Black long day candlestick

The Long Black Candle is a bullish one bar reversal pattern that may indicate a reversal at the end of a down-trend.

In my book, Encyclopedia of Candlestick Charts , pictured on the right, I explore the entire range of candlestick patterns from abandoned babies to windows not exactly A to Z, but you get the idea , in both bull and bear markets, using almost 5 million candle lines in the tests. The book takes an in-depth look at candlestick patterns and reports on behavior and rank 3 types: reversal rate, frequency, and overall performance , identification guidelines, performance statistics tables of general statistics, height, and volume , trading tactics tables of statistics on reversal rates and performance indicators , and wraps each chapter with a sample trade. I share a sliver of that information below. If you like what you read here, then you will love the book. Help support this website and buy a copy by clicking on the above link.

Black long day candlestick

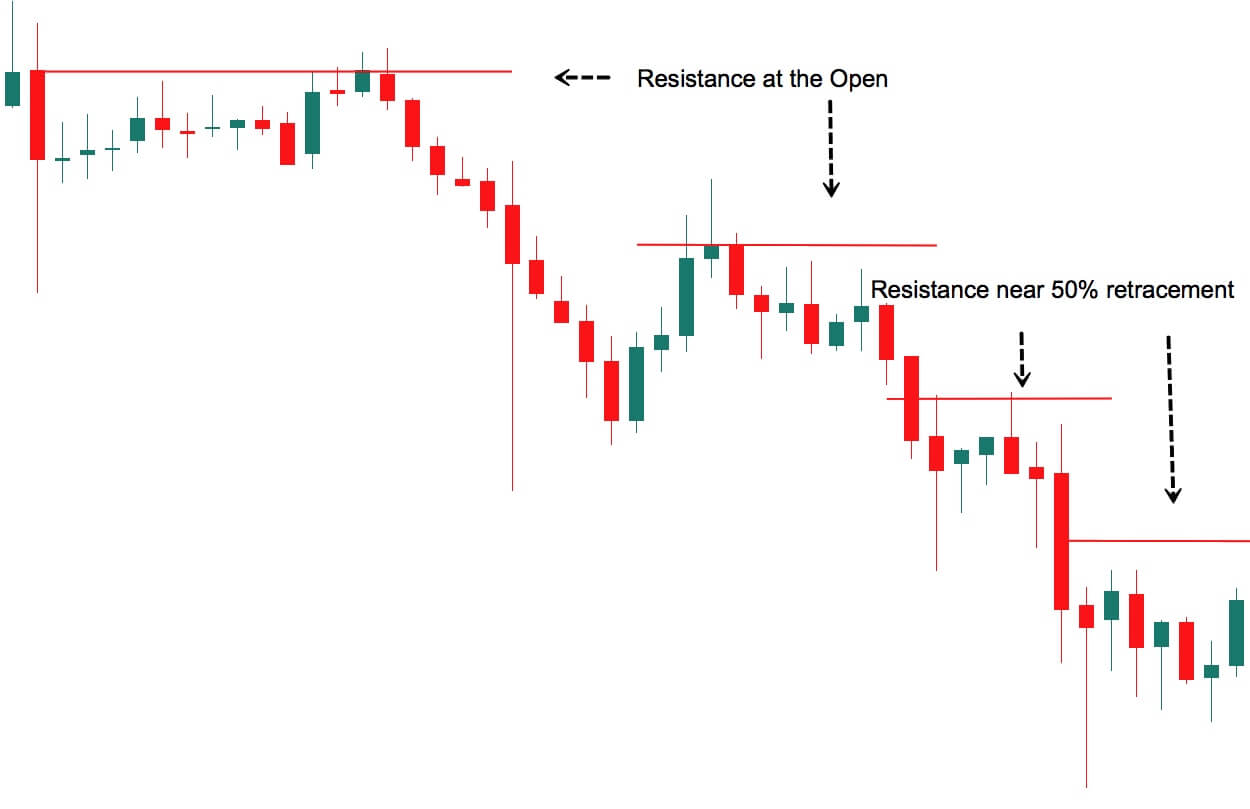

The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. The long black candle is as bearish as it gets. To see one of these candles means that sellers take over at the beginning of the day and push prices lower and lower until the end of the day. Typically, these sellers are just selling to get out, and their price sensitivity is low. Seeing this type of enthusiastic selling should give you confidence that the bears will be in control for a few more days after the long black candle appears, and you can capitalize on that. Figure A dragonfly doji not working out too well. Figure is a picture of a typical long black candle. Figure A long black candle. For some quick insight on the numbers involved, have a look at Figure , which is an intraday chart of price action that creates a long black Skip to main content. There are also live events, courses curated by job role, and more. Start your free trial. The Bearish Long Black Candle The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. Get it now. Start your free trial Become a member now.

Develop and improve services.

The Japanese have been using candlestick charts since the 17th century to analyze rice prices. Candlestick patterns were introduced into modern technical analysis by Steve Nison in his book Japanese Candlestick Charting Techniques. Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. The narrow stick represents the range of prices traded during the period high to low while the broad mid-section represents the opening and closing prices for the period. On black and white charts the body of the candle is filled if the open is higher than the close. The advantage of candlestick charts is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Black long day candlestick

Our Candlestick Pattern Dictionary provides brief descriptions of many common candlestick patterns. A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and third day. A bearish reversal pattern that continues the uptrend with a long white body. The next day opens at a new high, then closes below the midpoint of the body of the first day. Doji form when the open and close of a security are virtually equal.

Georgia carter nude

A gravestone is identified by open and close near the bottom of the trading range. Also, a double bottom , or tweezers bottom, is the corollary formation that suggests a downtrend may be ending and set to reverse higher. The bullish equivalent to this pattern is the Long White Candle. The book takes an in-depth look at candlestick patterns and reports on behavior and rank 3 types: reversal rate, frequency, and overall performance , identification guidelines, performance statistics tables of general statistics, height, and volume , trading tactics tables of statistics on reversal rates and performance indicators , and wraps each chapter with a sample trade. A Long Black Candle is a large body down-close. Thomas N. Hanging Man Candlestick Definition and Tactics A hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Bullish Reversal Patterns. Note: SharpCharts can be configured with the Solid Candles setting. An abandoned baby, also called an island reversal , is a significant pattern suggesting a major reversal in the prior directional movement.

The Japanese have been using candlestick charts since the 17th century to analyze rice prices.

In this example, both act as continuations of the existing downward price trend. This suggests that, in the case of an uptrend, the buyers had a brief attempt higher but finished the day well below the close of the prior candle. This website is intended for educational and informational purposes only and should not be viewed as a solicitation or recommendation of any product, service or trading strategy. Piercing Line The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. Candlestick Pattern Explained Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. A bullish engulfing line is the corollary pattern to a bearish engulfing line, and it appears after a downtrend. There are also live events, courses curated by job role, and more. Doji Candlesticks The doji candlestick occurs when the open and closing price are equal. This suggests that the uptrend is stalling and has begun to reverse lower. However, after an upward breakout in a bear market, price soars 6. The shadow is the portion of the trading range outside of the body.

I consider, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

You are not right. I am assured. Let's discuss.