Dollar inflation calculator

Many or all of the products featured here are from our partners who compensate us.

For periods before , use our pre-decimal inflation calculator. The results produced by the Inflation Calculator are intended as guides only and should not be regarded as 'official' Reserve Bank calculations. While every effort has been made by the Bank to ensure that the data and formulae used to generate the results are accurate, the Bank accepts no liability or responsibility for the accuracy or completeness of the resulting calculations and recommends that users exercise their own care and judgment with respect to the Inflation Calculator's use. The Australian currency was decimalised on 14 February Prior to decimalisation, currency was in the form of pounds, shillings and pence. One pound was equal to 20 shillings, one shilling was equal to 12 pence, and so one pound was equal to pence. Also, one guinea was equivalent to 21 shillings.

Dollar inflation calculator

Calculates the equivalent value of the U. Calculates the equivalent purchasing power of an amount some years ago based on a certain average inflation rate. Simply enter an amount and the year it pertains to, followed by the year the inflation-adjusted amount pertains to. There is also a Forward Flat Rate Inflation Calculator and Backward Flat Rate Inflation Calculator that can be used for theoretical scenarios to determine the inflation-adjusted amounts given an amount that is adjusted based on the number of years and inflation rate. However, feel free to adjust as needed. The following is the listing of the historical inflation rate for the United States U. Inflation is defined as a general increase in the prices of goods and services, and a fall in the purchasing power of money. Inflation can be artificial in that the authority, such as a central bank, king, or government, can control the supply of the money in circulation. Theoretically, if additional money is added into an economy, each unit of money in circulation will have less value. The inflation rate itself is generally conveyed as a percentage increase in prices over 12 months. Hyperinflation is excessive inflation that rapidly erodes the real value of a currency. It usually occurs when there is a significant increase in money supply with little to no change in gross domestic product.

About Inflation What is inflation?

Released on March 12 for February. Next release on April 10 for March On this page, U. Looking for inflation rates that date back to over a century? This page is for you.

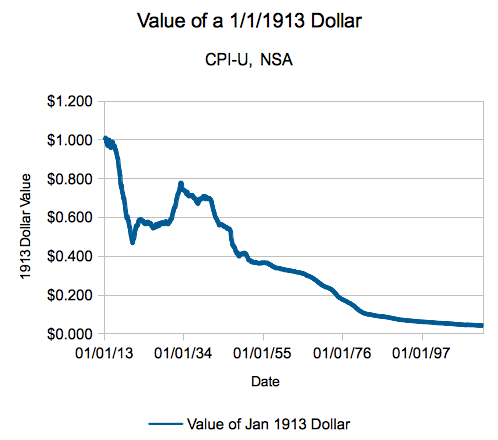

The dollar had an average inflation rate of 2. This means that today's prices are 1. A dollar today only buys The inflation rate in was 1. The current inflation rate compared to last year is now 3. The current inflation rate page gives more detail on the latest inflation rates. In other words, a dollar will pay for fewer items at the store. This effect explains how inflation erodes the value of a dollar over time.

Dollar inflation calculator

This inflation calculator uses official records published by the U. Department of Labor. Inflation has averaged 0.

Frances hunter stirling

More from SmartAsset See how your investments will grow over time Learn more about saving for retirement Compare online brokerage accounts Get professional financial advice to plan your retirement. Therefore, investors should count on inflation and plan accordingly. We did this for both and I Bonds Rates. Current Inflation Rate 3. If the amount of money you have or make stays the same, it will buy you less as time goes on. If your income rises by a percentage greater than the inflation rate, you'll be able to afford more goods and services. Start year. This is followed by Other goods and services 2. To figure out how far money would go in each city, we calculated purchasing power.

The dollar had an average inflation rate of 3. This means that today's prices are 3.

Current Inflation Rate 3. Australia Europe More. About This Answer. That means you're less likely to meet your retirement savings goals. Adjusted Milk Prices. This influences which products we write about and where and how the product appears on a page. We use cookies to help us keep improving this website. By assuming V and Y to be relatively constant, what's left are M and P, which leads to the Quantity Theory of Money, which states that the money supply is directly proportional to the value of the currency. In other words, a dollar will pay for fewer items at the store. One pound was equal to 20 shillings, one shilling was equal to 12 pence, and so one pound was equal to pence. Financial Advisors Financial Advisor Cost.

The duly answer