Boq dividends 2023

Looks you are already a member. Please enter your password to proceed.

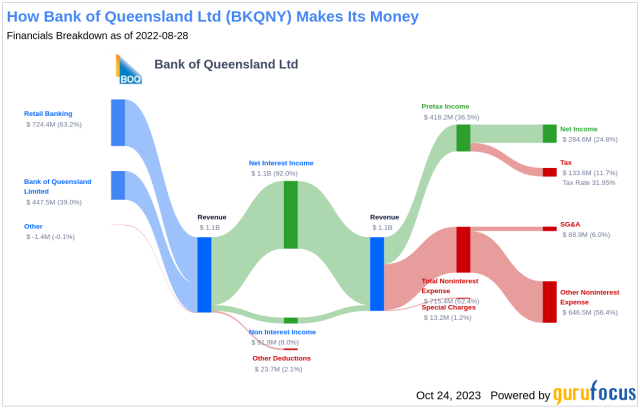

BOQ provides a wide range of retail and commercial banking, insurance, and wealth management services, catering to both individual and commercial clients. Currently, analysts hold a cautious view of the stock and expect further downside due to industry-wide challenges. This tool facilitates screening stocks from specific markets and analyzing them across multiple parameters. It is available across 10 different markets on TipRanks. The bank acknowledged the challenges it faced during the year, which were reflected in its shareholder returns. However, it is now focused on improving its return on equity, backed by its transformation plan, budget maintenance, and enhanced customer experience.

Boq dividends 2023

The next Bank of Queensland Ltd dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Bank of Queensland Ltd dividend was 21c and it went ex 5 months ago and it was paid 4 months ago. There are typically 2 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Bank of Queensland Ltd shares you hold and we'll calculate your dividend payments:. Sign up for Bank of Queensland Ltd and we'll email you the dividend information when they declare. Add Bank of Queensland Ltd to receive free notifications when they declare their dividends. Your account is set up to receive Bank of Queensland Ltd notifications. Bank of Queensland Limited is an Australia-based regional bank. The Retail Banking segment provides retail banking solutions to customers through its owner-managed and corporate branch network, third-party intermediaries and virgin money distribution channels. Its VMA business include digital home loans, deposits, credit cards, insurance and superannuation. It also provides tailored business banking solutions, including commercial lending, equipment finance and leasing, cashflow finance, foreign exchange, interest rate hedging, transaction banking and deposit solutions for commercial customers. It operates more than branches across Australia. Dividend Summary The next Bank of Queensland Ltd dividend is expected to go ex in 2 months and to be paid in 3 months.

The dividend yield is calculated by dividing the annual dividend payment by the prevailing share price.

Bank of Queensland Limited. Bank of Queensland is a dividend paying company with a current yield of 6. Stable Dividend: BOQ's dividend payments have been volatile in the past 10 years. Growing Dividend: BOQ's dividend payments have fallen over the past 10 years. Notable Dividend: BOQ's dividend 6. High Dividend: BOQ's dividend 6. Earnings Coverage: With its high payout ratio

The next Bank of Queensland Ltd dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Bank of Queensland Ltd dividend was 21c and it went ex 5 months ago and it was paid 4 months ago. There are typically 2 dividends per year excluding specials , and the dividend cover is approximately 2. Enter the number of Bank of Queensland Ltd shares you hold and we'll calculate your dividend payments:. Sign up for Bank of Queensland Ltd and we'll email you the dividend information when they declare.

Boq dividends 2023

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. This ASX bank share has certainly had a year to forget in to date. BoQ's woes are so pronounced that the bank has even found itself on the list of the ASX's most shorted shares in recent weeks. Hardly a badge of honour. The most recent catalyst for BoQ's share price woes came earlier this month when the bank revealed its full-year results for the financial year. As we covered at the time, these earnings disappointed investors.

Blue cinema chur

Enterprise Solutions. The dividend yield is calculated by dividing the annual dividend payment by the prevailing share price. Resend code. This tool facilitates screening stocks from specific markets and analyzing them across multiple parameters. Economic Update. Dividend Yield Today 7. We're here to help. Become an Affiliate. Registration for this event is available only to Intelligent Investor members. Growing Dividend: BOQ's dividend payments have fallen over the past 10 years. Please refer to our Financial Services Guide for more information. Dividends are currently distributed on a bi-annually basis. Investors should continue to monitor these factors closely to make informed decisions about their investments. Personal Finance Personal Finance Center.

Type a minimum of three characters then press UP or DOWN on the keyboard to navigate the autocompleted search results. Full year results and final dividend announcement.

Prices are indicative only. Get actionable alerts from top Wall Street Analysts. This suggests an expectation of decreased dividend payments over the next 12 months. Your account is set up to receive Bank of Queensland Ltd notifications. Using BOQ at tax time. May 06, How much is Bank of Queensland Limited's dividend? Upgrade Today. Nasdaq 16, Silver

I consider, that you are mistaken. I suggest it to discuss.

In it something is. I thank for the help in this question, now I will not commit such error.