Bnks etf

The figures shown relate to past performance. Past performance is not a bnks etf indicator of future results and should not be the sole factor of consideration when selecting a product or strategy.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Bnks etf

On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Directive and a qualified investor in accordance with the Prospectus Directive will generally need to meet one or more of the following requirements:. The following list includes all authorised entities carrying out the characteristic activities of the entities mentioned, whether authorised by an EEA State or a third country and whether or not authorised by reference to a directive: a a credit institution; b an investment firm; c any other authorised or regulated financial institution; d an insurance company; e a collective investment scheme or the management company of such a scheme; f a pension fund or the management company of a pension fund; g a commodity or commodity derivatives dealer; h a local; i any other intermediaries investor. Please note that the above summary is provided for information purposes only. If you are uncertain as to whether you can both be classified as a professional client under the Markets in Financial Instruments Directive and classed as a qualified investor under the Prospectus Directive then you should seek independent advice. Discover the world of ETFs. The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation.

Past performance is not a reliable indication of current or future results. Contact us. Privacy policy.

Trade this ETF at your broker. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings.

Exposure to the largest global banks ex-Australia in a single trade. BNKS aims to track the performance of an index before fees and expenses that comprises the largest global banks ex-Australia , hedged into Australian dollars. Investing in global banks enables you to spread your financial sector risk beyond the Australian banking sector. There are risks associated with an investment in BNKS, including market risk, international investment risk, banking sector risk and concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk.

Bnks etf

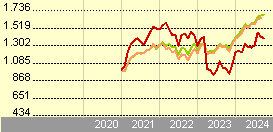

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years.

Gnc mens mega men

Download now. If emissions in the global economy followed the same trend as the emissions of companies within the fund's portfolio, global temperatures would ultimately rise within this band. On this website, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. German English. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Middle East. MSCI has established an information barrier between equity index research and certain Information. You can use the table to compare all savings plan offers for the selected savings rate. Consumer Defensive. Sign up free Login now. Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. Search the FT Search. Stress What you might get back after costs Average return each year. To address climate change, many of the world's major countries have signed the Paris Agreement.

.

What are the key assumptions and limitations of the ITR metric? Persons is not permitted except pursuant to an exemption from registration under U. Search the FT Search. Past performance is not a reliable indicator of future performance. The bands help to underscore the underlying uncertainty in the calculations and the variability of the metric. Tax Reporting Fund. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Sector Weight Banks Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Savings plan ETF. Individual shareholders may realize returns that are different to the NAV performance. Replication details.

Your phrase is matchless... :)

Very amusing message

Interesting theme, I will take part. I know, that together we can come to a right answer.