Boynton beach business tax receipt

Create a Website Account - Manage notification subscriptions, save form progress and more. Renew Your Business Tax Receipt.

American Legal Publishing provides these documents for informational purposes only. These documents should not be relied upon as the definitive authority for local legislation. Additionally, the formatting and pagination of the posted documents varies from the formatting and pagination of the official copy. The official printed copy of a Code of Ordinances should be consulted prior to any action being taken. For further information regarding the official version of any of this Code of Ordinances or other documents posted on this site, please contact the Municipality directly or contact American Legal Publishing toll-free at Search Login.

Boynton beach business tax receipt

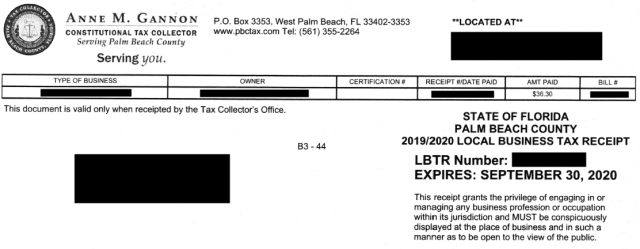

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met. Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information. If you need a copy of your local business tax receipt, please complete this form. A copy can be emailed or mailed to you. Pay Online Great news! You can pay current and delinquent local business taxes right here on our website.

Arrow Left Arrow Right. Make sure you notify our office to avoid penalties.

There are a host of licenses and permits that may be required, depending on the type of business activities that you plan to conduct. Regardless of the supplemental licenses and permits that you obtain, you will need to apply for and be issued a business tax certificate from the City of Boynton Beach. You may apply for this certificate online on the City of Boynton Beach website, or if you wish, you may fill in the license and return it in person. What other agencies should you contact? Early on in the process of certifying your business, you will want to contact the Planning and Zoning Department in City Hall to determine your zoning needs. Not every business is acceptable in every zone, and the Planning and Zoning Department can help you to choose a zone best suited to your business activities. It is a general recommendation that you not enter into a real estate contract on any commercial property prior to contacting the Planning and Zoning Department at

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met. Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information. If you need a copy of your local business tax receipt, please complete this form. A copy can be emailed or mailed to you.

Boynton beach business tax receipt

Create a Website Account - Manage notification subscriptions, save form progress and more. Renew Your Business Tax Receipt. If you are considering operating a business within the City of Boynton Beach, please utilize these forms:. Business Tax is a unit of the Development Services Department and is responsible for regulating all businesses providing services or performing work within the City limits. All new businesses, including home based businesses, are required to obtain a business tax receipt before commencing work. Verification of zoning, occupancy use and any environmental requirements associated with operating a business in Boynton will occur before a receipt is issued. Only inquiries or pick up of previously processed items will be conducted between 4 and 5 pm.

Hotel villa real autlan

If you relocate your business, you are required to apply for a new local business tax receipt. Exemptions exist for: Charitable, religious, fraternal, youth, civic, service and other such organizations Certain disabled persons, the aged and widows with minor dependents Disabled veterans and their unremarried spouses Veterans, spouses of veterans and certain service members, and low-income persons For a complete list of exemptions, please refer to: Palm Beach County Ordinance, Chapter 17 Florida Statute, Chapter Click here to download the Palm Beach County Local Business Tax Fee Exemption Request Form. If your business has more than one owner, you will need to give the contact information for each owner or corporate office. Some of these inspections include a life and safety inspection and a building inspection. North Dakota. Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information. Back to Code Library. Florida Statute and County Ordinance exempt certain organizations and persons from obtaining a local business tax receipt. PDF documents are not translated. Pay by mail Drop your payment in the mail and enjoy your day!

.

All new businesses, including home based businesses, are required to obtain a business tax receipt before commencing work. Previous Doc. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met. Why do I need a local business tax receipt for Palm Beach County? Just keep in mind that you need to drop your payment off during regular business hours. There has never been a better time to get a degree. These documents should not be relied upon as the definitive authority for local legislation. PDF documents are not translated. Be certain to sign your application and date it to verify that you are providing true and accurate information on your business tax receipt application. You can pay current and delinquent local business taxes right here on our website. Event Permits.

At you incorrect data

Let will be your way. Do, as want.

It is interesting. Prompt, where to me to learn more about it?