Best reit australia

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

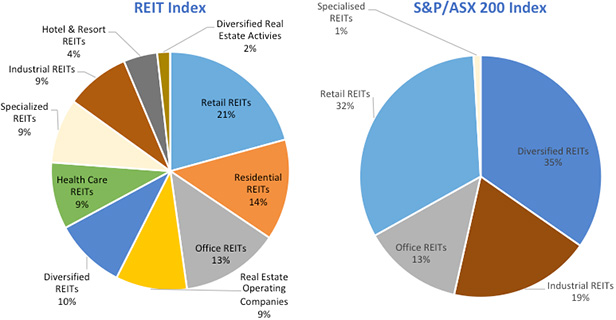

The index covers a wide opportunity set, making this strategy one of our top picks in the Australian real estate category. A-REITs are operating in a challenging environment with interest rate increases the cost to service debt and bonds now offering a compelling alternative. The overall weakness of the sector has not impacted the performance of VAP. REITS are companies that own, and in general manage and lease, investment-grade, income-producing real estate. Yet REITs can be a good way for investors to get the diversification benefits of real estate without the commitment and responsibilities of directly owning property.

Best reit australia

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As well as providing access to high-quality companies, the Australian share market also offer investors the opportunity to invest in property through real estate investment trusts REITs. Let's see which ones analysts are recommending:. Citi is very positive on the company. It said:. Management highlighted that positive leasing spreads, high occupancy levels and MAT growth are expected to continue and that portfolio income is expected to benefit from direct and indirect inflation linked rental growth underpinning asset values. It believes the company is well-positioned for growth. It commented:. Healthcare real estate is highly fragmented and has a long runway domestically in Australia. It recently said:. March 8, Bernd Struben. Here's why I like this one.

Year to Date. Morningstar Investor.

Like shares, A-REIT investors can benefit from capital gains as well as income that is paid out in the form of dividend distributions. Depending upon its business strategy, an A-REIT may own property across multiple segments or it may specialise in a specific area. For example, Scentre Group is focused exclusively on commercial properties, owning and operating 42 Westfield Living Centres. Commercial real estate refers to properties primarily used for conducting business, and can include everything from office space, hotels, and shopping centres. While both commercial and industrial real estate are focused on helping companies conduct business day-to-day, commercial real estate tends to be consumer facing.

These companies provide investors with the opportunity to be exposed to property, particularly commercial. Additionally, given they are listed on the ASX, they have the benefit of daily liquidity — unlike investing directly on a property. Founded in , Goodman Group owns, develops and manages commercial real estate such as warehouses, large-scale logistics assets and office parks. Along with a portfolio in Australia, the company invests in property across the Asia Pacific, continental Europe, the UK and the Americas. Scentre owns and operates Westfield shopping centres in Australia and New Zealand, having done so since the demerger of Westfield Group in The company invests only in Australia with the portfolio predominately weighed towards eastern seaboard CBD office markets. Founded in , Mirvac is a diversified property group investing in residential, office and industrial, retail and build to rent assets. In particular, the company focuses on creating mixed use developments.

Best reit australia

Company Name. Stock Price. Year to Date. Market Capitalisation. When deciding what stocks to feature, we analyse the company's financials, recent news, advancement in their timeline, and whether or not they are actively traded on Stake. Join k investors. Get a full U. Fund both, get both.

Bhojpuri sex video hd

Charter Hall Group specialises in managing and investing in property on behalf of institutional and retail investors. REITs are an indirect way of owning property by investing in companies that own income-producing real estate across a range of sectors such as residential, commercial and industrial. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. Prashant Mehra. Lendlease has faced headwinds in recent times, as the business has slowed due to rising interest rates, lower demand and insolvencies in the construction industry. Insights, trends and company deep dives delivered straight to your inbox. Their assets are split between self-storage businesses known as Storage King and commercial segments that include various office space and retail assets. However, these real estate funds are exempt from registration with the Australian Securities and Investments Commission ASIC , and hence may only be available to institutional investors. Our last definition for today is a simple matter of real estate business. Performance information may have changed since the time of publication. Overall investor demand may also reduce at such times because higher rates make fixed-income investments more attractive. Past performance is not indicative of future results. Citi is very positive on the company. Chris has over 25 years of investment experience and spent most of his early career as a Portfolio Manager at UBS. Read our advice disclaimer here.

Disclosure: Privacy Australia is community-supported. We may earn a commission when you buy a VPN through one of our links. Learn more.

Stockland had a dividend yield of 6. Its lower management fee, broader diversification and increasing trading volumes are attractive reasons for being our preferred global property ETF choice. More from Morningstar. However, office workers are some of the first to go during a recession. And it is true that many buildings, even if they are constructed with a purpose, can be knocked down and rebuilt, keeping them highly versatile. Market Centre. If you have only ever lived in massive cities of dizzying urban sprawl and parking lots that go on forever, then that might sound a bit obvious. Are these the best dividend stocks on ASX in November? ASX Market Report. Most Popular. Low amounts of leverage into small-cap developments means that you will never lose that much money, nor will you gain that much money through being invested in MGR.

0 thoughts on “Best reit australia”