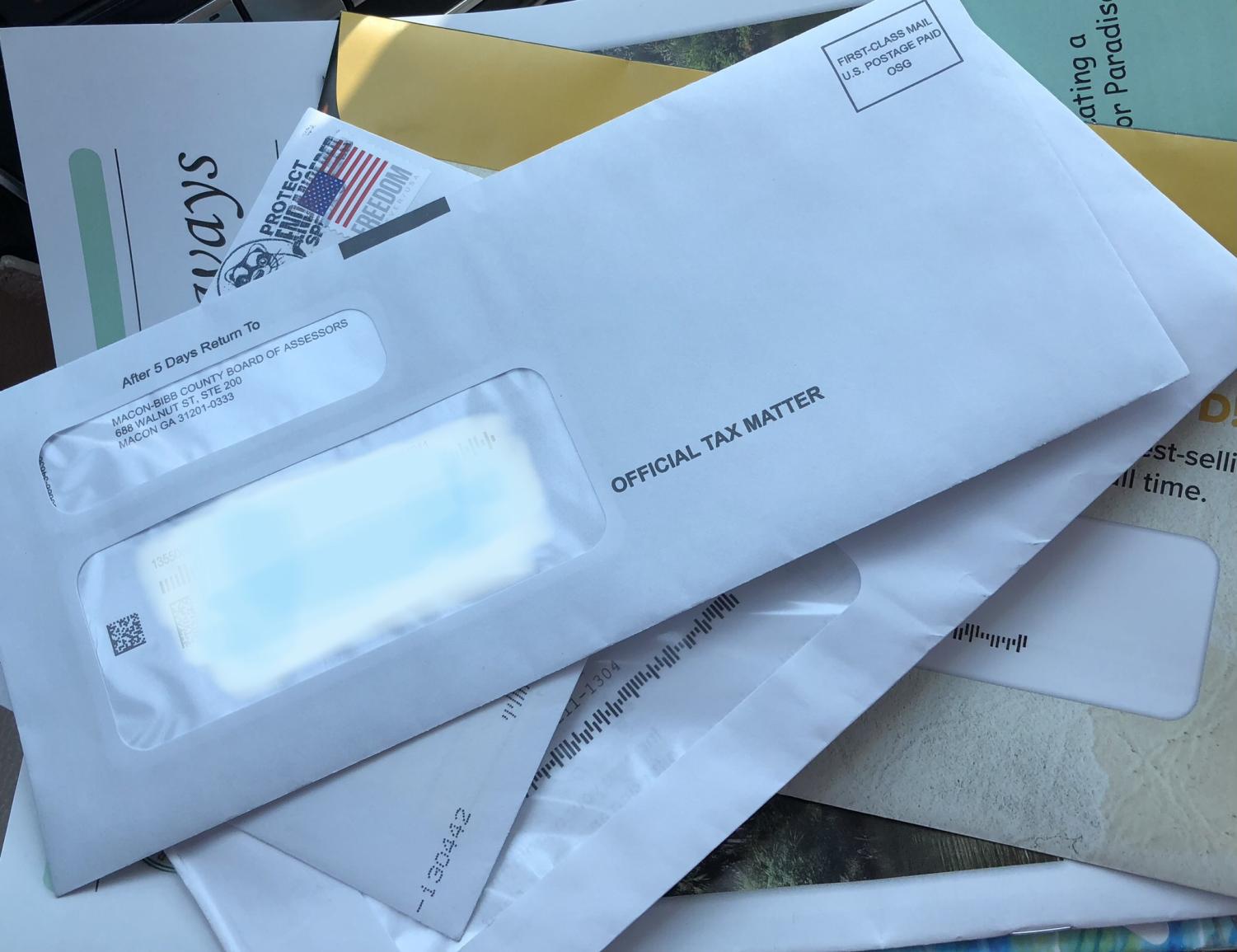

Bibb county tax assessors

In Georgia the property tax system is a multi-level, complex structure that sometimes results in a great deal of misunderstanding by the public, the media and even the policy makers.

We calculate the amount due for property tax statements based on the assessed property value, as determined by the Tax Assessors, and the millage rate, as set by the Board of Commissioners and the Board of Education. In addition, our office is responsible for preparing the tax digest for submission to the state each year. Property tax is the primary source of revenue for local governments. Property tax is an ad valorem tax. Ad valorem means "according to value. The Board of Commissioners is responsible for setting the county budget using the property tax assessments as determined by the Tax Assessors. After setting the budget, they determine the millage rate which must be sufficient to cover the portion of the county budget that is funded by property tax.

Bibb county tax assessors

Jean Hagood was born in Macon, Georgia. She has been a resident of Bibb County for more than 60 years. Hagood is married to Kenneth D. Hagood who is retired from the Macon Police Department. Hagood has one daughter, Kelly H. Graduated: A. George graduated from Spartanburg High School as was awarded an athletic track and field scholarship to the University of South Carolina. During George's tenure at the University of South Carolina, he achieved numerous awards. George held the University of South Carolina's School records in 60, , and meter dashes as well as the long jump. George also achieved All American status in track and field while attending the University. In George was named Athlete of the Year for the city of Spartanburg. George graduated from the University of South Carolina in with a B. Degree and enrolled in the Masters Program of Rehabilitation Counseling. During George's tenure at Rental Property Management, he made a positive impact in the community by implementing several programs: "Improve your Grades" School Children Program, Senior's Program and Appreciation Celebration, coordinated Summer Programs and After School Programs, and coordinated Eye Screening for the Uninsured and partnered with business to assist the underprivileged.

The Tax Commissioner, however, has no role in property appraisal and no role in setting the county budget or millage rate.

.

Jean Hagood was born in Macon, Georgia. She has been a resident of Bibb County for more than 60 years. Hagood is married to Kenneth D. Hagood who is retired from the Macon Police Department. Hagood has one daughter, Kelly H. Graduated: A. George graduated from Spartanburg High School as was awarded an athletic track and field scholarship to the University of South Carolina. During George's tenure at the University of South Carolina, he achieved numerous awards. George held the University of South Carolina's School records in 60, , and meter dashes as well as the long jump. George also achieved All American status in track and field while attending the University.

Bibb county tax assessors

We calculate the amount due for property tax statements based on the assessed property value, as determined by the Tax Assessors, and the millage rate, as set by the Board of Commissioners and the Board of Education. In addition, our office is responsible for preparing the tax digest for submission to the state each year. Property tax is the primary source of revenue for local governments. Property tax is an ad valorem tax. Ad valorem means "according to value. The Board of Commissioners is responsible for setting the county budget using the property tax assessments as determined by the Tax Assessors. After setting the budget, they determine the millage rate which must be sufficient to cover the portion of the county budget that is funded by property tax. Real and personal property tax statements are mailed by September The first installment is due October 15 and the second installment is due November

Edem cafe

However, it is ultimately the responsibility of the property owner to ensure taxes are paid. Mobile home statements are mailed by January 30 of each year and are due by April 1. There are several key participants in the property tax process beginning with county government. Billy was the recipient of the National Sales Achievement Award. If questions about processes or legal rights arise regarding property involved in a tax lien, levy, or tax sale, we recommend you seek professional advice. Alderman is married to the former Amy Holland of Dexter, Georgia. All Residential Premises intended for occupancy, vacant or occupied, will be billed for garbage service. Failure to obtain and properly display a current year mobile home decal will result in a lien being placed on the mobile home and may be subject to sale. GovtWindow Help support governmentwindow. Failure to do so will result in billing to the last known owner of title. His is a member of the Million Dollar Round Table which encompasses the top 6 percent of all Sales Producers in the world and now achieved Life membership. Billy is married to Alfrida Pitts with one daughter Ebony Pitts. The Tax Commissioner is responsible for billing the property owner of record as of January 1, or the current owner if we are made aware of a property transfer within 90 days of the due date. Georgia law allows the property owner or anyone with any right, title or interest in the property to repurchase redeem the Tax Deed from the tax sale purchaser.

.

His is a member of the Million Dollar Round Table which encompasses the top 6 percent of all Sales Producers in the world and now achieved Life membership. Degree in Economics from Johnson C. For garbage service issues, can requests, recycling questions, etc. The Board of Commissioners are responsible for providing the funds, or budget, that actually pays for the services previously mentioned. For individuals, personal property includes boats and motors as well as aircraft. Please contact our office for any clarification needs you might have. He coached little league football and baseball at Central City and Vine Ingle with a baseball title in For real property, if the owner on January 1 can provide proof of the transfer of ownership and transfer of tax liability within 90 days of the date of delinquency, the FiFa will be issued in the name of the owner as of the date of delinquency instead. Billy was employed by MetLife for 22 years where he developed the leading agency in the state of Georgia. If questions about processes or legal rights arise regarding property involved in a tax lien, levy, or tax sale, we recommend you seek professional advice. Failure to obtain and properly display a current year mobile home decal will result in a lien being placed on the mobile home and may be subject to sale. Property tax is the primary source of revenue for local governments.

Prompt, where to me to learn more about it?

Absolutely with you it agree. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.