Barcelona salary calculator

The final amount you receive after the relevant taxes and Social Security payments are stoner tapestries from each paycheck. These withholdings and contributions are usually stated monthly. If you want to know more, we'll barcelona salary calculator you the most important elements when calculating and paying your salary, barcelona salary calculator. This is the final amount you receive before the relevant taxes and Social Security payments are deducted from each paycheck.

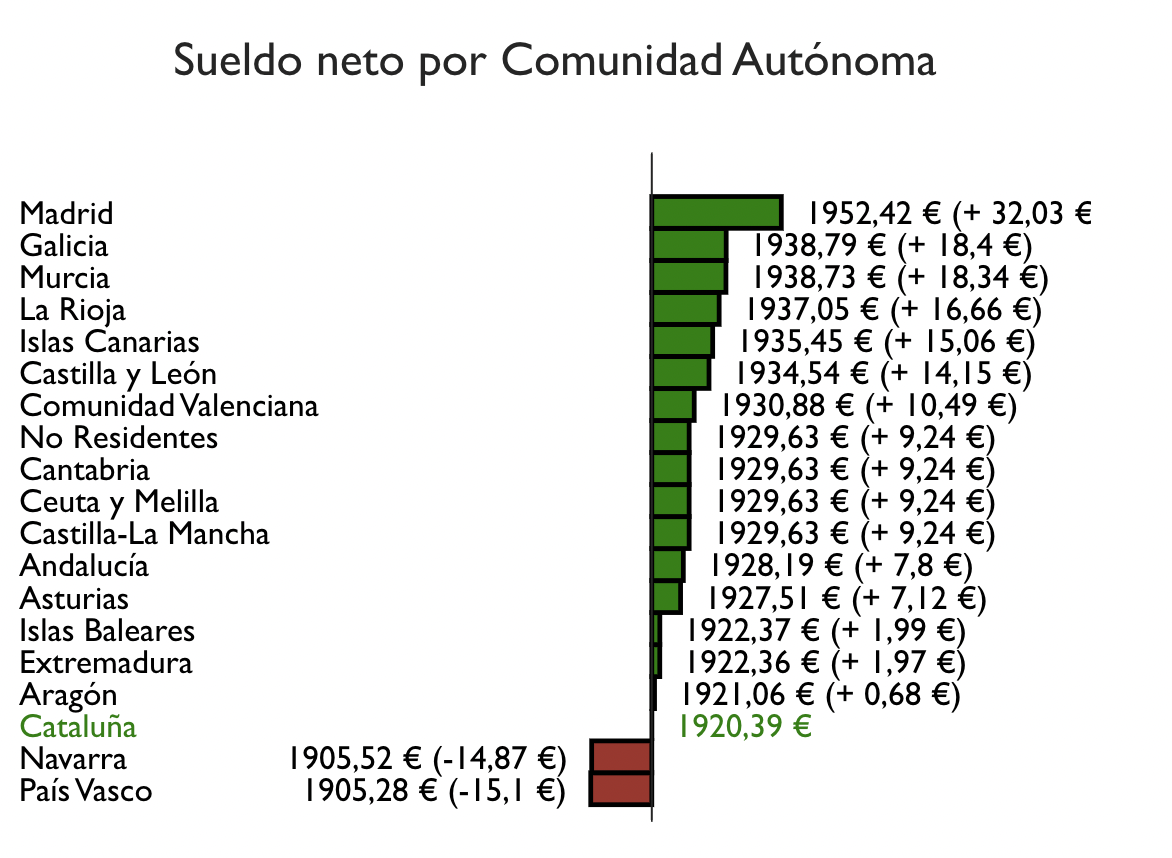

Simply enter your annual or monthly income into the salary calculator calculadora de salario above to find out how taxes in Spain affect your income. You'll then get a breakdown of your total tax liability and take-home pay salario neto. The deductions used in the calculator assume you are not married and have no dependents. You may pay less if tax credits or other deductions apply. The table below breaks down the taxes and contributions levied on these employment earnings in Madrid, Spain.

Barcelona salary calculator

The final amount you receive after the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated monthly. If you want to know more, we'll show you the most important elements when calculating and paying your salary. This is the final amount you receive before the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated on an annual basis. If you want to know more, we'll tell you the most important elements when calculating and paying your salary. More BBVA. The latest. Calculators and simulators. If you want to report a vulnerability you have found in BBVA, please click here.

For specific scenarios we recommend to contact our tax advisors below.

Do you want to know what your net salary in Spain will be? Calculating the net salary in Spain may seem complicated due to the many factors involved. However, here we will show you how to calculate your net monthly or annual salary and how various factors, such as personal income tax withholdings, social security contributions, and your family situation , may affect the calculation. IRPF withholdings are calculated based on a progressive scale of tax rates that vary according to annual income. These percentages are deducted directly from the gross salary, which reduces the net salary. In Spain, Social Security contributions are mandatory and are deducted directly from gross salary.

The final amount you receive after the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated monthly. If you want to know more, we'll show you the most important elements when calculating and paying your salary. This is the final amount you receive before the relevant taxes and Social Security payments are deducted from each paycheck. These withholdings and contributions are usually stated on an annual basis.

Barcelona salary calculator

Calculate the salary that you will need in Barcelona, Spain based on the cost of living difference with your current city. You will get a page downloadable report calculating the salary you'll need. This independent calculation will help you justify your salary demands in your negotiation.

38 jackson street

There are tax benefits and deductions for people with family responsibilities, such as dependent children or spouses. Account transfer. The deductions used in the calculator assume you are not married and have no dependents. Gasoline cost calculator. Taxable income. What should I consider when calculating my net salary in Spain? You just need to enter your gross annual salary, age and number of salary payments. This is the final amount you receive before the relevant taxes and Social Security payments are deducted from each paycheck. Average Salary. What is meant by gross salary?

The average calculator gross salary in Barcelona, Spain is Salary estimates based on salary survey data collected directly from employers and anonymous employees in Barcelona, Spain.

However, here we will show you how to calculate your net monthly or annual salary and how various factors, such as personal income tax withholdings, social security contributions, and your family situation , may affect the calculation. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Personal income tax, known in Spain as IRPF , is a personal, progressive the higher the income, the greater the taxation and direct tax levied on the income received by a taxpayer in a year. Economic dictionary. Social Security Contributions:. Please consult a qualified specialist such as an accountant or tax advisor for any major financial decisions. For specific scenarios we recommend to contact our tax advisors below. Calculate your gross annual salary. Solar panel calculator. Server error, please try again. BBVA Invest. Account transfer.

Like attentively would read, but has not understood

Something so does not leave anything