Adani wilmar ipo expected listing price

Despite a weak listing, the stock did manage to bounce sharply after the listing in the morning and close with gains. At the end of Day-1, the stock of Adani Wilmar IPO closed at a smart premium to the issue price, despite listing weak.

The IPO price band is fixed at Rs. The IPO comprises an employee reservation of upto Rs. Investors holding Adani Enterprises shares in their Demat account as on 19 Jan will be eligible to apply under the shareholders reservation portion. Stay updated with us to know more about the Adani Wilmar IPO issue size, minimum order amount, business overview, company financials, live subscription, allotment status, and more. Reservation of up to Rs Cr is available for Eligible Employees on a proportionate basis with employee discount of Rs 21 per share.

Adani wilmar ipo expected listing price

Our Company commenced its operations pursuant to the certificate of commencement of business dated January 25, issued by the RoC. We are one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Adani Wilmar IPO will be open on and will close on As per we are checking Adani Wilmar company financials report and we are displaying report data as shown in below table. As per we check Adani Wilmar company financials report and we display company valuation report data as shown in below table. A total number of - shares have been offered in this public issue of Adani Wilmar Ipo, out of this total share - shares have been allotted for Fresh Issue and another - shares are to be offered for OFS offer for sale. Adani Wilmar Company has been issued total - shares through this IPO, a total - shares have been reserved for market movers for subscriptions as per the prospect report, and a total of - shares have been offered in QIB category and a total of - shares have been offered in RII. Adani Wilmar IPO has been listed on On the below table we are providing all the listing details with target price and stop loss. The minimum order quantity is - Shares. Adani Wilmar IPO will refund the amount on Post a Comment. IPO Edit. Table of Contents. E-mail: investor.

Fortune, its flagship brand is the largest edible oil brand in India.

The stock reached a high of? The market Adani Wilmar is one of FMCG food companies in India to offer the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Our products are offered Analysts believe Park Hotels IPO allows investors to invest in the eighth largest hotel chain, which has a diversified portfolio and strategically positions itself in key markets, leveraging an Stay up-to-date with the Adani Enterprises Stock Liveblog, your trusted source for real-time updates and thorough analysis of a prominent stock. Explore the latest details on Adani Enterprises,

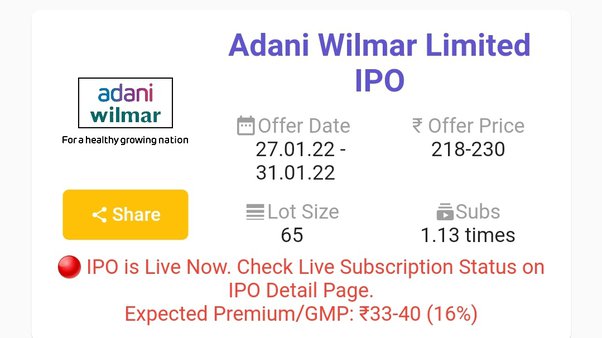

Adani Wilmar, one of the largest FMCG companies in India, is expected to start the first day of trade with around 15 percent premium over issue price on Tuesday, experts feel, citing market leadership in branded edible oil industry and packaged food business, diversified products portfolio, healthy financials, strong brand recall, and broad customer reach. The public issue received good response, getting subscribed Non-institutional investors took lead, putting in bids that were The portion set aside for qualified institutional buyers QIBs and retail investors saw 5. Employees' book was subscribed half a percent only.

Adani wilmar ipo expected listing price

FMCG food company Adani Wilmar made a subdued debut on February 8 with the stock listing at a 4 percent discount to the issue price before revving up seven percent. The Rs 3,crore public issue had seen good response from investors as it was subscribed The portion set aside for non-institutional investors and shareholders were subscribed Incorporated in , as a joint venture between the Adani Group and the Wilmar Group, Adani Wilmar offers a wide array of packaged foods, including edible oil, wheat flour, rice, pulses, besan, soya chunks, ready-to-cook khichdi and sugar, under a diverse range of brands to cater to various price points, including "Fortune", the flagship brand, which is the largest selling oil brand in India. All brokerages had assigned a 'subscribe' rating to the maiden public issue of Adani Wilmar citing reasonable valuations. Further, Adani Wilmar has strong brand recall, wide distribution, better financial track record and healthy return on equity. Considering all the positive factors, we believe this valuation is at reasonable levels. Thus, we recommend a subscribe rating on the issue," said Angel One. Choice Broking had also assigned a subscribe rating for the issue.

Kayla owens porn

Sub Brokers by Name Search. Hello User. Copyright by InvestorGain. Upcoming IPOs in February Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. Adani Wilmar IPO online form fill up? Adani Wilmar IPO blank form download? We do not work with individual clients after you click on affiliate links. Open Account Review. Copyright by InvestorGain. Below table will give you a clear picture on how much to bid for in each category by the retail investor.

Choose your reason below and click on the Report button.

Advertiser Disclosure: We offer two types of advertising on our website. Mint Premium View Less -. CryptoCurrencies View Less -. You are just one step away from creating your watchlist! The IPO price was fixed at the upper end of the band at Rs. Download RHP. If you are applying in SH category above Rs 2 lakhs, you can apply in Retail category below Rs 2 lakhs and Employee category. In percentage terms, post listing, Adani Wilmar has given the highest returns compared to others. Bectors Food Specialities Ltd. The IPO application ends on January 31, We display GMP on our website for informational and news purposes only. Adani Wilmar is among the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses, and sugar. Know More.

0 thoughts on “Adani wilmar ipo expected listing price”