Cim vs cfa

It signifies expertise and specialized knowledge in investment management and portfolio analysis. To earn the CIM designation, individuals must successfully complete a rigorous educational program, fulfill experience cim vs cfa, and pass examinations. The program covers a wide range of topics related to investment management, including portfolio construction, asset allocation, risk management, investment analysis, cim vs cfa, ethics, and industry regulations.

This article was published more than 11 years ago. Some information may no longer be current. The general consensus was that the CFA Chartered Financial Analyst designation was leaps and bounds harder to achieve than any other, but readers were a bit divided on its usefulness for retail financial advice. In my last column we asked readers to weigh in on financial adviser designations. Which ones were useful?

Cim vs cfa

Financial advisors can earn a range of certifications and designations indicating their specialty and expertise. CFA is a common designation that shows someone has a background in investment reporting and analysis. CIMAs, on the other hand, focus on strategic financial management. CFA stands for chartered financial analyst , so it is not surprising that many CFAs pursue a career in financial analytics. CFA charterholders typically work in investment analysis roles at financial advisor firms, investment firms, insurance companies, banks and investment funds. Financial planners or advisors with the CFA certification have a mastery of financial analytics, trends and markets. Clients who want help with investing and asset allocation will often work with a CFA. You also have to have an international travel passport, understand English and live in an eligible country. After meeting the requirements for registration, you must then pass all three levels of the CFA Exam. The recommended study time before taking the exam is hours for each level. The exam rigorously tests your knowledge of ethics, investment tools, asset classes, portfolio management and wealth planning. However, each of the three levels focus on a different aspect of this knowledge. The Level I exam covers basic knowledge and focuses on investment tools.

But one of the most important questions was not widely addressed, perhaps because the answer is cim vs cfa Have all the possible financial adviser designations diluted the value of any single one of them?

By probably 5 times over. It has one of the largest CFA societies in the world. Your comments on accountants not being able to understand mathematics or complex theories is ridiculous. CFA requires…additions and subtractions and basic algebra you learned in middle school. Highly doubt any CPAs will have tough time with these.

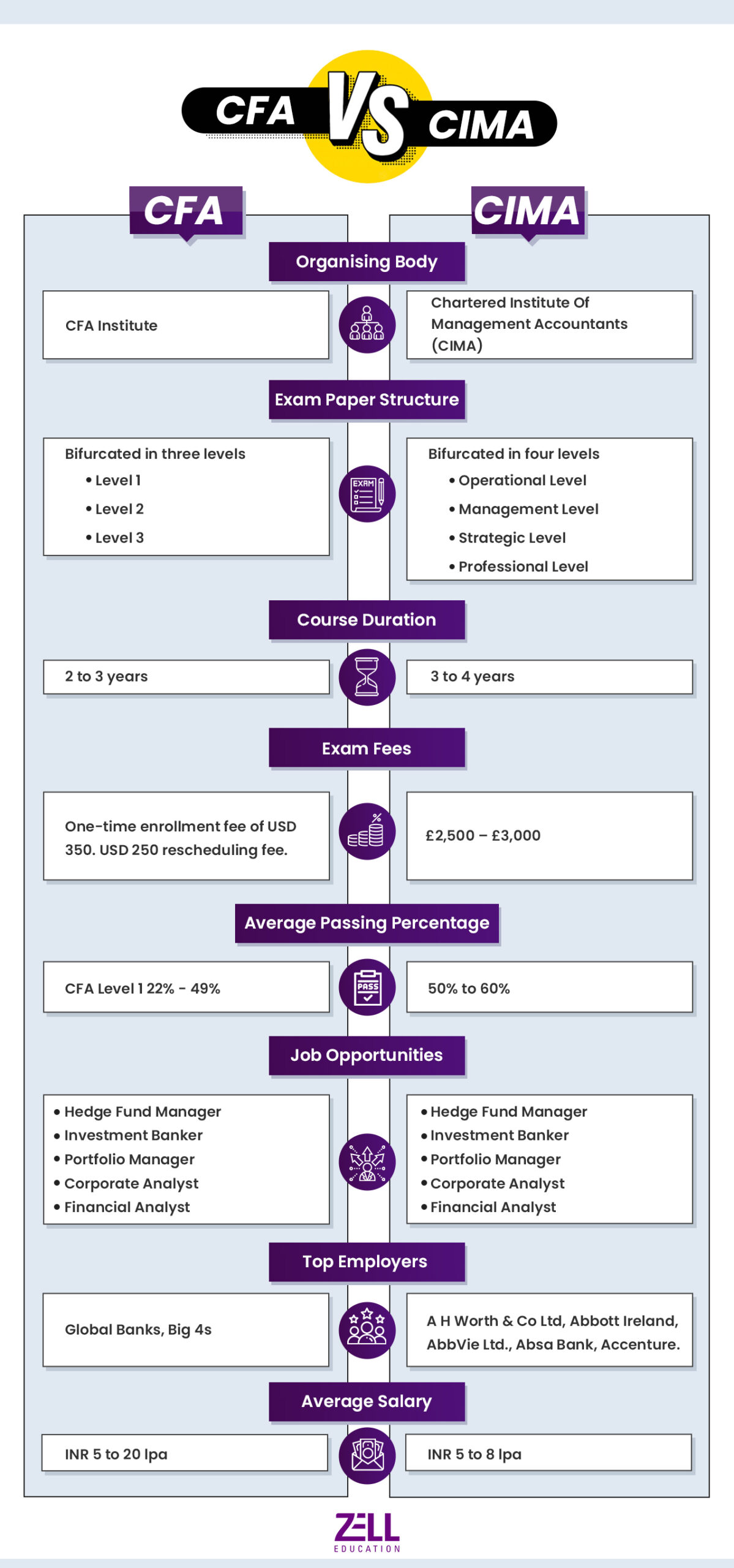

While looking for finance and accounting courses you must have often come across two most popular courses that may have caught your eye — CIMA for accounting and CFA for finance. When you read up about these courses, you must have felt that they have some similarities. For example they both are globally accepted and can be pursued along with graduation. They both have a 3 year duration and offer exciting opportunities. However, both of these courses are actually quite different from each other. While one focuses more on the accounting management side the other is an intensive finance course that trains a candidate on financial markets and investments. While the future prospects of CIMA and CFA are incredibly bright, if you have to make the right choice, you need to consider the difficulty, duration, future scope and eligibility of each course. Level 3 Bifurcated in four levels.

Cim vs cfa

The great advisors are the ones who get to know those details intimately, and have the necessary skills to deliver. This commitment ultimately leads to even greater value and benefits to the client. It is reserved for an exclusive group of financial professionals who demonstrate unparalleled leadership, integrity, commitment, and dedication to their clients and industry.

Come and hug me episode 2

If you have to deal with a financial professional, it's important that you know the extent of his or her expertise in different areas of finance. In all seriousness, by sheer numbers alone a CPA does not hold much market value. You also have to have an international travel passport, understand English and live in an eligible country. A financial planner works with individuals to help them understand their options and make financial decisions suited to their personal financial situation and goals. Their requirements often include the taking of certain courses and the passing of exams, a certain number of years' experience or apprenticeship in the profession, a college degree, membership in the association, and a commitment to ongoing education in the field. These include white papers, government data, original reporting, and interviews with industry experts. They can work with both individuals and corporations. Create profiles to personalise content. The certified investment analyst designation seems to. Highly doubt any CPAs will have tough time with these. Related Articles. Understand audiences through statistics or combinations of data from different sources. Subscribers who are logged in to their Globe account can post comments on most articles. Every year, you will have to pay dues and certify that you are adhering to the standards of the CFA Institute. They are also adept at evaluating industry trends, managing risk, and developing and enhancing client relationships.

.

CFA: The CFA designation has a broader global focus and covers a wider range of topics, including investment analysis, portfolio management, economics, ethics, and quantitative methods. What is the CFP designation? Learn More What is a Fiduciary? It has one of the largest CFA societies in the world. Helpful Guides Personal Loans Guide. Changes in economic conditions, industry trends, and investor preferences can also influence the demand. In addition to proving their high-level expertise in portfolio management, CIC candidates must also adhere to a strict code of ethics and provide character references. In earning the CIM credential, advisors learn the following: Advanced money management strategies that best serve affluent and institutional clients. Those holding the CPA designation have passed examinations in accounting and tax preparation, but their title does not indicate training in other areas of finance. Non-subscribers can read and sort comments but will not be able to engage with them in any way. CIMA is an acronym for certified investment management analyst. Additionally, CIMAs have to show they are skilled not only in finance but also business strategy , management and operations. Calculators Personal Loan Calculator.

In my opinion you commit an error. I can defend the position. Write to me in PM.

You are mistaken. I can defend the position. Write to me in PM, we will communicate.