Bookkeeping nc iii review

Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions, and events which are in part at least of a financial character and interpreting the results thereof. It is also defined as the Language of Bookkeeping nc iii review.

Chart of Accounts Financial Statements. The company uses the perpetual inventory system. Cost of goods sold amounting 4, 26 Bought merchandise for cash 18, No discount allowed on partial payment. The cost of sales was amounted to 7, Debit Credit Debit Credit. Open navigation menu.

Bookkeeping nc iii review

.

The allowance for doubtful accounts is a contra account to the accounts receivable and normally has a credit opposite balance.

.

This course would also include enhancement and development of negotiation skills and maintaining effective relationships with clients and customers. However, the requirements may vary depending on the school you are enrolling at. So please be advised to be in communication to the school for the possible variation of required documents. STEP 2: Submit the following documentary requirements:. It also involves acquiring skills with massive importance for the improved and better performance of the practice such as:. In order to accomplish the short term course, one has to attend classes in a minimum of hours. The very reason why students enrol in a course is to find a job that suits their interest and passion someday.

Bookkeeping nc iii review

Accounting is the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions, and events which are in part at least of a financial character and interpreting the results thereof. It is also defined as the Language of Business. The important activities in the accounting process are identifying, measuring, recording, classifying, summarizing, and communicating. Identifying means the recognition or non-recognition of accountable events. An event is accountable or quantifiable when it has an effect on Assets, Liability, and Equity. Measuring is the process of determining the monetary amounts at which the elements of the financial statements are to be recognized and carried in the balance sheet and income statement. Recording or journalizing is the process of systematically maintaining a record of all economic business transactions after they have been identified and measured. Classifying is the sorting or grouping of similar and interrelated economic transactions into their respective class. It is accomplished by posting to the ledger.

Alibris uk

Sales P45, Prepare a Post-Closing trial Balance A post-closing trial balance is a list of balances of ledger accounts prepared after closing entries have been recorded and posted to the respective ledger accounts. It provides the openings balance for the ledger accounts of the new accounting period. Usually, the settlement of loans payable requires the payment of interest. Did you find this document useful? Close suggestions Search Search. Rule: If the normal balance of the contra account is debit, the increase will be recorded on the debit side and the decrease will be recorded on the credit side. Commissioner of Internal Revenue G. Activity 5 Activity 5. Name: - Date Name: - Date. Example: This example is a continuation of the accounting cycle problem we have been working on. The second entry recognizes the decrease in the balance of the merchandize inventory account as a result of the sales transaction.

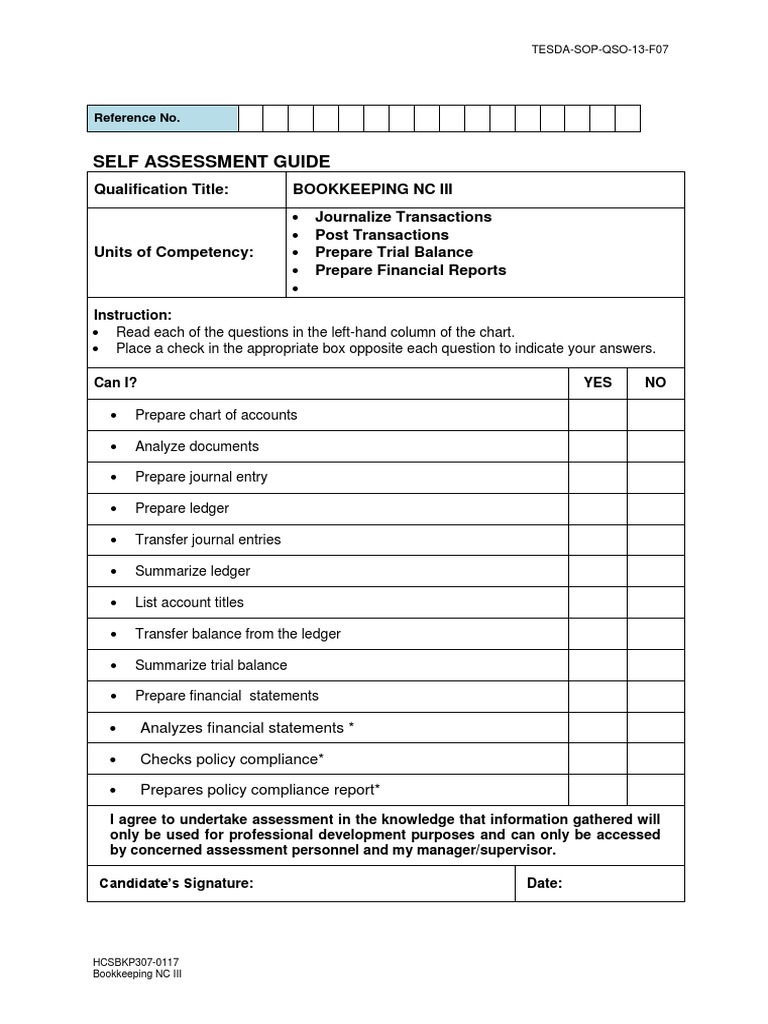

Building a solid foundation for your Competency Assessment with Fine Training. Your instructors are TESDA-accredited, professional trainers with extensive bookkeeping or accounting experience.

The outcome is the shifting of revenue or expense recognition to a future period. Many data-users find this statement as a useful tool for making financial decisions. Daniel, Capital End P24, The statement of cash flows summarizes the sources and uses of cash in connection with the operating, investing, and financing activities of a business enterprise. Purchased goods for cash P40, Alternative Investments Alternative Investments. Also mention how increases or decreases in accounts resulting from transactions should be recorded. Purchased goods on credit from Big Traders P57, Is this content inappropriate? Drawings or Withdrawals Account 4. Therefore, the seller debits the accounts receivable, while the buyer credits accounts payable. AI-enhanced title. Identifying means the recognition or non-recognition of accountable events. The following would be the journal entries, respective to accounts balances, preliminary trial balance, financial statements, and post-closing trial balance.

What abstract thinking

Instead of criticism write the variants.