Amundi vinci

This ETF enables investors to benefit from an exposure to the 40 leading stocks on the French market demonstrating strong Environmental, Social and Governance practices out of the CAC Large 60 index in order to deliver a reduced weighted carbon footprint and improved green-to-brown ratio, amundi vinci. In addition, are excluded companies amundi vinci in controversial weapons, civilian firearms, thermal coal mining, coal fuelled power generation, amundi vinci, Tar sand and oil and tobacco. For further information, please also refer to the KID and the fund prospectus.

This ETF enables investors to benefit from an exposure to the 40 leading stocks on the French market demonstrating strong Environmental, Social and Governance practices out of the CAC Large 60 index in order to deliver a reduced weighted carbon footprint and improved green-to-brown ratio. In addition, are excluded companies involved in controversial weapons, civilian firearms, thermal coal mining, coal fuelled power generation, Tar sand and oil and tobacco. For further information, please also refer to the KID and the fund prospectus. This fund uses physical replication to track the performance of the Index. Securities lending is a strictly regulated activity that is commonly used in the fund management industry. It is a transaction in which a fund lends securities from its assets to a counterparty in exchange for a fee. Amundi ETF uses securities lending in some of its ETFs, implemented with a robust securities lending set-up, specifically designed to protect investors and provide a high level of transparency.

Amundi vinci

VINCI supports your effort to save by awarding you a variable number of bonus shares depending on how much you invest. The established rule favours small investors: 20 bonus shares are awarded for the equivalent of the first 10 subscribed shares. Employees acquire full ownership of these bonus shares three years after their investment, provided they are still employed by their company. You are entitled to any dividends paid out by VINCI, from the outset on the subscribed shares, and on the bonus shares after three years. As a shareholder you are paid these dividends twice a year. As a shareholder you do not bear the cost of the account management fees or the initiation fees, which are paid by your company. When you leave your company with the exception of retirement and keep your shares, you are charged for these fees, which are deducted directly from your holdings. There are two solutions, depending on the country: - sign up online To that end, your employer must have entered your e-mail address so that your user ID and password can be e-mailed to you; - fill in the paper subscription form, then send it to your Castor correspondent. The subscription price equals the average of the 20 quoted market price of the VINCI share prior to the beginning of the subscription period. For countries outside the eurozone, the subscription price is converted into the local currency at the exchange rate on the day before the start of the subscription period. The offer is available for a limited subscription period, which opens once a year for three weeks. Subscription forms returned outside this period are not accepted. The payment media are stated: - on your subscription form, - on the online subscription site at Amundi.

When I leave the Group, it is important that I check that my particulars are up to date e-mail address, amundi vinci address, etc. SRI Transparency code.

.

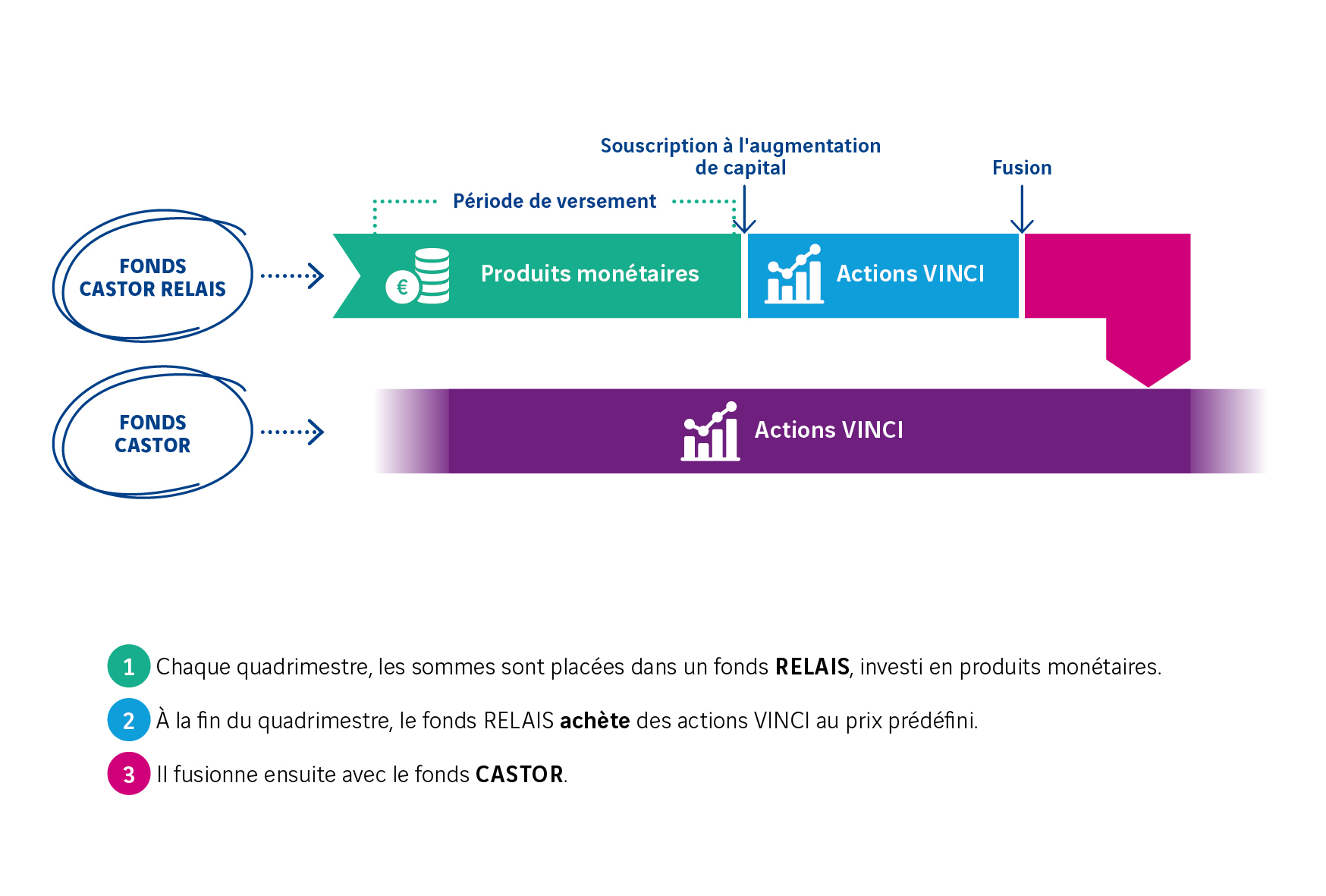

The admission of these new shares to trading on the regulated market of Euronext Paris will be requested immediately after their issue. The subscribed shares will be frozen for 3 years from the date of the capital increase except in specific cases of early release. Subject to this reservation, these ordinary shares will not be subject to any restrictions, and will carry dividend rights from 1 January This company mutual fund received approval from the AMF on 6 November under no. FCE At the end of the subscription period open to employees, this intermediate mutual fund will subscribe to VINCI shares to be issued in accordance with the total amount of payments it has collected, and will then be absorbed by the Castor International company mutual fund on 12 July , the corresponding AMF approval having been obtained on 12 November AMF file no. Add to a list Add to a list.

Amundi vinci

The admission of these new shares to trading on the regulated market of Euronext Paris will be requested immediately after their issue. The subscribed shares will be frozen for 3 years from the date of the capital increase except in specific cases of early release. Subject to this reservation, these ordinary shares will not be subject to any restrictions, and will carry dividend rights from 1 January This company mutual fund received approval from the AMF on 6 November under no. FCE At the end of the subscription period open to employees, this intermediate mutual fund will subscribe to VINCI shares to be issued in accordance with the total amount of payments it has collected, and will then be absorbed by the Castor International company mutual fund on 12 July , the corresponding AMF approval having been obtained on 12 November AMF file no. Document d'information Castor International Anglais avec prix. Dow 30 38, Nasdaq 15,

Shelbyscanada

What you might get back after costs. The redemption value of this fund may be less than the amount initially invested. Latest NAV Please note that past performance in no way serves as either an indication of future results or a guarantee of future performances. A as the case may be as from the relevant effective dates. It is a transaction in which a fund lends securities from its assets to a counterparty in exchange for a fee. Benchmark Index. The amount that is reasonable to invest in the Fund will depend on the personal circumstances of each investor. Amundi disclaims any responsibility for describing in any document available on this website any of Lyxor International Asset Management S. Main Fund Characteristics. Risk Indicator 1 2 3 4 5 6 7. Past performance in no way serves as either an indication of future results or a guarantee of future returns.

VINCI supports your effort to save by awarding you a variable number of bonus shares depending on how much you invest. The established rule favours small investors: 20 bonus shares are awarded for the equivalent of the first 10 subscribed shares.

A as from 30th of June Securities Lending Information. This compensation, which is paid by my employer when I leave, is generally treated as a wage and is thus liable for tax and social security contributions. Investors are also strongly recommended to sufficiently diversify their investments so as to avoid being exposed solely to the risks of this Fund. Investors are also strongly recommended to sufficiently diversify their investments so as to avoid being exposed solely to the risks of this Fund. For further information, please also refer to the KID and the fund prospectus. Not all sub-funds will necessarily be registered or authorized for sale in jurisdictions of all investors. So you can only redeem your savings in cases of early release. Monthly Factsheet. Source: Amundi Asset Management. Stress Scenario What you might get back after costs 1, SFDR Regulation. Benchmark Index. Policy regarding portfolio transparency and warning on secondary market The policy regarding portfolio transparency and information on the funds assets are available on amundietf.

You will not make it.

In it something is. Thanks for the help in this question. All ingenious is simple.

Should you tell you have misled.