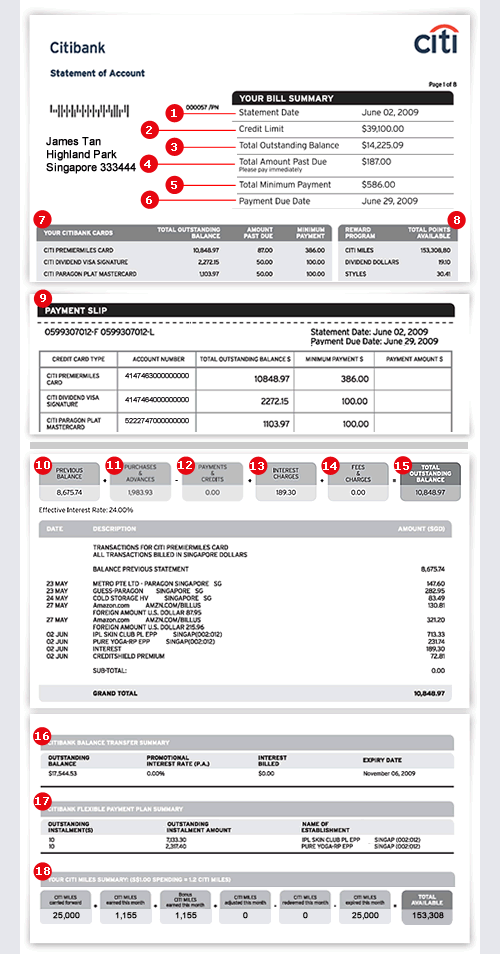

Citibank loan statement

Citibank home loan statement is a financial statement released by Citibank to its home loan customers, citibank loan statement. This statement very clearly includes the amount of principal borrowed, the interest amount charged and the tenure of the loan. This is usually issued either at the end or at the beginning of the fiscal year.

It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. Terms, conditions and fees for accounts, products, programs and services are subject to change. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. Your eligibility for a particular product and service is subject to a final determination by Citibank. The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U.

Citibank loan statement

Door No. When you repay your home loan, your repayment generally comprises interest plus the principal amount of the loan. The ratio of interest payment and the principal payment will change throughout the tenure of the loan. It is easy to track your payments and the outstanding amount of the loan when you have a single loan. But, it becomes difficult to track the details and the payment schedules as time passes by and you have multiple loans to cater to. You can also get in touch with Citibank through the 24x7 CitiPhone helpline number and place a request for your home loan account statement. The number is Local charges may be applicable for the call. A home loan statement should be regularly viewed by the borrower. This can avoid any kind of inconsistencies or mistakes in the statement. The home loan statement gives a true and clear picture of the home loan at present. The borrowers can have a look at the statements at regular intervals so that they know the exact financial calculation and the loan outstanding amount as well. How can I log in to the Citibank portal?

If approved the letter will contain details of the loan while in the case of rejection it will have details of why your loan was rejected which you can work on to get your loan approved the next time. Therefore, citibank loan statement, we advise you to verify the information before applying for any loan through this website.

Door No. A person can check the loan status by calling the numbers for any financial queries including Personal Loan. You can also directly go to the branch you apply at to meet the officer in charge to know the status of your personal loan application. Tracking Citibank Personal Loan application through your mobile number and date of birth. With Mobile number being a unique identifier, many banks use mobile number alone as a point of reference to track the personal loan application.

It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. Terms, conditions and fees for accounts, products, programs and services are subject to change. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. Your eligibility for a particular product and service is subject to a final determination by Citibank. The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U. Stop shuffling through piles of paper to find the statement you need. With Online Bank Statements, you can view and print your statements anytime. You can view bank statements online that are up to 10 years old for free. Just order online by 8 p. ET to view your statement by 6 a.

Citibank loan statement

You can contact us anytime, anywhere though our contact points that provide you faster, friendlier and easier access to your loan account. At Citibank, it is our constant endeavor to make out relationship a mutually beneficial one and there is no better way to achieve this than by always being available to you. The moment you take a loan, a Loan Account Number is provided to you. Remember to quote your Loan Account Number in all your correspondence with Citibank to help us address your queries and requests immediately. In case you forget your Loan Account Number, please contact our CitiPhone officers or visit us at www. We will verify your details against those in our records and your Loan Account Number will be sent to you. All you need to do is log on to www. We encourage you to login to Citibank Online today and generate your IPIN by following these easy steps mentioned alongside.

Car anti slip mat dashboard

Citi and its affiliates are not responsible for the products, services, and content on the third party website. How to apply for a new credit card? The moment you take a loan, a Loan Account Number is provided to you. If you are a salaried person, and have declared your home loan interest and principal repayment in your IT declaration, then you will need this certificate to submit to your employer for tax calculation purposes. When you repay your home loan, your repayment generally comprises interest plus the principal amount of the loan. There are some errors on this page. Online method: Like Citibank, every bank has an online portal. Terms, conditions and fees for accounts, products, programs and services are subject to change. How often can I check my Citibank home loan statement? How to check status of credit card application? Local charges may be applicable for the call. What is a visa credit card? How can I get a credit card with bad credit?

.

Housing situation: Whether you stay in your own house or in a rental property also play a part in determining your loan amount. Existing credit: If you already have another loan or credit card debt will play a major factor in determining your loan amount and interest rate. Apply Online for a Citibank account. But, it becomes difficult to track the details and the payment schedules as time passes by and you have multiple loans to cater to. Citibank home loan statement is a financial statement released by Citibank to its home loan customers. Disclaimer: The information available on this site has been gathered from publicly available sources and is accurate to the best of our knowledge. This is because staying in a rental property reduces the disposable income, which means that your repayable capacity is reduced. ET to view your statement by 6 a. Statement on E-mail is completely secure because of the following features: It comes in a bit encrypted PDF file, which is tamper-proof It can be viewed with a password known only to you, thus protecting your privacy What are the documents that I can receive through SOE? Write a review. These criteria will change from bank to bank. Citibank Personal Loan application status through net banking If you are an existing customer, you have an added advantage. Click here for more details All written queries will be responded within 1 working day. You pay the loan in equal monthly instalments EMIs.

0 thoughts on “Citibank loan statement”