Capital one savor vs quicksilver

Many or all of the products featured here are from our partners who compensate us.

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies. The Capital One Savor is tailored for those who enjoy dining out and entertainment. In contrast, the Capital One Quicksilver helps you earn a straightforward and consistent 1.

Capital one savor vs quicksilver

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks. Best Money Market Accounts. Best Premium Checking Accounts. Best Regional Banks. Best Investments. Best Mutual Funds. Best Stocks for Beginners.

Both cards have no annual fees and no foreign transaction feesmaking them the perfect card to carry abroad. Entertainment includes tickets to movies, plays, concerts, sporting events, tourist attractions, theme parks, aquariums, zoos, dance clubs, pool halls, bowling alleys, and purchases at record and video stores.

Travel rewards credit cards come in many forms. Some are cobranded with a specific airline or hotel loyalty program. Cardholders can then convert them into airline miles or hotel points with a number of different travel partners. Then, there are credit cards that earn cash-back points, which can be redeemed at fixed rates toward travel and other purchases. For many consumers, these are the most useful types of travel credit cards.

Both of these credit cards have their strong points and it all boils down to your spending habits to find which card is right for you. For example, if you do a lot of shopping at grocery stores then one card might be better. Or maybe you make a lot of entertainment purchases which might make one card a good option over the other. Either way you are getting a great cash back credit card that is simple and easy to use. Both in the form of earning rewards and also redeeming them as well. Be sure to understand your current credit history before applying. Capital One Quicksilver Credit Card. Then after that things start to get interesting. The Capital One SavorOne Card will be a better choice if you maximize the bonus categories that it comes with.

Capital one savor vs quicksilver

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies. The Capital One Savor is tailored for those who enjoy dining out and entertainment. In contrast, the Capital One Quicksilver helps you earn a straightforward and consistent 1. The Capital One Savor Cash Rewards is a cashback card designed to reward cardholders who often dine out and spend money on entertainment purchases. The Capital One Quicksilver Cash Rewards is also a cashback card, but you can use it to earn rewards on every purchase, regardless of the category it falls under.

2x x2 x

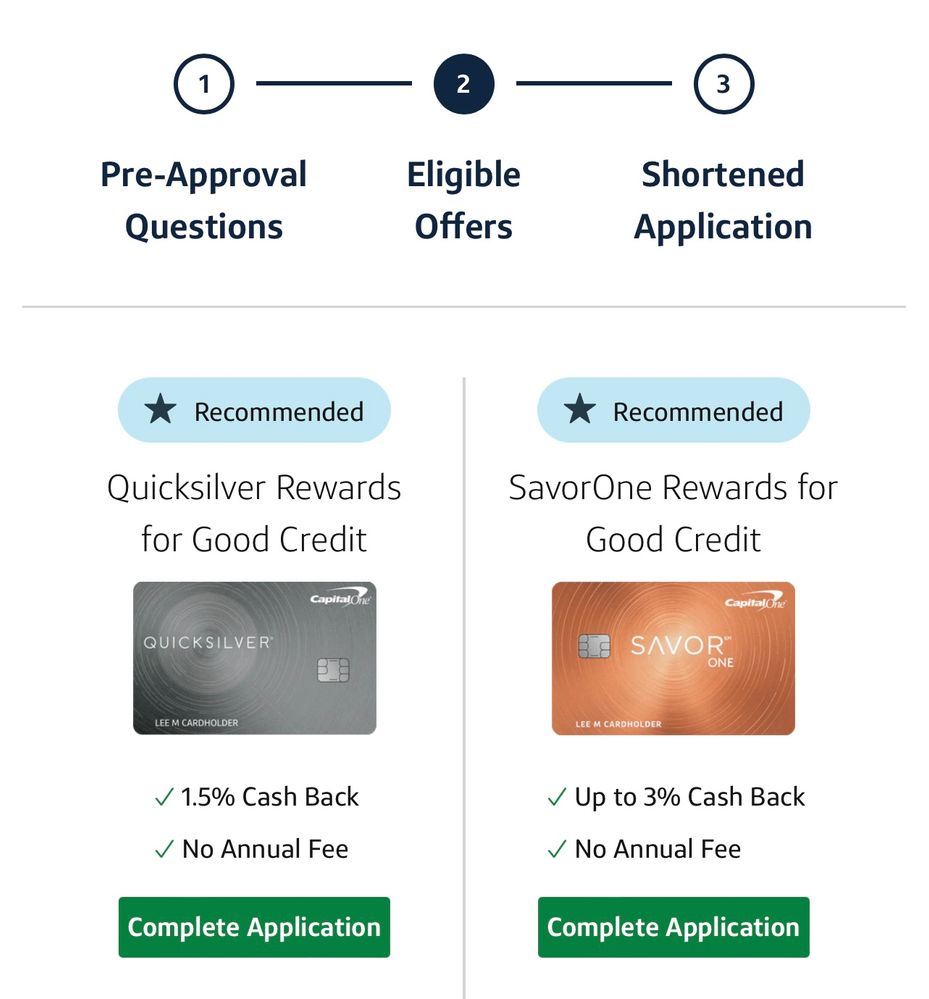

Tax Deadline and Tax Due Dates. You may have better odds of approval if you have an excellent credit score. Read more. So if you have excellent credit and get pre-approved for either, the decision might come down to how you prefer to earn rewards. Card Details. Here is a list of our partners and here's how we make money. You can click on the 'unsubscribe' link in the email at anytime. Annual fee. Retirement Calculator. If you often dine out and attend live events, or the bulk of your credit card spending is at grocery stores, the Savor's elevated earning rates will be much more beneficial. Quicksilver and SavorOne offer a new cardholder bonus.

Many or all of the products featured here are from our partners who compensate us.

Check for pre-approval offers with no risk to your credit score. The latter is a stable, no-annual-fee card with a fixed 1. NerdWallet's ratings are determined by our editorial team. See the respective Guide to Benefits for details, as terms and exclusions apply. With this card, you also get benefits like automatic credit line reviews, which could result in automatic credit limit increases if you use your card responsibly. February 06, SavorOne and Quicksilver offer similar benefits. It earns unlimited cash back at different levels, depending on the category. Quicksilver: Card comparison. Sign up. Hurry, check your email! The Capital One SavorOne card is a cash back rewards card for those with excellent credit who may not want to pay an annual fee. And while it's marketed as a cash back card, you actually earn Chase Ultimate Rewards points when you spend.

To fill a blank?

It is remarkable, very valuable message