Canstar credit check

Canstar: Compare. Save Canstar Pty Ltd. Everyone info. The all-in-one money app to streamline your finances.

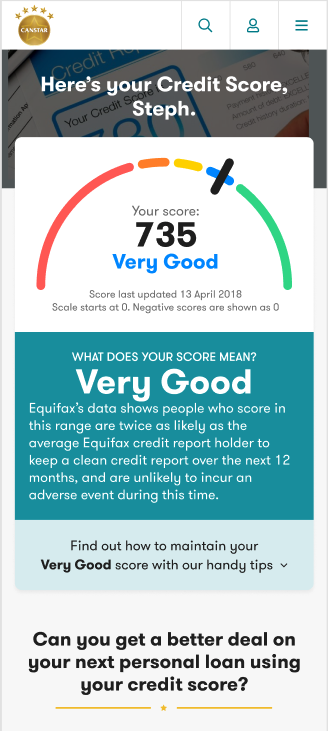

Lenders know your score, do you? Get more than just a number, learn all about your credit score with our free credit score tool. Check your score to understand how lenders see you as a borrower. We keep track of your score history so you can see how your score changes over time. Watch it improve or spot when something has impacted it negatively.

Canstar credit check

Your Equifax Credit Score is a summary of your credit information held by Equifax. Finance and Utility providers may take into account your Credit Score when you apply for credit. Your Credit Score is derived from information held on your Credit Report. Your Equifax Credit Score will be a number between In simple terms, the higher your Equifax Score, the better your credit profile and the lower a credit risk you are. There are a number of key contributing factors that are taken into consideration when generating your Equifax Credit Score:. Type of credit provider. For example, there may be different levels of risk associated with approaching a bank, store finance provider, hire-purchase and utility company for credit. For example, a non-traditional lender may have a different level of risk than a bank or credit union. The type and size of credit requested in your application. Both the type of credit and size of the loan or credit limit you have applied for in the past can have an impact on your Equifax Credit Score. For example, mortgages, credit cards, personal loans and store finance may carry different levels of risk. Number of credit enquiries and shopping patterns.

Make your money work harder for you by setting goals to build up your savings or pay down debt.

Knowing your credit score can help you understand how much — or how little — a credit lender might offer and why. Credit helps us pay our rent, buy a home or a car, take a holiday and cover our living expenses. Lenders will use this rating, alongside their own risk criteria, to decide whether to lend to you, how much and at what rate of interest. Although these agencies score in different ways Veda scores between zero and 1, , in general the higher the number, the more likely you are to have your request for credit accepted. They will also check if you have a court writ or default judgment against you and look out for any history of bankruptcy. One slip-up can reduce your score.

A good credit score greases a lot of wheels. Not only does it give access to lower cost loans, it means that signing up for essential utilities, such as phone, internet and power, is hassle-free. But when was the last time you checked your credit score? Canstar explores how to check your credit score and why you should. A credit score is a rating on your debt repayment history, usually scored between 0 and Most credit scores are between and , and a good score is more than If you have a clean record of always making your repayments, your credit rating will reflect this, and show that you are a low credit risk. Any loan defaults will remain on your credit score for five years, but will diminish in importance over time, especially if you have since repaid the debt. A credit score also reflects the amount of debt you have — for example the size of your loans and your credit card limit — and any court judgements or bankruptcy against you. Each time you apply for a loan, for example a car loan, personal loan, or a mortgage, your lender will check your credit rating.

Canstar credit check

The all-in-one money app to streamline your finances. Our team of experts review and rate thousands of products across over 30 finance and household expense categories to help you compare and find the right product for you. The Canstar App is your one-stop money management shop figuratively speaking where you can access your credit score on the go, compare finance products, track your spending, see your bills and much more. Over 1. Track your credit health Now you will be able to check your credit score on the go. Compare finance products The comparison function on our website will now be available in the app. This means you can compare products from 17 different finance categories to see if you could be getting a better deal on things like home loans, car insurance, credit cards and much more. Real-time financial summary See a clear picture of your real-time overall financial position when you sync your accounts to the personal finance manager powered by Frollo in the Canstar App. Get a handle on your spending Get familiar with your spending habits so you can decide what changes you need to make and where you can save money. Stay on top of regular payments Track your regular bills to identify the big expenses that could be worth switching providers.

Green boots visage

Explore our credit card options Discover credit cards. The lender or credit provider may also look at whether you can afford to repay the loan based on your current income, savings and expenses and whether you have been making any current loan repayments on time. On the other hand, a lack of court writ or default judgement information would indicate a reduced level of risk. Track your regular bills to identify the big expenses that could be worth switching providers. Or you may simply be declined. Making a number of applications within a short space of time will be recorded on your file and is not always looked upon positively by lenders, as it may be an indicator that you're in credit stress. Skip to main content. What impacts my Equifax Credit Score? Showing results for Credit Score Check. Consumer Finance, Business, Economics and Finance. Manage money on-the-go with a personalised dashboard, expense insights, goals tracking and product comparisons. The way an Equifax Credit Score is used in practice by lenders may differ to the way it is displayed in the Equifax Credit and Identity portal.

Lenders know your score, do you? Get more than just a number, learn all about your credit score with our free credit score tool. Check your score to understand how lenders see you as a borrower.

Part IX Debt Agreement discharged. Yes, in certain circumstances. A smaller loan or credit card limit may carry a different level of risk to a larger loan. They collect this data to generate what is called your credit report and calculate your credit score , which lenders then use to assess how risky you are as a borrower. One slip-up can reduce your score. The Equifax Credit Score rating is based on historical analysis that determines how likely an adverse event, such as a default, court judgement, personal insolvency or similar, is to be recorded on a credit report in the next 12 months. There are a range of different packages that will provide you with access to your Equifax Credit Report, Equifax Credit Score and additional features such as credit alerts, a Score Tracker and identity monitoring tools. Your Equifax Credit Score may change every time new activities, such as credit enquiries or loan defaults, are recorded in your Equifax Credit Report. Privacy Terms of use. The Equifax Credit Score is a number between and in simple terms, the higher your Equifax Credit Score, the better your credit profile and the lower the credit risk. Thanks to Comprehensive Credit Reporting, your credit is now assessed based on more than just any blemishes you might have on your record.

I can recommend to come on a site on which there is a lot of information on this question.

Cold comfort!