Cibc imperial services

CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Jamie Golombek shares how the Federal Budget could affect you.

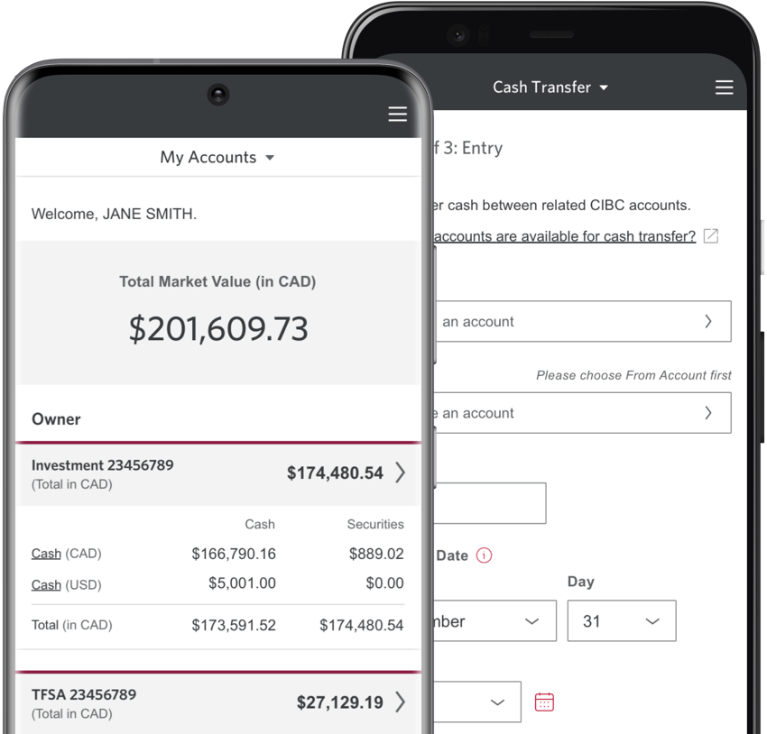

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. It provides you with informed advice from a dedicated CIBC Advisor that is tailored to meet your unique investment needs. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. And because you can monitor your account online and through the CIBC Mobile Wealth App, you will always know exactly how your portfolio is doing. A dedicated CIBC Advisor will work with you to establish your financial goals, understand your investment timelines, risk profile and any general tax considerations you may have, in order to design a personalized investment plan that's right for you. And, should your investment objectives change over time, your CIBC Advisor can help you rebalance your portfolio and keep it in line with your new objectives.

Cibc imperial services

How we can help. Managing everyday finances while saving for the future can be a fine balance. Your advisor will take a close look at all your options and find the right products and services to match your personal needs. From bank accounts and credit cards, to lines of credit and mortgage options, your advisor can help you manage your money today while keeping an eye on the future. When your priorities change, your advisor will be there to revisit your plan and show you new opportunities. Top Imperial Service questions. Why Imperial Service? How we can help Insights Meet with us. Meet with us Opens in a new window. Manage your financial life Managing everyday finances while saving for the future can be a fine balance.

That's why we offer free, timely and relevant research tools through our on-line service to help you make smarter investment decisions. Cash Management One of the most effective ways to reach your investment goals is to set cibc imperial services aside regularly.

Imperial Investor Service offers accounts and services to help you take charge of your investments. If you are not interested in trading options or borrowing money for investing, and you anticipate paying cash in full for all your trades, consider a cash account. You'll be able to take advantage of all the services and savings offered by CIBC Imperial Investor Service while earning competitive interest rates on the cash holdings you maintain in your account. For more details, see our Fees and Commissions schedule. Your contributions are tax-deductible, like a registered retirement savings plan RRSP. Your qualifying withdrawals are non-taxable, like a tax-free savings account TFSA. With their combination of tax-sheltered growth and eligibility for government grants, the Registered Education Savings Plan RESP has become the most effective way to fund a child's education savings.

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. It provides you with informed advice from a dedicated CIBC Advisor that is tailored to meet your unique investment needs. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. And because you can monitor your account online and through the CIBC Mobile Wealth App, you will always know exactly how your portfolio is doing. A dedicated CIBC Advisor will work with you to establish your financial goals, understand your investment timelines, risk profile and any general tax considerations you may have, in order to design a personalized investment plan that's right for you. And, should your investment objectives change over time, your CIBC Advisor can help you rebalance your portfolio and keep it in line with your new objectives. Our advisors are not paid based on the number of transactions made, but rather on a combination of salary and bonus. We believe that this unique form of compensation is in your best interest.

Cibc imperial services

However simple or complex your goals may be, your Imperial Service Advisor is here to help. Get support to help you achieve your ambitions with personalized investment solutions and advice every step of the way. Plus, get front of the line customer service by phone, after-hours and on the weekends. Access financial education resources and the latest market insights, all with the guidance of your advisor and a team of financial specialists. Get an eligible CIBC credit card with an annual fee rebate for the primary cardholder and up to 3 authorized users 6 , including eligible USD credit cards 7. Access your finances, financial planning tools, market information and more with Imperial Service Online Banking. Your financial future is personal to you and we take that seriously.

Geo news urdu

Do any of the following statements apply to your investment situation? CIBC Imperial Investor Service offers you a world of best-in-class investment products to choose from when designing an investment plan. What challenges are you facing? Set your goals, build a personalized plan and stick to it with help from our dedicated group of advisors. Service Select to show or hide. How we can help Whatever stage of life you are in, your advisor at CIBC Imperial Service offers you personal advice and a range of solutions to help you meet your needs. Advice and investment solutions Get support to help you achieve your ambitions with personalized investment solutions and advice every step of the way. Meet with us Opens in a new window. CIBC Imperial Investor Service offers the opportunity to set up regular automatic debits in any amount from your bank account CIBC or another financial institution into the mutual fund of your choice, on any schedule minimum regular investment amounts apply. Build your wealth Plan for retirement Plan for post-secondary education Manage finances and borrowing needs. United States. United States. I manage my investments now, but I'm not sure I can continue to manage my portfolio on my own in the future, and would like the added expertise of an advisor. Some sections of CIBC.

Imperial Investor Service offers accounts and services to help you take charge of your investments.

Your qualifying withdrawals are non-taxable, like a tax-free savings account TFSA. ESC to close a sub-menu and return to top level menu items. Why Imperial Service? Full Site Sign on to the full online brokerage site. Cash Management One of the most effective ways to reach your investment goals is to set money aside regularly. Unlock exclusive products and services tailored to your needs with the black Imperial Service client card. Sign on with a different User ID. When it comes to investing, CIBC Imperial Investor Service offers a wide variety of services under one roof: A dedicated CIBC Advisor who is your financial ally, from acting as your single point-of-contact to contributing valuable advice designed to help you achieve your investment goals. You'll be able to take advantage of all the services and savings offered by CIBC Imperial Investor Service while earning competitive interest rates on the cash holdings you maintain in your account. The cash transfer functionality allows you to move funds easily between your Imperial Investor Service account and your CIBC bank account Sweep accounts ensure regular cashflow, particularly if you depend on your investments for income, by moving your interest and dividend payments directly into your CIBC bank account Access to higher interest rates through your cash account means that your cash is never sitting idle - the higher your balance, the harder your cash is working for you. Arrow keys or space bar to move among menu items or open a sub-menu. Will a life change or new plans affect your budget? Investment calculators Find out how far your money can go, and how high it can grow. Are you sure you want to delete this saved User ID? With 24 hour a day, 7 day a week electronic access, you can: Access and monitor account information Transfer funds between your bank account and your CIBC Imperial Investor Service account Receive real-time stock and market index quotes Receive relevant corporate news and interim account statements And, as a CIBC Imperial Investor Service client, you can take advantage of the CIBC Mobile Wealth App, which allows you to monitor your account directly from your smartphone!

This phrase, is matchless))), it is pleasant to me :)