Empower wealth fees

Two of the leading web-based investment platforms are Wealthfront and Empower. The empower wealth fees targets a wide pool of investors with its low fees; the latter caters to those who still want a human touch in their investment guidance.

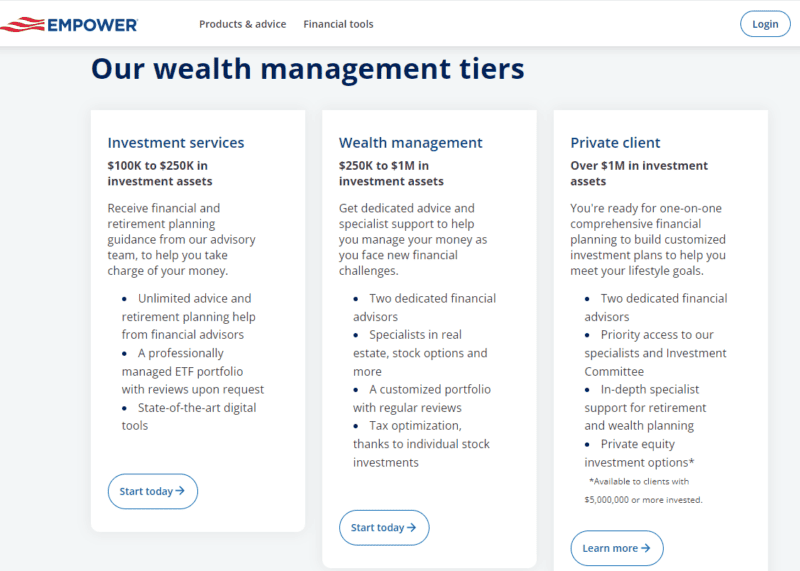

Personal investors. Workplace retirement. Employers and plan sponsors. Financial professionals. As a private client, you get more than just a personalized portfolio, you get a team dedicated to helping you reach your goals. Take advantage of our expertise in legacy planning, private equity and more.

Empower wealth fees

Empower offers wealth management services and free financial tools. But is it legit? Find out if this robo advisory service is right for you. With a 0. But it claims to offer a more personalized investing strategy that can lead to a better financial outcome. So is it worth the higher fee? If you're not sure about using their investment service, you can always use their free financial tools and get a free portfolio consultation. You'll still receive custom advice you can implement yourself. Empower is an all-in-one financial toolkit. It offers 2 main services:. Advanced financial tools free Empower's robust money management tools are some of the best out there.

This gives you a personalized investment strategy at less cost.

Personal investors. Workplace retirement. Employers and plan sponsors. Financial professionals. Rest assured:. Your free dashboard is as robust, secure and easy to use as ever. Your Personal Capital app will automatically become the Empower Personal Wealth app with your next update.

Before acquiring Personal Capital in , Empower was most well-known for offering retirement services to corporations. While a large company, it was not a household name for most individual investors. By acquiring Personal Capital, Empower expanded its service offerings to include individual wealth management and financial planning tools. Plus, integrating these tools into its existing services has allowed Empower to offer a more comprehensive suite of financial management services to its existing clients. The first of these products is a free financial dashboard that lets you link your accounts so you can manage your money and track your investment portfolio in one online location. You gain access to this dashboard immediately upon signing up for an Empower account. Its tools cover budgeting, cash flows, education planning, investments, retirement savings and more.

Empower wealth fees

The bottom line: Empower, formerly known as Personal Capital, has fees that are on the higher end, but anyone can use the robust free tools. Free, comprehensive investment management tools. Vanguard Personal Advisor. Most importantly, our reviews and ratings are objective and are never impacted by our partnerships. Our opinions are our own. Editor's note: Empower acquired Personal Capital in , and in Feb.

Pyrex mixing bowls with lids

Go to Empower. Like with most financial advisors, clients have to pay the expense ratios of the exchange-traded funds included in the portfolio in addition to the management fee. Learn more on Facet's website. Some clients want aggressive growth; others just need to keep up with inflation. The annual fee is 0. Empower never directly takes custody of client assets, and only you have access to your money. Portfolio construction. We prefer individual stocks and ETFs for two main reasons. There are no hidden fees, no trailing fees and no trade commissions. It offers 2 main services:. Empower also offers spending analysis, a look at your cash flow that divides expenses into categories such as groceries, health care, clothing and restaurants. You gain access the more you invest.

Written by investor.

Tax strategy: 4 out of 5 stars. We believe in the power of people to change the nature of investment advice, making it more transparent, objective and personal. You must manually link your accounts when you sign up for Empower. Empower directs most of its attention on an individualized experience for those who tend towards mid-level investments. They want to streamline how you manage your accounts by putting them in one accessible place. However, a number of their investment management tools come free, which may appeal to DIY investors. Login and see for yourself. They both offer a thorough range of tools that cater to financial planning. For more details about the categories considered when rating brokers and our process, read our full methodology. Investing involves risk. You can:. Learn more on Empower's website. Free and easy to setup Wealth management plan offers more custom strategy than other robo advisors Advanced money management tools See all your financial accounts in one place Retirement planner Free personalized investment advice Cryptocurrency tracking.

I think, that you commit an error. I suggest it to discuss. Write to me in PM, we will talk.