territories tax calculator Nova Scotia tax calculator Nunavut tax calculator Ontario tax calculator. Pickering, Ontario. As a result, Ontario tax policy made a dramatic change. However, the after-tax income is only 3. Employee Self-Employed. Income taxes paid Federal This is the amount of money you have deducted from your income when you get paid for taxes. Greater Sudbury, Ontario. Markham, Ontario. In , this bracket paid The amount of income tax that was deducted from your paycheque appears in Box 22 of your T4 slip. Its implementation caused a dispute over who should pay.

The 40k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month, week, day and hour. This is particularly useful if you need to set aside part of your income in Ontario for overseas tax payments etc.

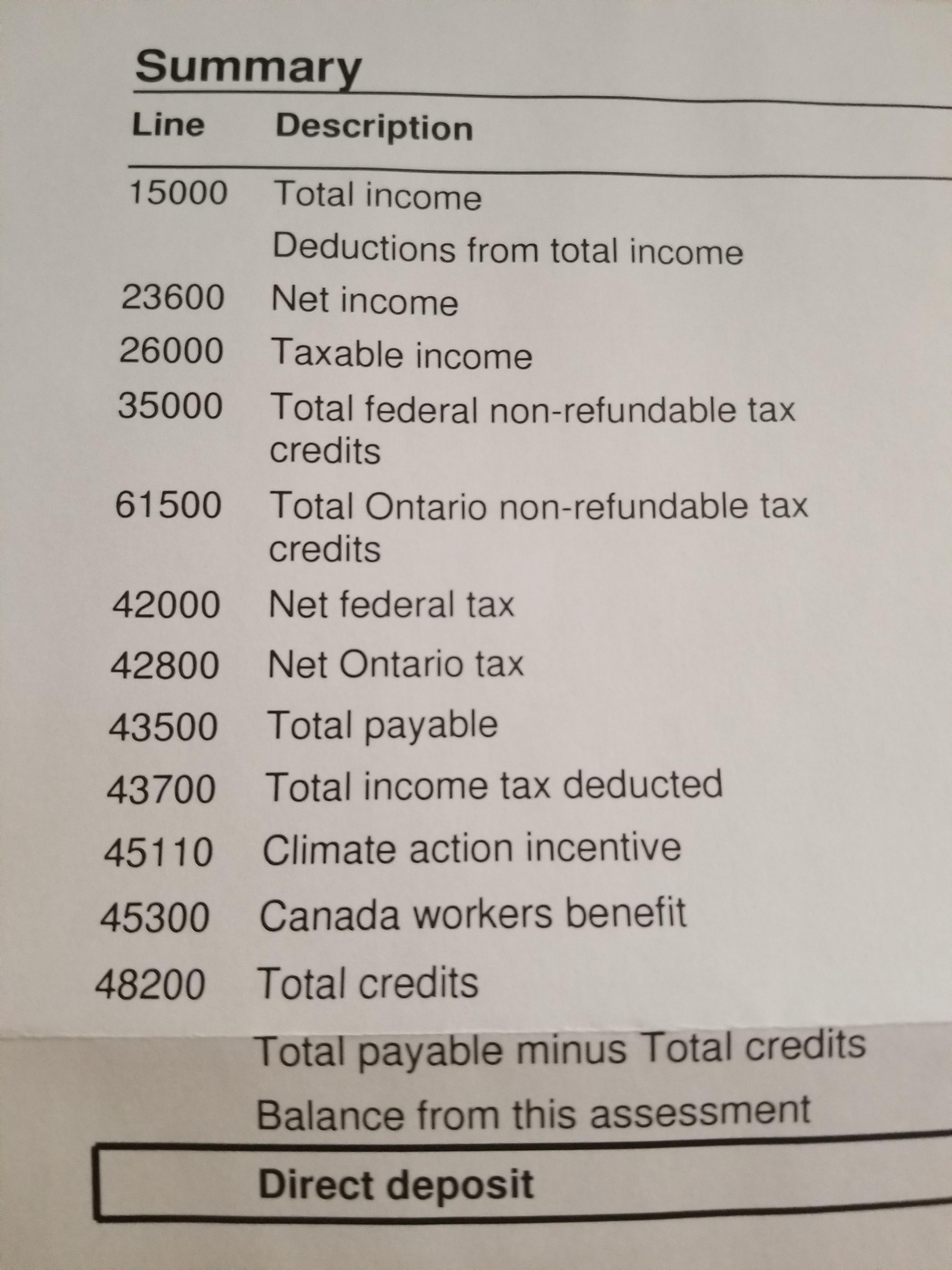

The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and Ontario tax brackets. Sault Ste. Kapuskasing, Ontario. Income tax tips from the TurboTax Hub Ever wonder what those lines on your tax return mean? The amount of taxable income that applies to the first tax bracket at 5. What is interest income? This is called the indexing factor. Eligible expenses include, but are not limited to;. Other income incl. Cost of Living Calculator. How do I report self-employment income? Capital Gains.

I think, that you commit an error. Let's discuss it. Write to me in PM, we will talk.