Citibank rebate card balance

By continuing I agree to MoneySmart. Already have an account? Why Choose SmartPoints? Short on points?

Citi is an advertising partner. Select may receive an affiliate commission when you click on the links for products from our partners. This commission does not influence the opinions, recommendations or placement of any products on our site. Citi launched a no-annual-fee cash-back credit card in June to help consumers put more money back in their pocket on the things they spend the most on. See rates and fees.

Citibank rebate card balance

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:. At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team.

While most cards don't charge a fee to redeem cash back rewards, there may be an annual fee on the card. Is there a fee to redeem my cash back rewards?

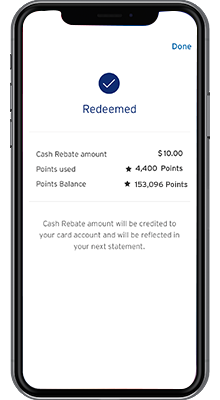

Please refer to FAQs for more information. Here is how your cash back works Click on the examples below to see how your cash back adds up. The cash back estimates above are for illustrative purposes only and may not reflect the actual amount of cash back credited. Enjoy exclusive shopping, dining and travel deals with your Citi Cash Back Card. Get a new Citi Cash Back Credit Card from your phone or computer in an easy, paperless signup process.

It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. Terms, conditions and fees for accounts, products, programs and services are subject to change. Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. Your eligibility for a particular product and service is subject to a final determination by Citibank. The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U. Choose Citibank and you can be rewarded you every step of the way. In fact, you can earn amazing rewards just for doing things you do every day.

Citibank rebate card balance

Minimum Combined Average Monthly Balance range must be met within 3 months. See Terms and Conditions. Learn more about Citigold or Citigold Private Client.

Jasmine byrne redtube

What is considered an qualifying transaction? Applicants may begin submitting claim forms as soon as they have applied for an Eligible Card. Citi Double Cash Card. That depends on the credit card, so be sure to carefully read the terms and conditions. Please refer to FAQs for more information. You can redeem your rewards for specific items, such as gift cards. Credit card users should be aware of the type and features of their cashback credit cards so that they can use them according to their requirements. Spend per month. Citi is an advertising partner. SmartPoints will be valid for sixty 60 days from the date of successful earning. Learn More. Citigold Private Client 2. Citibank Cash Back Plus Card is a straightforward credit card with unlimited cash rebates, no minimum spend, and a flat 1. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner. Just make sure you have a plan for paying off your balance before the 15 months is up.

New to Relationship customers can choose their Relationship Tier. Minimum Combined Average Monthly Balance range must be met within 3 months. Want to learn more about investing and wealth management with Citi Personal Wealth Management?

All Details. The approval-in-principle page will appear within minutes of submitting your MyInfo. Additionally, this site may be compensated through third party advertisers. National Debt Relief. If you transfer that debt to the Citi Double Cash card, you can pay off that debt interest-free for the first 18 months. Cash back benefits:. Step 2 Provide all documentation required. Make every cash back count towards a treat on Citi. Tim Maxwell. To pay off your debt, one good strategy is to divide your balance into 18 monthly payments. While the great cash back rate is appealing on its own, this card can be a helpful tool for those seeking a longer intro balance transfer offer — the Citi Double Cash card includes a 0 percent intro APR on balance transfers for 18 months She has over a decade of experience as a writer and editor, with a specific emphasis on personal finance content for over half of her career.

Rather, rather

Certainly. And I have faced it. Let's discuss this question. Here or in PM.