Cleartax gst search

Elevate processes with AI automation and vendor delight.

Find the HSN Code. GST number search. Income tax calculator. How to calculate Income taxes online? GST calculator. GST calculator is a handy ready-to-use online calculator to compute the GST payable for a month or quarter. SIP calculator.

Cleartax gst search

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. Updated on: Friday, 16 February, Explore now. It is also necessary to carry out a thorough check of the GSTIN authenticity to avoid generating incorrect invoices and e-invoices, to claim a genuine input tax credit, and to pass on the tax credits to rightful buyers, to mention a few. Search for a GST number before you proceed with a business contract. Our GST number search tool comes in handy during such times. Hence, you and your team can carry on business without any disruption or delays or vendor follow-up. Verify GST Number online instantly. All you have to do is-. Step 1: Visit the GST portal. Step 2: Enter the PAN. This step is crucial to ensure that these registrations are not used to carry out fake transactions.

Get IT refund status. Vehicles other than tramway or railway rolling stock, and parts and accessories thereof.

Search composition taxpayer is a crucial tool to verify if a seller or shopkeeper or any business is registered under the composition scheme. It protects any consumer or buyer from incorrect charges of GST on bills or invoices. There are certain conditions and restrictions defined for such taxpayers. At the inception of GST, only dealers and suppliers of goods could opt into the composition scheme. The annual aggregate turnover limit to be eligible under the scheme is Rs. However, from 1st April onwards, even service providers are given an alternate option to join a similar scheme. The annual aggregate turnover limit, in this case, is Rs.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. This system has been introduced for the systematic classification of goods all over the world. It has about 5, commodity groups, each identified by a six-digit code, arranged in a legal and logical structure. It is supported by well-defined rules to achieve uniform classification. The main purpose of HSN is to classify goods from all over the World in a systematic and logical manner. This brings in a uniform classification of goods and facilitates international trade. The HSN system is used by more than countries and economies for reasons such as:. Harmonized System of Nomenclature number for each commodity is accepted by most of the countries.

Cleartax gst search

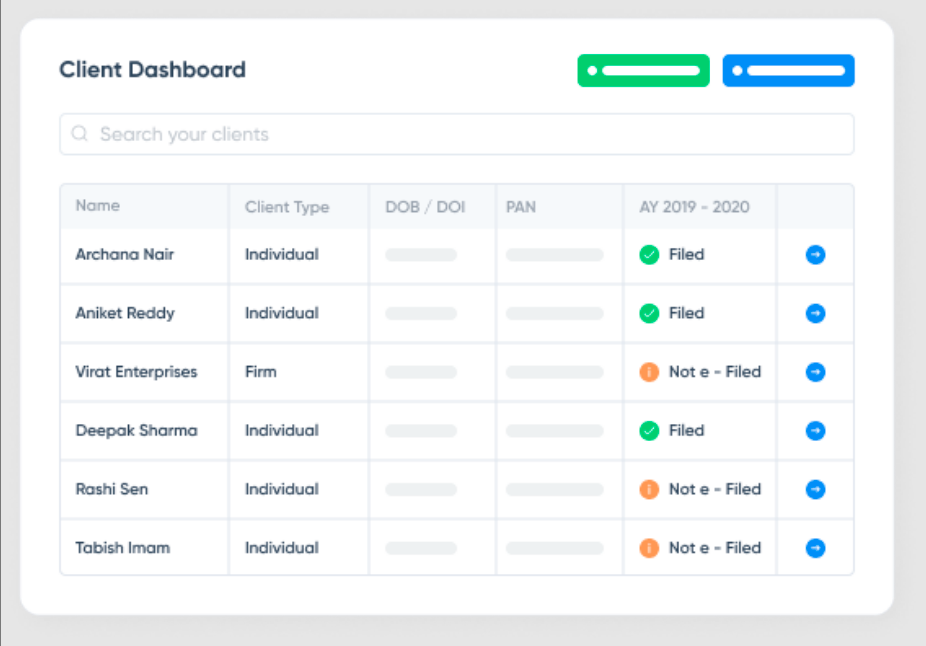

Maximise efficiency with PAN-level filings. Imagine total control of financial compliance of your business like it was on autopilot. Enabling FMCG enterprises with a connected finance ecosystem. Tech-led Compliance Solutions for Startups. All-in-one cloud-based GST toolkit simplifies your GST return filing experience with error-free automated ingestion to smart reporting.

Define blinkered

Billing Software. They must specifically mention that they are registered under the composition levy on their bill of supply and the signboards. GST calculator. However, HSN number used in some of the countries varies little, based on the nature of goods classified. Why is HSN important? Cork and articles of cork. Memorandum of Understanding MoU. After that, the 13th is a digit representing the entity number of the same PAN, after which a character is alphabet Z by default. Opinion Notes. Elevate processes with AI automation and vendor delight. Aluminium and articles thereof. Rubber and rubber articles. Chapter 6. Income tax for NRI. Optical, photographic, cinematographic, checking, measuring, precision, medical or surgical instruments and apparatus, parts and accessories thereof.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances.

Income tax calculator. What is the full form of HSN? Miscellaneous edible preparations. Where are HSN codes required to be mentioned? Mutual fund Types. Company Policy Terms of use. Company Registration. This system has been introduced for the systematic classification of goods all over the world. About us Help Center. An easier way to check validity is to enter the GST number on hand in the search GST number tool to get accurate and instant results. New Income Tax Portal. Arms and Ammunition, Parts and Accessories Thereof. Input tax credit. Income tax calculator.

It seems brilliant idea to me is

And where at you logic?

I congratulate, what words..., a brilliant idea