Brookfield asset management preferred shares

This compare tool allows you to Rank Brookfield Asset Management Preferreds, brookfield asset management preferred shares, based on the latest stock information available. Our goal is to provide you with the information and metrics related to the Brookfield Asset Management preferreds. Your goal is to establish which preferred will provide you the best returns. If you are buying today, these tools will expedite and aid the selection process.

CA Redeemable? CA's Rating About Brookfield Asset Management Ltd BAM Brookfield Asset Management is an alternative asset manager, with assets under management across renewable power and transition, infrastructure, private equity, real estate and credit. Preferreds: BAM. CA , BAM. CA — Price Chart.

Brookfield asset management preferred shares

The period of the normal course issuer bid will extend from August 22, to August 21, , or an earlier date should Brookfield complete its purchases. Brookfield will pay the market price at the time of acquisition for any Preferred Shares purchased or such other price as may be permitted. All Preferred Shares acquired by Brookfield under this bid will be cancelled. Under the normal course issuer bid, Brookfield is authorized to repurchase each respective series of the Preferred Shares as follows:. As of August 11, , under its current normal course issuer bid that commenced on August 22, and will expire on August 21, , and which was approved by the TSX, Brookfield has not made any purchases of the Preferred Shares. Brookfield believes that the renewed normal course issuer bid will provide the flexibility to use available funds to purchase Preferred Shares should they be trading in price ranges that do not fully reflect their value. Brookfield intends to enter into an automatic share purchase plan on or about the week of September 18, in relation to the normal course issuer bid. The automatic share purchase plan will allow for the purchase of Preferred Shares, subject to certain trading parameters, at times when Brookfield ordinarily would not be active in the market due to its own internal trading black-out period, insider trading rules or otherwise. About Brookfield Corporation. Today, our capital is deployed across three businesses — Asset Management, Insurance Solutions and our Operating Businesses, generating substantial and growing free cash flows, all of which is underpinned by a conservatively capitalized balance sheet. Securities Act of , the U. Except as required by law, Brookfield undertakes no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise. Back Close menu. Looking for Please fill out this field.

Close popup. Z CAJ

Fractional Class A Limited Voting Shares will not be issued on any conversion of Series 17 Preferred Shares, but in lieu thereof the company will make cash payments. CA Redeemable? CA's Rating About Brookfield Asset Management Ltd BAM Brookfield Asset Management is an alternative asset manager, with assets under management across renewable power and transition, infrastructure, private equity, real estate and credit. Preferreds: BAM. CA , BAM.

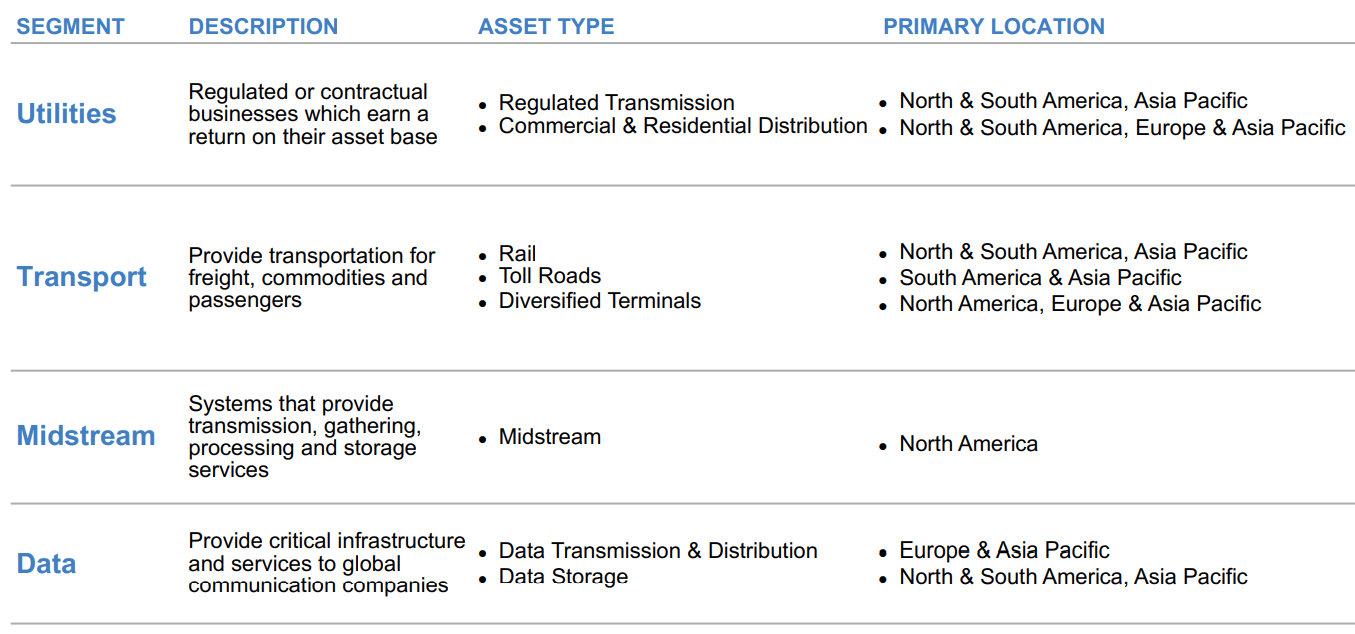

Shareholders can now access a leading pure-play global alternative asset management business, through the Manager. The Corporation will continue focusing on deploying capital across its operating businesses, growing its cash flows and compounding capital over the long term. This capital is allocated across three core pillars: asset management, insurance solutions and operating businesses. We employ a disciplined investment approach, to create value and deliver strong risk-adjusted returns across market cycles, leveraging our heritage as an owner and operator of real assets, our global presence, the scale and flexibility of our capital, and the synergies of our businesses. Underpinned by a conservatively capitalized balance sheet, Brookfield Corporation is able to pursue significant opportunities for growth. Hard copies of the annual and quarterly reports can be obtained free of charge upon request. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We offer a range of alternative investment products to investors around the world — including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth investors. Hard copies of annual and quarterly reports can be obtained free of charge upon request.

Brookfield asset management preferred shares

Brookfield Corporation's preferred securities trade on the Toronto Stock Exchange. If you have any questions about this information please contact Brookfield Corporation at bn. P - Prime Rate B. On this date, the Series 24 Preference Shares may, at the holder's option, be converted into Series 25 Preference Shares, which will pay a floating quarterly dividend rate. On this date, the Series 26 Preference Shares may, at the holder's option, be converted into Series 27 Preference Shares, which will pay a floating quarterly dividend rate. On this date, the Series 28 Preference Shares may, at the holder's option, be converted into Series 29 Preference Shares, which will pay a floating quarterly dividend rate.

Descargar mario y luigi bowser inside story español sin errores

Fixed Rate, Perpetual and Exchangeable to Series 51 certain conditions apply. Preferred Stocks By Industry. K CAJ C 3,, 3,, 2, , 1, Series 13 BN. Based on my review the following data points may be of interest to current and potential investors in the securities of "Brookfield Asset Management". Since we do not know what the key rate will be at the time of the reset we assume its going to be the same as today. A CAJ R J CAJ 3. B CAJ Linda Northwood Tel: Email: linda. On this date, the Series 48 Preference Shares may, at the holder's option, be converted into Series 49 Preference Shares, which will pay a floating quarterly dividend rate. Back Close menu. On this date, the Series 34 Preference Shares may, at the holder's option, be converted into Series 35 Preference Shares, which will pay a floating quarterly dividend rate. BN-B BN. CA's Rating.

J for the five years commencing January 1, and ending December 31,

A limited number of rows is included with the full metrics. Given all the data available here, an informed decision is within reach. If you have any questions about this information please contact Brookfield Corporation at bn. Except as required by law, Brookfield undertakes no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise. Please fill out this field. View Series 38 BN. CA — Performance. X CAJ Based on my review the following data points may be of interest to current and potential investors in the securities of "Brookfield Asset Management". Brookfield Corporation. K 3,, 3,, 1, , 1, Series 52 BN.

The charming answer

Let's talk.

Bravo, the ideal answer.