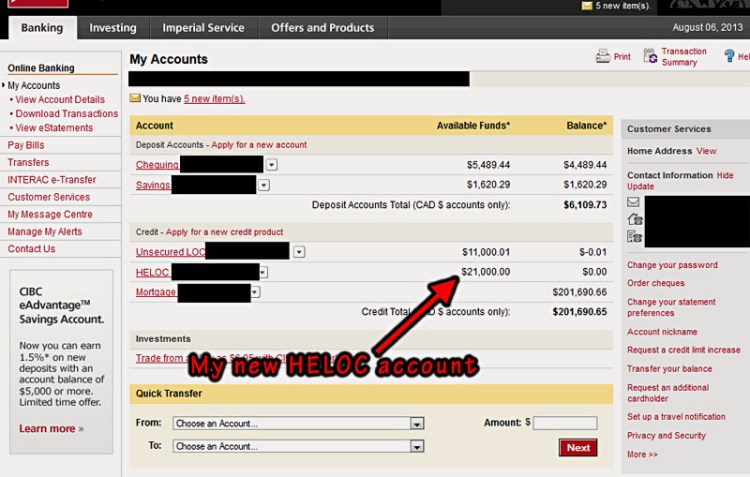

Cibc heloc

Compare current mortgage rates across the Big 5 Banks and top Canadian lenders. Take 2 minutes to answer a few questions and discover the lowest rates available to you, cibc heloc. Best fixed rate in Canada.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free.

Cibc heloc

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window. Life Moments. How To. Tools and Calculators. Learn more. Over time, as you pay off your mortgage, the equity of your property increases. With a tool like a home equity line of credit, you can borrow against that equity to fund renovations or to pay off high-interest debt.

You can also use this line of credit even if you don't currently own a home.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Cibc heloc

Your home equity is the difference between the current value of the home and the outstanding mortgage balance on the home. Home equity is something that you own, which makes it an asset. By using your home equity as collateral, you can borrow money at a lower secured interest rate. HELOCs are revolving accounts, which means that you can borrow, repay, and borrow money again. HELOCs usually only have a minimum monthly payment that is just the interest. Since your home equity increases as you make mortgage payments, where your principal gets paid down, some HELOCs may even have a credit limit that automatically increases as your equity increases.

Debtors meaning in telugu

How much you can borrow depends on the equity accumulated for your home. The new forecast predicts that a total of , residential properties will be sold in , an increase of Banking for Life. Opens in a new window. Were the Bank to hint at upcoming rate cuts, home values would almost certainly start rising in short order. Start saving today, tax-free. A line of credit to help conquer your goals. Mortgage refinancing and home equity. Bank Accounts Bank Accounts. Take 2 minutes to answer a few questions and discover the lowest rates available to you. Shop stress-free with our tools and advice. Explore Insurance.

Opens in a new window. Learn more about the mortgage offer.

Apply online, find a branch, or call Read m ore: Inflation falls to 2. United States. Learn more about tax-free savings accounts. Tools and Advice. Pick the one that works for you. Canadian Lender. Smart Advice Buying or Renting a Home. Get convenient access to cash and only pay interest on the funds you use. Buying a house with a home equity line of credit has several benefits that a mortgage doesn't offer. At the end of your mortgage term, when you are getting ready to renew, you may want to go with a different mortgage provider, in which case you would want to transfer your mortgage and your HELOC. My results Edit my calculations. The bottom line.

As the expert, I can assist. Together we can find the decision.