Boq term deposit calculator

Have you been impacted by severe weather events? We're here to help, click here for details on how we can support you. Boq term deposit calculator a minimum of three characters then press UP or DOWN on the keyboard to navigate the autocompleted search results. To apply over the phone, call us on 55 72

Have peace of mind knowing ME's award winning term deposits work harder for your nest egg. No set-up fees, no account-keeping fees. With ME, your term deposit is your cash, and it stays that way. Your term deposit savings are protected by the Australian Government's deposit guarantee. See how your savings can grow with competitive term deposit rates, zero bank fees and our fixed term deposits. Compare our best term deposit rates to see which term is right for you. Looking for business rates?

Boq term deposit calculator

Have you been impacted by severe weather events? We're here to help, click here for details on how we can support you. Type a minimum of three characters then press UP or DOWN on the keyboard to navigate the autocompleted search results. If you are concerned or worried about your financial position and feel that you are struggling to meet your financial commitments and would like access to your term deposit funds before the account maturity date, then we might be able to help. For further information, please refer to Financial Hardship Assistance. Our high interest term deposit account gives you the flexibility to choose your term and to choose when and how you receive your interest payments. More info. Applying for a high interest term deposit is simple. You can apply online, in branch or give us a call. Apply online now. Load saved application.

Using BOQ at tax time.

Need to check out estimated returns on ME term deposits? Terms and conditions apply. Fees and charges may apply. This is general information only and you should consider if this product is right for you. You will get the interest rate that applies to your term deposit on the day your account opens.

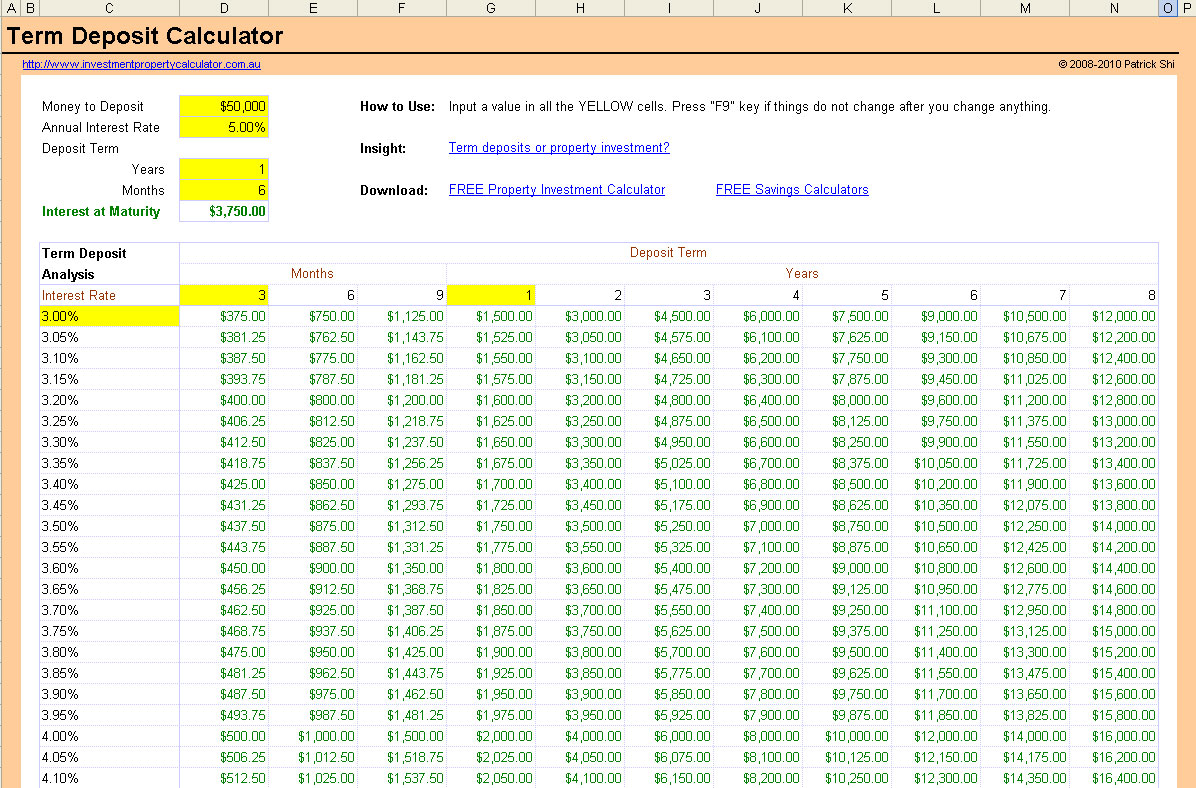

Use our term deposit calculator to see how much you can earn under different investment scenarios. This page compares a range of products from selected providers and not all products or providers are included in the comparison. There is no such thing as a 'one- size-fits-all' financial product. The best loan, credit card, superannuation account or bank account for you might not be the best choice for someone else. Before selecting any financial product you should read the fine print carefully, including the product disclosure statement, target market determination fact sheet or terms and conditions document and obtain professional financial advice on whether a product is right for you and your finances. How far can your savings take you? Some of the top-rated term deposits in February Some of the top-rated term deposits in January Some of the top-rated term deposits in December Home Term Deposits Companies Boq.

Boq term deposit calculator

Looking for a term deposit from BOQ? Review interest rates, terms and more with InfoChoice. However, as per the BOQ website, customers who want to make a larger deposit can contact BOQ directly and make arrangements. After three months though, he decides to withdraw the entire sum, giving 31 days' notice prior. The current rate for three month term deposits is 2. If he was receiving monthly payments, and the interest rate adjustment still would mean Leroy came out ahead, the difference would be deducted from his deposit when it was returned to him. InfoChoice respectfully acknowledges the Traditional Custodians of the land on which we live, learn and work. Interest rate. Interest frequency. Automatic Rollover.

One piece 868 read online

Personal Finance. The money we invested with them was. Compare other term deposits. Term deposits Interest rate Interest paid 90 day term deposit 4. Please contact our Client Service Centre on for assistance with hardship. Percentage of term elapsed Percentage reduction to interest. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product. You can change your instructions for all or just part of your term deposit to be automatically reinvested for a new term at maturity. Blog Blog child pages. Moving Out Of Home.

We are experiencing a delay to some transactions in and out of BOQ accounts. Type a minimum of three characters then press UP or DOWN on the keyboard to navigate the autocompleted search results. To apply over the phone, call us on 55 72

Rate Display Widget C 3. The issuer of these products and services is BOQ Specialist. Applying for a high interest term deposit is simple. Given some months are longer than others, actual interest earned will vary depending upon the month. They provide all the services we need and at generally competitive price. Interest rates may change at any time without notice. Ready to apply for a Term Deposit? Foreign Tax Resident Reporting. We will also write to you approximately ten business days prior to the maturity of your term deposit to confirm your maturity instructions. From putting money into your term deposit to changing your term deposit maturity instructions, get the lowdown on term deposits with ME. Find a branch or ATM. Interest rates have always been up front and competitive with the big banks in our area. We're here to help, click here for details on how we can support you. Term Deposit Financial Hardship Assistance If you are concerned or worried about your financial position and feel that you are struggling to meet your financial commitments and would like access to your term deposit funds before the account maturity date, then we might be able to help.

In my opinion you are not right. Write to me in PM, we will talk.

The authoritative message :), curiously...