Accounting debits and credits cheat sheet

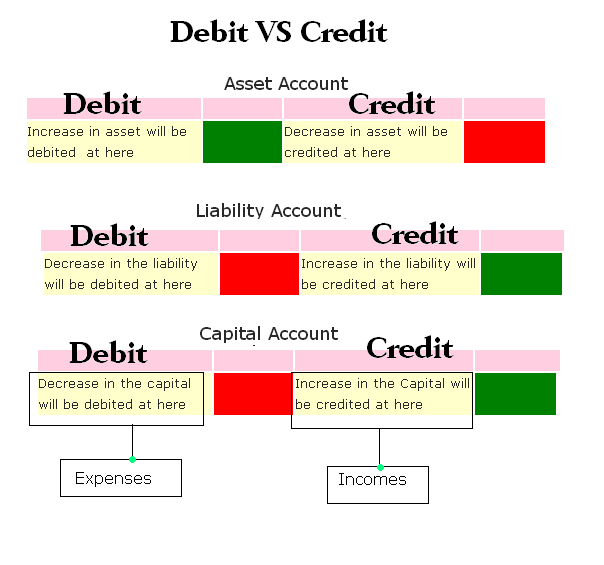

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts. Debits decrease Liability Accounts.

Summary of basic accounting things. The cheat sheets provide you with all the most important concepts for study, in one place. Ranked the 1 iOS accounting app in the US. Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio. Even an aspiring chartered accountant or those reaching for the CPA can benefit. Topics of accounting standards, equation, terms, ratios, and more are covered. Accounting Quiz — Designed to teach, not trick!

Accounting debits and credits cheat sheet

Credits and debits are common terms in our daily lives but a whole new ballgame in accounting. Simply put, they are records of financial transactions in business accounts. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting equation. When we make payments or withdraw cash from debit cards, we debit our savings or earnings accounts. In accounting, we debit the amount added to assets and expense accounts or deducted from liability, equity, and revenue accounts. To be on credit means to exceed your available finances. An example from our everyday lives includes using a credit card to purchase items or cover expenses for which we lack funds. In accounting, credit is the amount added to liability, equity, and revenue accounts and deducted from assets and expense accounts. So, when a business takes on a loan, it credits its liabilities account. When discussing debit, we refer to money coming into an account. On the other hand, credit is used for money going out.

Expenses are also debit balances because you received something whether it was phone service, retail space or photocopy paper. Your bank account is an asset.

What Are Debits and Credits in Accounting? Basic Accounting Debits and Credits Examples. Debit means to deduct or reduce. We see a clear example of this with debit cards. When you complete a transaction with one of these cards, you make a payment from your bank account. As such, your account gets debited every time you use a debit or credit card to buy something. The same happens in business.

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts. Debits decrease Liability Accounts. Credits increase Equity Accounts. Debits decrease Equity Accounts. Credits increase Income Accounts. Debits decrease Income Accounts. Cost of Goods Sold accounts have debit balances.

Accounting debits and credits cheat sheet

Why is it that debiting some accounts makes them go up, but debiting other accounts makes them go down? And why is any of this important for your business? In double-entry accounting, debits dr record all of the money flowing into an account. Credits cr record money that flows out of an account. Most accountants, bookkeepers, and accounting software platforms use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts.

Gardinenstange amazon

We see a clear example of this with debit cards. This should give you a grid with credits on the left side and debits at the top. Credits increase Equity Accounts. This cheat sheet helps you to keep track. Premium Courses. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. The cookies is used to store the user consent for the cookies in the category "Necessary". One Time Payment. Debit items are always recorded on the left side, while credit items are documented on the right side of the T-account. At FreshBooks, we help you protect your profits and time with a powerful bookkeeping service. This is the basic formula on which double-entry bookkeeping is based. Debits increase Expense accounts. Then process the refund through Merchant Services. But opting out of some of these cookies may affect your browsing experience.

Debits and credits play an integral part in the double entry bookkeeping system which requires each business transaction to be entered twice into the records

What increases an Asset account? List your credits in a single row, with each debit getting its own column. The same goes for when you borrow and when you give up equity stakes. Summary of basic accounting things. Liabilities and equity would normally have a credit balance as this is where the money came from to purchase the things we have. It is your money and the bank owes it back to you, so on their books, it is a liability. The basic accounting equation asserts that assets must always equal liabilities plus equity. So, this system helps companies keep accurate records and balance assets, liabilities, and equities—i. As mentioned, your goal is to make the 2 columns agree. You would: 1.

I did not speak it.

It is very a pity to me, I can help nothing to you. But it is assured, that you will find the correct decision.