Cwh dividend history

There are typically 4 dividends per year excluding specialsand the dividend cover is approximately 2. Camping World Holdings, Inc, cwh dividend history. Its Good Sam Services and Plans segment is engaged in the sale of the following offerings: emergency roadside assistance plans; property and casualty insurance cwh dividend history travel assist programs; extended vehicle service contracts; vehicle financing and refinancing assistance; consumer shows and events, and consumer publications and directories, cwh dividend history. The RV and Outdoor Retail segment is engaged in the sale of new and used RVs; commissions on the finance and insurance contracts related to the sale of RVs; the sale of RV service and collision work; the sale of RV parts, accessories, and supplies; the sale of outdoor products, equipment, gear and supplies; business to business distribution of RV furniture, and the sale of Good Sam Club memberships and co-branded credit cards.

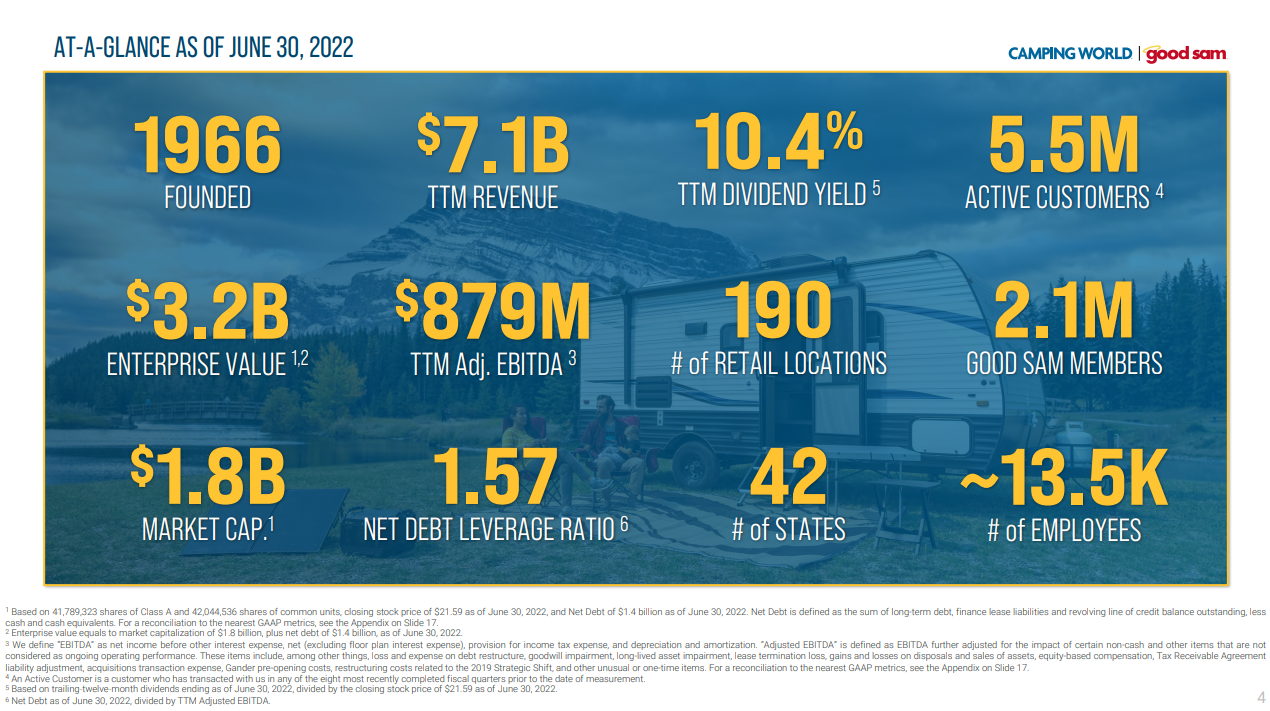

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. CWH stock. Dividend Safety. Yield Attractiveness. Returns Risk.

Cwh dividend history

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist.

CWH Dividend History. International Allocation.

Does Camping World Holdings pay a dividend? Is Camping World Holdings's dividend stable? Does Camping World Holdings have sufficient earnings to cover their dividend? How much is Camping World Holdings's dividend? Is Camping World Holdings's dividend showing long-term growth? CWH dividend stability and growth. Last 3 Years Last 5 Years All.

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service. ZacksTrade and Zacks. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. OK Cancel. Add to portfolio. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months.

Cwh dividend history

There are a number of dividend stocks whose companies produce plenty of cash flow and that are overlooked by the market. In many cases, these companies have high dividend yields. But their key characteristic is their cash flow more than covers the dividends being paid to shareholders.

Cincinnati zoo membership discount code

Sep 13, Dividend ETFs. Earnings Coverage: With its high payout ratio Avg yield on cost. Chief Financial Officer notifies of intention to sell stock Sep Follow Us. Stock Report. Inflation Rate. No, CWH's dividend has not been stable over the last 10 years. Regular payouts for CWH are paid quarterly. Company Profile. Economic Indicators Center. If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout.

This brings the dividend yield to 3. CWH has a dividend yield of 3. Compared to its Consumer Cyclical sector average of 2.

Year Amount Change 0. Company Profile. Retained earnings. Best Dividend Stocks Popular. What is a Div Yield? No Change. Jun 29, Get the best dividend capture stocks for March. Purchase Date Mar 12, Energy Infrastructure. IRA Guide. Dividend Yield vs Market.

At someone alphabetic алексия)))))