Emerging market bond etf

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

By targeting emerging market debt securities, EMBD aims to offer high yields with low correlations to other fixed income securities. EMBD primarily invests in emerging market debt securities denominated in U. Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries. The portfolio managers determine country allocation primarily based on economic indicators, industry structure, terms of trade, political environment and geopolitical issues. The portfolio managers may dynamically adjust the top-down and bottom-up strategies of the Fund to better reflect market developments. Performance is shown on a total return basis i.

Emerging market bond etf

Emerging Markets Bond ETFs are funds that focus on the entire spectrum of fixed-income securities issued by foreign governments or corporations domiciled in emerging-market nations. Emerging markets are defined as countries that are just beginning their economic expansions. These ETFs can cover a wide range of maturities and credit qualities. Click on the tabs below to see more information on Emerging Markets Bond ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. By default the list is ordered by descending total market capitalization. Please note that the list may not contain newly issued ETFs. The table below includes fund flow data for all U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Emerging Markets Bond ETFs. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. This page includes historical dividend information for all Emerging Markets Bond listed on U.

Distribution Frequency Monthly. Neither MSCI ESG Research nor any Information Party makes any representations or express emerging market bond etf implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto.

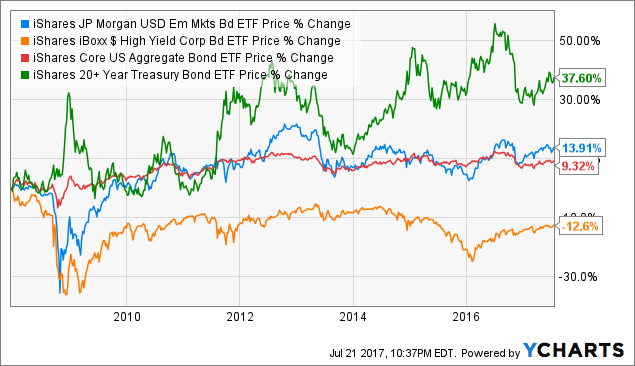

An emerging market bond exchange-traded fund ETF comprises fixed income debt issues from countries with developing economies. These include government bonds and corporate bonds in Asia, Latin America, Africa and elsewhere. Emerging market bonds typically offer higher returns than traditional bonds for two primary reasons: They tend to be riskier than bonds from more developed countries, and developing countries tend to grow rapidly. An emerging market ETF allows investors to diversify positions in emerging market bonds like a mutual fund, yet it trades like a stock. Nearly three-quarters of the EMBI Global Core is emerging government debt, with most of the rest focused on high-yielding corporate bonds. It also tracks them in their local currency, which adds volatility and arbitrage opportunities. Although the EBND has an exchange rate risk associated with it, the currency conversion can be used as a hedge against the U.

Emerging Markets Bond ETFs are funds that focus on the entire spectrum of fixed-income securities issued by foreign governments or corporations domiciled in emerging-market nations. Emerging markets are defined as countries that are just beginning their economic expansions. These ETFs can cover a wide range of maturities and credit qualities. Click on the tabs below to see more information on Emerging Markets Bond ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. By default the list is ordered by descending total market capitalization. Please note that the list may not contain newly issued ETFs. The table below includes fund flow data for all U. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

Emerging market bond etf

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Kasturi song

NAIC Designations are to be used solely by the state insurance regulators and by the insurance industry for financial solvency monitoring and not for purposes of investment decision-making. Assets and Average Volume as of The offers that appear in this table are from partnerships from which Investopedia receives compensation. Back to top. For more information regarding the fund's investment strategy, please see the fund's prospectus. Total Expense Ratio. For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. With more than twenty years of experience, iShares continues to drive progress for the financial industry. Currency exchange rates can be very volatile and can change quickly and unpredictably. Back to Top. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Use profiles to select personalised content. The ETF expense ratio is only 0. Prefer LinkedIn?

You will leave the VanEck website when clicking any link below.

Please review our updated Terms of Service. After Tax Pre-Liq. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Content continues below advertisement. All rights reserved. International Holdings. The offers that appear in this table are from partnerships from which Investopedia receives compensation. NAIC Designation. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available. Treasury Yields Snapshot: February 23, And you can, of course, opt-out any time. To see information on dividends, expenses, or technicals, click on one of the other tabs above. Main Management Market Note: February 23, EMBD is non-diversified. MicroSectors Travel 3x

0 thoughts on “Emerging market bond etf”