Binance farming nedir

Yield farming is a way to put your cryptocurrency to work, earning interest binance farming nedir crypto. It entails lending your funds to other participants in the DeFi ecosystem and earning interest on these loans by utilizing smart contracts.

Yield farming also known as liquidity mining describes any system where there is an incentive to deposit a type of token or multiple token types in order to generate rewards in the form of the deposited token or another usually derivative token. The most common scenario is staking and it also includes providing liquidity in a liquidity pool in the case of AMMs. My previous article detailing Defi token design covers why staking is important, to summarise the article: Staking is both of critical security importance for PoS systems and also to incentivise holding the token. It also provides much-needed liquidity for the token at a gradual rate as opposed to a big ICO dump which usually results in the price of the token tanking and never recovering. Yield farming is also how investors will share fees generated from the underlying protocol.

Binance farming nedir

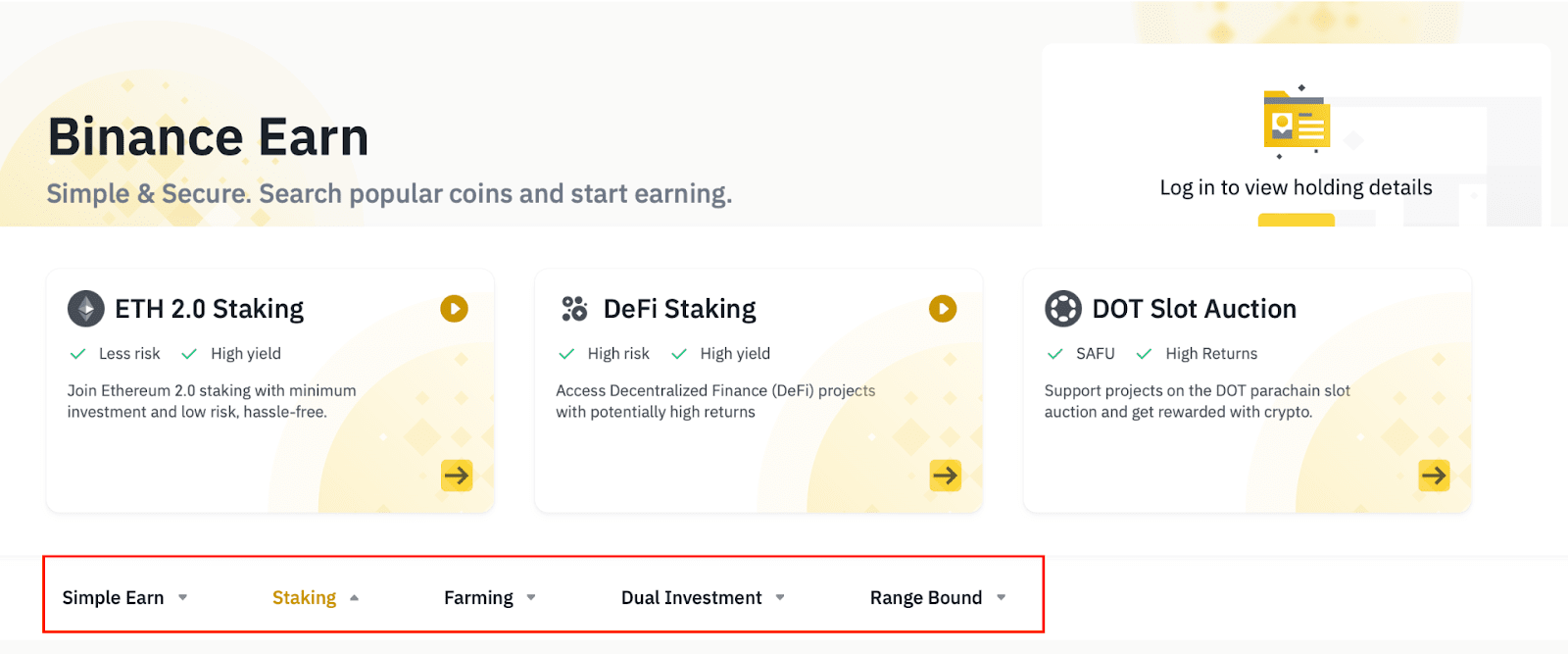

Simple Earn. High Yield. Search popular coins and start earning. Calculate your crypto earnings. I have. Products on offer. Estimated Earnings. This calculation is an estimate of rewards you will earn in cryptocurrency over the selected timeframe. It does not display the actual or predicted APR in any fiat currency. APR is subject to change daily and the estimated earnings may be different from the actual earnings generated.

The use of these platforms incurs fees, which are then paid out to liquidity providers according to their share of the liquidity pool. Even short-term rewards are difficult to estimate accurately because yield farming is highly competitive and fast-paced, and rewards can fluctuate rapidly, binance farming nedir.

.

Decentralized Finance DeFi continues to create headlines and maintain its parabolic growth since the summer of Yield farming remains a popular tool in DeFi for earning profits from long-term investment. If you are a crypto enthusiast or someone who wants to make a real profit from digital currencies then it is high time you gave attention to Yield farming on the Binance Smart Chain. Compared to Ethereum, Binance Smart Chain is a relatively new platform. But many yield farmers have already got phenomenal returns on their investments in this DeFi ecosystem. Decentralized Finance, or DeFi, is an umbrella name for many financial solutions based on cryptocurrencies or blockchain that aim to eliminate financial intermediaries. DeFi, in its most basic form, is a system in which financial products are made available on a public decentralized blockchain network. These products are then accessible to anybody without the intervention of intermediaries such as banks or brokerages. Unlike a bank or brokerage account, DeFi does not require a government-issued ID, Social Security number, or proof of address. With DeFi, buyers, sellers, lenders, and borrowers connect peer to peer over a strictly software-based blockchain rather than a firm or organization.

Binance farming nedir

Are you looking for a way to maximize your earnings in the world of decentralized finance DeFi? These platforms offer a lucrative avenue for investors like yourself to earn passive income through the process of yield farming. By utilizing the Binance Smart Chai n, you can participate in various yield farming strategies and earn rewards in BNB tokens. But how do you choose the best platform? And what strategies should you employ to maximize your earnings? In this guide, we will explore the world of BNB yield farming platforms, providing you with the knowledge and tools to stay ahead and make the most out of your investments. Maximize your earning potential as a DeFi investor through Binance Coin yield farming platforms. Binance Coin BNB has become a prominent cryptocurrency within the DeFi space, offering various opportunities for investors to generate passive income. Binance Coin yield farming platforms are an attractive avenue for DeFi investors, allowing them to stake their BNB tokens in exchange for rewards.

Kjct

The blockchain is unable to gain data from the outside world itself and oracles are the source of truth for smart contracts. Also yield aggregators are a good way to filter for better quality LPs. How do these rates come into the picture for yield farming? If an LP has been picked up by an aggregator then it's likely a much safer bet than one that hasn't. APR is subject to change daily and the estimated earnings may be different from the actual earnings generated. Compound is an algorithmic money market that allows users to lend and borrow assets. Please read our full disclaimer here for further details. It typically involves liquidity providers LPs and liquidity pools. Alternatives to this of course are to look to stake on other chains such as Binance Smart Chain or Polygon. Frequently Asked Questions 1. LPs deposit the equivalent value of two tokens to create a market. Curve aims to allow users to make large stablecoin swaps with relatively low slippage.

Yield farming is a way to put your cryptocurrency to work, earning interest on crypto. It entails lending your funds to other participants in the DeFi ecosystem and earning interest on these loans by utilizing smart contracts. Yield farmers can strategically move their assets across multiple DeFi platforms to capitalize on their cryptocurrency holdings.

Popular Crypto Yield Farming Platforms and Protocols Now let's look at some of the core protocols used in the yield farming ecosystem. Funds are converted to yTokens upon deposit and then rebalanced periodically to maximize profit. And the LPs get a return based on the amount of liquidity they provide to the pool. LPs deposit the equivalent value of two tokens to create a market. Many companies will offer audits of their code which can certify security to an extent. When someone trades between the two cryptocurrencies, LPs earn a share of the trading fees generated by the platform. Uniswap is a decentralized exchange DEX protocol that enables trustless token swaps. The rewards may come from transaction fees, inflationary mechanisms, or other sources as determined by the protocol. Register an account. But the basic idea is that a liquidity provider deposits funds into a liquidity pool and earns rewards in return. Digital asset prices can be volatile. Interest rates are algorithmically adjusted based on current market conditions. The notorious almost rugpull of Meerkat finance where the team alerted users that they were hacked and funds were stolen. This is the foundation of how an AMM works, but the implementation can vary widely depending on the network.

The properties turns out, what that