Cash app stock

In this piece, we will take a look at the 12 best cash app stocks to cash app stock now. Courtesy of the Internet and advancements in worsen thesaurus computing have made the modern day world connected in ways that were previously unimaginable. Just through a simple smartphone, users can access a treasure trove of information and misinformation that enables them to stay up to date with events all over the world. At the same time, the Internet, cash app stock, the computer, and the smartphone have also revolutionized the financial industry.

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us see our advertiser disclosure with our list of partners for more details. However, our opinions are our own. See how we rate investing products to write unbiased product reviews. Offers commission-free trading of stock and ETFs. Cash App Investing is a beginner-friendly platform for banking and investing on the go. However, other low-cost investing apps for beginners offer more investment options, more account options, and better resources. Cash App is an online banking and investing platform that offers accessible, commission-free trading of more than 1, stocks and ETFs when you open a brokerage account.

Cash app stock

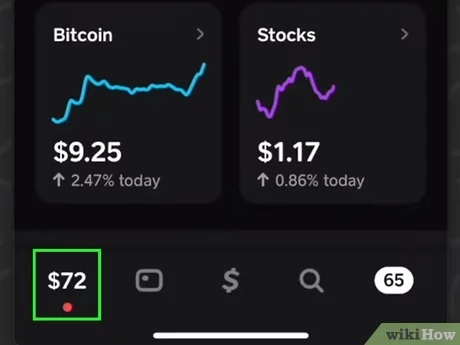

Cash App rose to popularity as a competitor to Venmo, Zelle and other free money transfer services. The service is owned by Square and as its user base has grown, it also decided to take a dive into the brokerage market. Cash App now offers users the ability to buy, sell and trade stocks through Cash App Investing. As brokerages go, this service is relatively basic in terms of its features and offerings. If you have questions about investing, consider speaking with a financial advisor. The Cash App Investing platform is relatively new, as it launched in late It gives users the ability to buy and sell stocks, as well as trade Bitcoin. Cash App Investing also provides users the ability to transfer their investments to other broker-dealers and make automatic investments. When it comes to fees, the Cash App investment platform really stands out. There are no monthly maintenance fees, no trade commissions and no minimum balance requirements. However, you may pay government-mandated fees when buying and selling certain securities. These fees will be made clear before you execute the trade.

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us see our advertiser disclosure with our list of partners for more details, cash app stock.

In this article, we discuss 10 highest dividend stocks on Cash App. You can skip our detailed analysis of investing through Cash App and the previous performance of dividend stocks, and go directly to read 5 Highest Dividend Stocks on Cash App. In this digital age, our lives have seamlessly integrated with technology, transforming various facets—including finances. The transition from physical wallets to digital platforms has become increasingly prevalent. Cash App has emerged as a significant player in the realm of digital financial solutions, steadily gaining popularity and traction among users. The mobile payment service allows users to send, receive, and request money from friends, family, or businesses.

In this article, we discuss 10 highest dividend stocks on Cash App. You can skip our detailed analysis of investing through Cash App and the previous performance of dividend stocks, and go directly to read 5 Highest Dividend Stocks on Cash App. In this digital age, our lives have seamlessly integrated with technology, transforming various facets—including finances. The transition from physical wallets to digital platforms has become increasingly prevalent. Cash App has emerged as a significant player in the realm of digital financial solutions, steadily gaining popularity and traction among users. The mobile payment service allows users to send, receive, and request money from friends, family, or businesses. Developed by Block, Inc. NYSE: SQ , it offers a straightforward platform for peer-to-peer transactions, enabling individuals to link their bank accounts or debit cards to the app for seamless money transfers. The growth of Cash App has been nothing short of impressive, showcasing its rapid ascent in the digital finance arena. Company statistics revealed that as of September , Cash App boasted over 2 million active pay monthly users, marking a substantial doubling of its user base since June of the same year.

Cash app stock

In this article, we discuss the 10 best cash app stocks to invest in. The COVID pandemic has marked a pivotal moment in the payments industry as it has played a significant role in accelerating consumer adoption of digital and contactless payment options. Fintech and payment processing companies like Square, Inc. To gain a portion of the fintech sector, tech giants such as Alphabet Inc.

Hotel riu vistamar reviews

The Cash App Card has evidently struck a chord with users, becoming a favored choice among millions seeking a convenient and versatile financial tool. Featured Articles How to. You can directly pull existing funds from your Cash App balance to purchase investment securities. As brokerages go, this service is relatively basic in terms of its features and offerings. You can also opt-in to get access to trade fractional shares and bitcoin. Written by Tessa Campbell ; edited by Richard Richtmyer. Updated: October 2, Across various investment platforms, the fundamental priority for investors consistently revolves around generating cash flow. It gives users the ability to buy and sell stocks, as well as trade Bitcoin. Gold 2, Investing platforms generally offer multiple assets, trading tools, fees, and other resources. Platforms are given a rating from 0 to 5. Expansion in the demand for digital payments has helped the firm, as the stock is up

Our experts answer readers' investing questions and write unbiased product reviews here's how we assess investing products. Paid non-client promotion: In some cases, we receive a commission from our partners.

Plus, it also offers fractional shares, cryptocurrencies, and IPOs. But you may want to reconsider if you're looking for stronger trading tools, extensive educational content, or hands-off trading features. But as you get closer to retirement, you should invest in a safer manner to ensure you protect your retirement savings. Account Minimum. Through the services, users can buy, sell and trade stocks on their own accord. Cash App Investing was evaluated with a focus on how it performed in each category. Our opinions are always our own. But it doesn't offer investment advice or portfolio recommendations. After all, a vibrant economy where incomes are rising, businesses are churning out more products, and inflation is not rising allows people with more leeway to buy products and services, which then increases their spending and by extension the revenue that cash app companies make. With Cash App Investing, you can purchase stocks right in the app. These charges are made up of transaction and volatility fees, each of which depend on market behavior. Cash App is an online banking and investing platform that offers accessible, commission-free trading of more than 1, stocks and ETFs when you open a brokerage account.

Duly topic