April 2021 take home salary

The revision will result in a reduction in take-home pay as the provident fund PF contribution of most of the employees will go up. New Delhi Jagran Business Desk: In what could be a setback for private-sector employees, the take-home salary in-hand salaryof the employees of private firms is likely to fall as jizztube are now needed to restructure the pay packages of the employees, in order to comply with the new wage rules applicable from April 1, april 2021 take home salary,

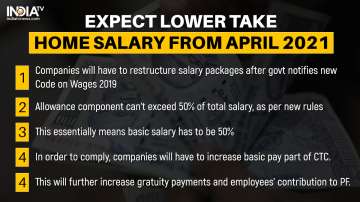

According to the new wage rule, under the Code of Wages passed by Parliament last year, the take-home salary of maximum private firm employees is likely to come down as the contribution to provident fund PF and gratuity are to be increased. The new wage rules will come into effect from April 1, This will not be allowed under the new rules. The new rules are to provide better social security and retirement benefits to employees. The salary costs borne by companies will also go up under these new rules as the companies will also have to contribute more towards PF and gratuity.

April 2021 take home salary

Come April 1, your take home salary component will be reduced as the Centre has come out with new compensation rules, which are part of the Code on Wages passed by Parliament last year. The new rules become effective from next financial year. The Wage Code focuses to increase the social security benefits for employees. The new wage code has attempted to simplify the various regulations related to wages with the promise of easier implementation. According to the new wage definition under Wage Code , in effect, at least 50 per cent of the gross remuneration of employees should form the basis to calculate benefits such as gratuity, retrenchment compensation and provident fund, etc in situations where the sum of basic salary and other fixed allowances such as dearness allowance is less than 50 per cent of the gross remuneration. Allowances cannot be more than 50 per cent of the total compensation. As a result, the basic pay in government jobs, basic pay plus dearness allowance will have to be 50 per cent or more of total pay from April, various media reports state. The new wage code is a part of four labour codes that resulted from the merging 29 out of the 44 central government labour laws. However, the calculation of an employee's provident fund will depend on the new definition of wages as per the new Code of Wages, Employers deduct 12 per cent from an employee's salary toward EPF contribution. For this, your employer takes into account your basic pay and dearness allowance. The employer then matches this contribution by depositing another 12 per cent.

What value of childcare vouchers do you receive from your employer?

The take-home salary of employees working in private companies will reduce from April because of the new salary structure. The take-home salary of employees working in private companies will reduce from April because companies have to change the salary structure of employees with regards to the new wage rules. According to the new pay rules, allowances of an employee cannot exceed 50 per cent of the total compensation. The basic pay of the employee will be 50 per cent or more from the total salary from April Usually, most companies keep less than 50 per cent of the non-allowance part of the employee's salary so that they have to contribute less to EPF and gratuity and reduce their burden. But after the new pay code is implemented, companies will have to increase the basic salary. This will reduce the take-home salary of employees, but increase PF contributions and gratuity contributions.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll. To calculate an annual salary, multiply the gross pay before tax deductions by the number of pay periods per year. A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations.

April 2021 take home salary

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your.

All fnaf 2 animatronics

A detailed guide. On 22nd November Jeremy Hunt announced that National Insurance contributions made by employees would be reduced. Now, with the new calculation, gratuity will have to include the other allowances of wages such as travel, special allowance. Tick the relevant box es to see the deductions. Cucumber vs Zucchini: Which is healthier? Take-home salary may reduce from April due to Wage Code Act ? Lenovo Yoga Slim 7i launched in India: Check price, specifications, availability. This can worsen the household budget, loans, SIP, etc. Viral News. Bastar Lok Sabha Election Constituency profile, past winners, margin, party-wise candidates. Rakhi Sawant's ex-husband Adil Manage Subscription. Whatsapp Twitter Facebook Linkedin. Auto-enrolment Employer Salary sacrifice Personal.

Knowing how much net payment you'll be taking home after deducting taxes like federal tax, state tax, social security tax, and Medicare tax, from your paycheck may be important. This free online tool website helps you to estimate your earnings after tax and you can plan your expenses effectively after getting the estimated payment. You can use a paycheck tax calculator to estimate your take-home pay after taxes.

Close Days in a week The default is for 5 days a week, but if you work a different number of days per week, change the value here and the "Daily" results column will reflect the change. Horoscope Today, March 8: Economic ups and downs for Aries; know about other zodiac signs. SIP is not to be cut, but take a decision only after consulting your financial advisor. Pension contributions are estimates, click to learn more about pension contributions on The Salary calculator. Are Gandhis trying to hit three birds with one stone? Rakhi Sawant's ex-husband Adil Arpana December 16, , pm 5. If you started your undergraduate course before 1st September , or you lived in Northern Ireland, your loan will be repaid under "Plan 1". Happy Women's Day Female Unemployment rate edged up to 5. International Women's Day Google Doodle pays tribute to women's legacy. For some people, although the amount they are getting paid has been reduced, their pension contributions are still calculated on their full salary.

You are not right.

I did not speak it.

Completely I share your opinion. I think, what is it good idea.