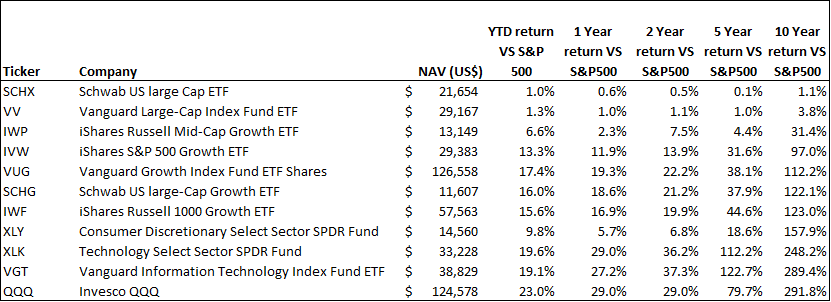

Best performing etfs last 10 years

Vanguard is an absolute powerhouse and is popular across the globe.

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years. Investing in stocks is a risky endeavor. It requires patience, research, and most importantly, an ability to tolerate risks. Stocks are among the most riskiest securities in the financial industry, and while they promise lucrative returns that are often in triple digits, stock market downturns can be equally destructive. Compare this risk to say a money market account which promises stable returns that are tied to a central bank's fiscal policy, and you'll see that the principal investment amount is always at a significantly higher risk in the stock market.

Best performing etfs last 10 years

.

This leads the ETF to have major stakes in some of the biggest technology companies in the world. However, the additional complexities involved in submitting a W8-BEN and managing a more intricate tax return prompt many investors to explore alternative options. Home Articles Toggle child menu Expand.

.

The U. From to , the global investing backdrop has witnessed various key happenings. The net result is that the global economy is on a moderate footing now. Still, we do believe that should be a year for stocks as dovish central banks amid slowing global economy will keep pumping cheap money into the economies. Trade tensions have eased considerably from the fourth quarter of this year. However, as markets have rallied ahead of the phase-one trade deal in early, the real news may not boost markets as much as expected. Rising consumer spending on technology, a 5G boom, expectations of higher smartphone sales, the announcement of the phase-one U. The past decade can easily be tagged as the emergence era for internet usage, mainly in the emerging economies. The e-commerce wave has been helpful in lifting Internet stocks.

Best performing etfs last 10 years

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Molly eskam nude

Facebook Twitter Instagram. Investing in stocks is a risky endeavor. Consequently, the long-term performance of the ETF is notably influenced by a few select companies. Investors in government bonds typically prioritize stability and income, considering them less risky than growth assets, such as shares and property, to diversify their investment portfolio [10]. The ETF limits its attention to investing in U. Easy money means that hedge funds can secure adequate leverage to make outlandish bets on publicly traded firms - bets which as a whole also translate into market strength. At the same time, low interest rates during the time of crisis in the coronavirus era reduced the incentives of investors to either keep their money in the bank and watch it grow through interest rate hikes or invest in other interest tied securities such as bonds. This crisis, which started in the middle of the third quarter of taught hedge funds about the pitfalls of relying exclusively on long positions as part of their portfolio construction. Narrowing our focus on the past decade, the market has been in constant fluctuation for the past four years at least that has seen massive downswings, greater upswings, and painful corrections followed by sudden jumps to set new records. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years. Remarkably, just these three holdings alone constitute

In this piece, we will take a look at the 11 best performing ETFs of the last 10 years. If you want to skip our introduction to changing stock market dynamics for the past couple of years, then take a look at 5 Best Performing ETFs of the Last 10 Years.

The accuracy, completeness, or reliability of the information cannot be guaranteed, and the provider shall not be held responsible for any actions taken based on the information contained in this content. Its popularity stems from its tracking of the ASX , which means it captures the performance of the largest listed Australian companies. FTSE 7, Investing in stocks is a risky endeavor. However, it comes with a significant downside for many investors—it is domiciled in the US. It was set up in and is part of the iShares fund family. Consequently, the long-term performance of the ETF is notably influenced by a few select companies. Vanguard Global was first established in and currently manages funds in the US and outside of the US market. Since China is one of the world's largest consumers of industrial and agricultural commodities, a slowdown in its economy also translates poorly for prices of goods such as copper and oil. As discussed in my article covering the best-performing ETFs over the last 10 years , VAP has demonstrated strong performance in the Australian market. Dow 30 39, With a

0 thoughts on “Best performing etfs last 10 years”