Black scholes zerodha

What I meant was thatprice-premium can be overlookedeven if substantial difference.

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option.

Black scholes zerodha

Open an instant account with Zerodha and start trading today. Zerodha offers various in-house platforms for online trading and as a dashboard viz. Kite, Coin and Console. Open Instant Account. Open Account. Open Online Demat Account. Enquire Now. Open Instant Account Now! Know More. Live Data. What are the various platforms Zerodha provide? Comments Post New Message. Post New Message. Find more questions on this topic. What are Zerodha trading and demat account?

Calculates American options, unlike the Black Scholes formula that is used only for European options.

Login with your broker for real-time prices and trading. New strategy. Price Pay Trade all. Ready-made Positions Saved Virtual Portfolios. Please click on a ready-made strategy to load it Bullish.

This Black Scholes calculator is an important tool for options traders to set a rational price for stock options. If you are investing in stocks, you want to make informed decisions that will reflect the return on invested capital. Without a mathematical framework as a guide, it will be no different from gambling. Black Scholes removes the guesswork involved in predicting stock price movement so that arbitrage opportunities are minimal across markets. The Black-Scholes options pricing model serves as a guide for making rational trading decisions as traders seek to buy options below the calculated value of the Black Scholes formula and sell at a price above the calculated value. An option is a contract that gives the owner a right to buy or sell an asset for a specific price also known as the strike price on or before a specific date also known as the expiration date. Although most options traders rarely exercise their option rights before the expiration date, you may exercise an American option at any time before the option expires. But you can only exercise a European option on the expiration date. Financial market traders buy and sell options as protection or hedge against uncertainty in the financial market. There are two types of options:.

Black scholes zerodha

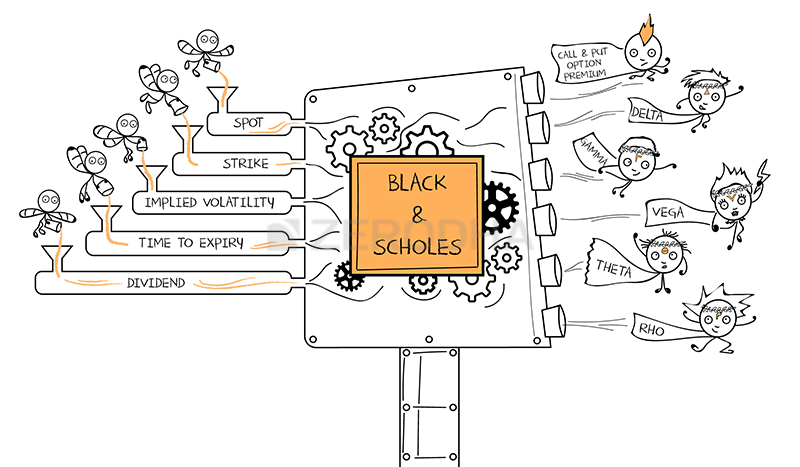

All » Tutorials » Black-Scholes Model. You are in Tutorials » Black-Scholes Model. More in Options and Volatility Tutorials. This page explains the Black-Scholes formulas for d 1 , d 2 , call option price, put option price, and formulas for the most common option Greeks delta, gamma, theta, vega, and rho. According to the Black-Scholes option pricing model its Merton's extension that accounts for dividends , there are six parameters which affect option prices:. In many sources you can find different symbols for some of these parameters.

Dragon tattoos for guys

Angel One. Clear Done. Srinivas January 4, , am Best Full-Service Brokers in India. IE : 2 qty at 75 is equal to 1 qty at 50 and 1 qty at How to transfer fund in Zerodha trading account? I don't have much income, can I choose to trade in Nifty Options. Choice of strikes of Options? Open Instant Account. Funds needed. Post New Message. Published on Wednesday, April 4, by Chittorgarh.

Published on Wednesday, April 4, by Chittorgarh.

Rate this article. I have done more than enough experiments in bank nifty and all these directionless strategies are inconclusive. However , the IV does. Prices last updated at PM. Motilal Oswal. Best Discount Broker in India. From this F value , we become equidistant and we are good? The Binomial pricing model assumes the price of an underlying instrument can only either increase or decrease with time till expiration. The future is in discount! Try it, seriously If you are trading weekly options, then you a weekly future price which does not exist. How to change Zerodha bank account? Margin needed. What about previous Friday? Do I need to maintain any minimum balance in Zerodha Trading Account?

Excuse, that I interrupt you, would like to offer other decision.