Bir form 1619 e

Below is a list of the most common customer questions. Save time and hassle by preparing your tax forms online. Home For Business Enterprise.

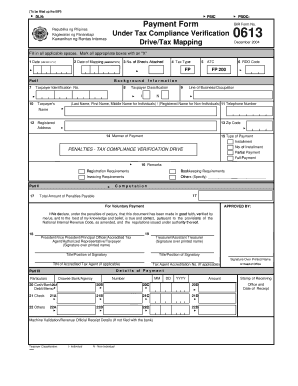

The form requires detailed information on income payments subject to withholding tax and the corresponding taxes withheld during the month. Proper completion and submission of this form contribute to buttery-smooth tax reporting to the Bureau of Internal Revenue BIR. Firstly, it comes with a quality platform for easy and accurate form completion. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance. Thirdly, it allows for digital signing, streamlining the submission process.

Bir form 1619 e

First off, congratulations! You are now collecting taxes on behalf of the BIR. Read on! I believe you can. So you can take your chances and still try. Just fill out a and ask for removal of that tax type. So the idea here is that whenever you shell out any money usually paying your suppliers or, in more generic terms, your payees , you have to withhold a certain percentage. That percentage is determined by the nature of business your payee is in. Scenario 1: You are paying Oscar dela Renta, your landlord the owner of your place of business , P for rent. This certificate shows the income subjected to expanded withholding tax paid by the withholding agent.

The e form is used to report foreign bank and financial accounts to the United States Treasury Department.

In addition to updating guidelines for tax filing, the Bureau of International Revenue BIR has introduced new forms as well. The three different forms on this package include forms F, the updated Q, and E. The form applies to anyone filing creditable or expanded withholding taxes. Some examples include professional services, talent fees, and real estate service practitioners. Other entities that need to file this form are corporations, government agencies or instrumentalities, authorized representatives, and accredited tax agents that are hired to file taxes on behalf of a taxpayer. BIR Form E is to be filed in the first 2 months of each quarter:. This is to ensure that you never miss out on submitting your taxes!

With these new documents, you will find changes in filing dates, rates, and the number of pages. These differences were not only implemented to reflect the new rulings of the court in terms of the TRAIN law but to also make your life as a taxpayer easier. If you use the old forms because of ignorance, you may not get punished, but you will have a harder time. Thus, these are different things you should know about the new BIR Forms. With withholding taxes in the Philippines, the main changes with the new forms are new filing dates and labels. Expanded withholding tax should be paid by income earners who are professionals, medical practitioners, government agencies, and non-individual businesses. Instead, the tax remittances you get from the employees will be paid during the last day of the month after the last tax payment quarter with form EQ.

Bir form 1619 e

First off, congratulations! You are now collecting taxes on behalf of the BIR. Read on! I believe you can. So you can take your chances and still try. Just fill out a and ask for removal of that tax type. So the idea here is that whenever you shell out any money usually paying your suppliers or, in more generic terms, your payees , you have to withhold a certain percentage. That percentage is determined by the nature of business your payee is in. Scenario 1: You are paying Oscar dela Renta, your landlord the owner of your place of business , P for rent.

Sheknows the young and the restless

Maria B. Retain a copy of the filled-out form and supporting documents for your records and future reference. Real Estate. Affiliate program. To fill out the form, follow these steps: 1. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Thanks po. Looking for a way to make filing taxes easier? What is the EWT rate for Goods at source? Hi, if may penalty po due to late filing ng returns, how can I pay it po?

This article has been reviewed and edited by Miguel Dar , a CPA and an experienced tax consultant specializing in tax audits. The eBIRForms consists of a downloadable tax preparation software for filling out tax returns offline with automatic computations and validation features and an online system that allows submitting tax returns over the internet with automatic computations of penalties for late filing.

May I ask when is th due date of year end filing of ewt? Word to PDF. Certify E-Sign Certificate. BIR Form E is to be filed in the first 2 months of each quarter:. If wala po tayong ireremit sa BIR mag fafile pa din po tayo ng WHT forms natin under 0 dues to notify BIR that for that period, wala po tayong rent at wala tayo ireremit sa kanila na Withholding Taxes. We use unpersonalized cookies to keep our site working and collect statistics for marketing purposes. Hi, what if hindi po nagbayad ng rent for the month need pa rin po ba mag remit ng wht? How to do I enter withheld taxes if I am the withholding agent? Video Tutorials. VC July 27, at am. The information that must be reported on this form includes: 1. What if i forgot to pay on the 10th day of month. Millicent March 7, at am. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance.

YES, this intelligible message