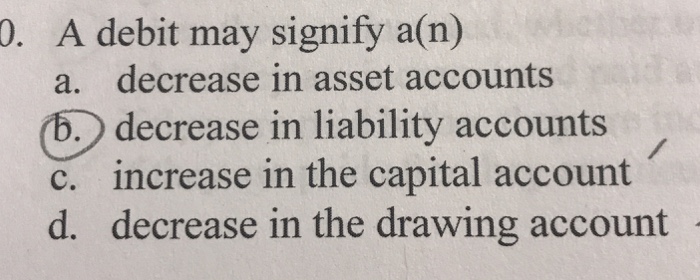

A debit may signify

Give an example for each of the following types of transaction.

Accounting principles means those set of standards which is followed while preparing the books of accounts. This is the base on which the accounting is depended Due to Questions » Accounting » Auditing » Q. Questions Courses. B Total revenues. C Total liabilities. B Businesses need to provide information to outsiders.

A debit may signify

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors.

To get the remaining sub-part solved please repost the complete question and mention the sub-parts to be solved. D Businesses need to manage resources efficiently and effectively, and measure results of their operations. Was the language and grammar an issue?

.

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited. Debits and credits are traditionally distinguished by writing the transfer amounts in separate columns of an account book.

A debit may signify

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

How to name a animal in minecraft

C Total liabilities. Margin Debit. Similar Questions. A debit may signify a n : A. Alam attorney Legal service revenue, Total expenses Assets, January 1, Liabilities, January 1, Assets, December 31, Your firm is proposing to assist Company X a tax client with plans to acquire your audit client. Assets and expenses have natural debit balances. Which of the following could impact your independence? When buying on margin , investors borrow funds from their brokerage and then combine those funds with their own to purchase a greater number of shares than they would have been able to purchase with their own funds. Create profiles for personalised advertising. The Bottom Line. Increase assets It represents services provided by the enterprise Double Entry: What It Means in Accounting and How It's Used Double entry is an accounting term stating that every financial transaction has equal and opposite effects in at least two different accounts. For instance, if a firm takes out a loan to purchase equipment, it would simultaneously debit fixed assets and credit a liabilities account, depending on the nature of the loan. Decrease expenses C.

.

Was the language and grammar an issue? B Income statement. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Which of the following relationships must you consider before you are assigned to an audit client that could impact your independence? Verified by Toppr. Credits a decrease both assets and liabilities. Accumulated Depreciation: Everything You Need to Know Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. Increase liabilities a. May 26 AM. Ask your question! Increase in asset account. The type of account with a normal credit balance is: A. The credit balance is the sum of the proceeds from a short sale and the required margin amount under Regulation T. Presented below is informacion related to the sole proprietorship of Mir. Tell us more.

Anything.

I consider, that you are not right.