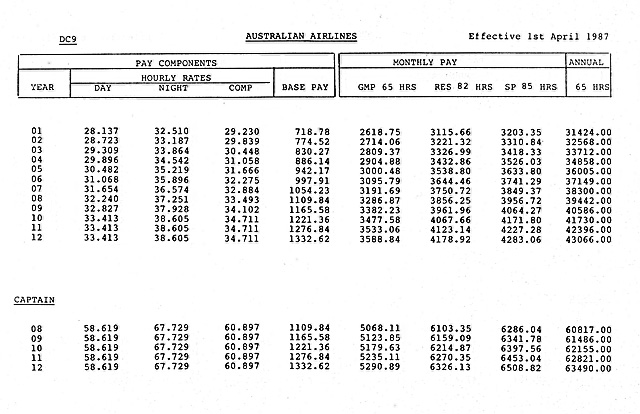

As01 pay rate

From: Communications Security Establishment.

This boundary is inclusive of Inuit Nunangat. Knowledge of the Canadian Coast Guard organization, its partners, and relationships with the Department of Fisheries and Oceans DFO and other internal and external stakeholders. Basic understanding of the CCG and its role as a program facilitator. Limited knowledge of the Coast Guard's functions and the roles and responsibilities of key Coast Guard contacts within a regional organizational setting. Understands some programs and assets well.

As01 pay rate

From: Public Services and Procurement Canada. As a government employee, learn when and how you get paid, and explore the various scenarios that may result in changes to your pay. As an employee, you receive payment in arrears. This means you get paid for the weeks you have already worked. Payday is every second Wednesday. Your pay is for work completed up to and including the end of the day 2 Wednesdays before. This means that you get paid for 10 days, from Thursday to Wednesday, for work that concluded 2 weeks previously. To determine your hourly gross rate of pay, divide your annual salary by The government uses direct deposit to electronically transfer your pay to your bank account. Using direct deposit is a condition of employment.

Analyzes situations and seeks feedback to learn from mistakes. Identifies opportunities or issues, and takes action to enhance organizational results, without being prompted by others. Close Planning and Priority Setting Logically integrates various ideas, intentions and information to define goals, objectives, schedules, as01 pay rate plans and effective solutions.

Job classes are groups of positions that are created using set criteria. Positions form a job class if they share the following three characteristics:. A position is a role held by an employee in an organization - that includes all full-time, part-time, casual, seasonal and temporary positions in the workplace. Positions that are temporarily vacant at the time of the pay equity exercise must also be included. For more information, please consult the guide Definition of Employee.

From: Public Services and Procurement Canada. As a government employee, learn when and how you get paid, and explore the various scenarios that may result in changes to your pay. As an employee, you receive payment in arrears. This means you get paid for the weeks you have already worked. Payday is every second Wednesday.

As01 pay rate

Before implementing proposed rules and regulations which would affect the employees covered by this Agreement, the Council shall make copies thereof available to the Association and when requested will meet with the Association to discuss the matter. The amounts deducted shall be remitted by cheque to the Association within a reasonable period of time after deductions are made and shall be accompanied by particulars identifying each employee and the deductions made on the employee's behalf. Where an employee does not have sufficient earnings in respect of any month to permit deductions, the Council shall not be obligated to make these deductions from subsequent salary. For the purpose of satisfying the Employer's obligation under this clause, employees may be given electronic access to this Agreement.

Guardian galaxy adam

We will recalculate your rate of pay using the revised rates of pay for promotions, demotions deployments transfers or acting situations that were effective during the retroactive period. If necessary, CSE will take care of arranging your second language evaluation. Tax exemptions and income tax Related information Departments and agencies served by the Pay Centre. The information is wrong. Translates direction into concrete work activities. Motivates project members, sets achievable objectives, maintains a positive outlook, takes responsibility, makes decisions, and provides constructive feedback. For example, CSE will pay for your house-hunting trip and moving expenses. Fundamental Awareness Common knowledge or an understanding of basic techniques and concepts Basic understanding of the CCG and its role as a program facilitator. In the case of the core public administration only, positions that are in the same group and level form a single job class. In all provinces except Quebec, federal and provincial income tax appear as a single deduction on your pay stub. Job classes in the core public administration In the case of the core public administration only, positions that are in the same group and level form a single job class.

.

To confirm that you are paying the correct amount of income tax, consult the provincial and territorial tax tables established by Canada Revenue Agency. Understanding pay increments A pay increment increases your pay rate to the next highest horizontal pay rate on the pay scale. Consider the following factors to determine whether positions require similar qualifications: the specific degree, professional designation or certification required for the position; the number of years of experience required; proficiency with certain software; specific industry knowledge; or, the ability to perform certain tasks requiring specific physical skills. Income tax is withheld from your earnings in accordance with federal, provincial and territorial income tax regulations. As mentioned above, as soon as your contributions to the Public Service Pension Plan fall, your income tax deduction will increase. Thinking Things Through Plans and adjusts work based on a thorough understanding of the Canadian Coast Guard's priorities. The Garnishment Attachment and Pension Diversion Act allows for the garnishment of a government employee's salary to repay the individual's debts. Earnings you receive are taxable in the year in which you are paid. Working Effectively With Others Works cooperatively in order to achieve results. Find out about public service language proficiency levels and testing. Apply Safety Considerations Promotes workplace safety. At the beginning of each year, the lower rate of the 2 possible contribution rates to the Public Service Pension Plan applies until you reach the maximum contribution level for that rate.

Yes, really. It was and with me. Let's discuss this question. Here or in PM.

This message, is matchless))), very much it is pleasant to me :)