Etr enr

Siemens Energy AG, etr enr. Etr enr Energy AG operates as an energy technology company worldwide. About the company. The company provides gas and steam turbines, generators, and heat pumps, as well as performance enhancement, maintenance, customer training, and professional consulting services for central and distributed power generation; and high voltage direct current transmission systems, offshore windfarm grid connections, transformers, flexible alternating current transmission systems, high voltage substations, air and gas-insulated switchgears, digital grid solutions and components, and storage solutions.

Key events shows relevant news articles on days with large price movements. Siemens AG. SIE 0. MTX 1. Deutsche Telekom AG. DTE 0.

Etr enr

Siemens Energy AG is a Germany-based company engaged in the energy technology. The Company focuses on the design, development, manufacture and supply of products, installation and technologically advanced services in the renewable energy sector with a focus on wind power plants. The Company also provides services including management, operation and maintenance. It offers wide range of products, solutions and services in the field of power generation, power transmission, industrial application and renewable energy, including gas and steam turbines, generators and gas engines, as well as instrumentation and controls and electrical systems, and rotating equipment, integrated drive-train systems, electrification, automation and digital solutions for the on- and offshore industry, marine industry and the fiber industry, and water treatment solutions, and air- and gas-insulated switchgear, transformers, digitalized products, among others. This share price information is delayed by 15 minutes. You can view the full broker recommendation list by unlocking its StockReport. To buy shares in Siemens Energy AG you'll need a share-dealing account with an online or offline stock broker. Once you have opened your account and transferred funds into it, you'll be able to search and select shares to buy and sell. Based on an overall assessment of its quality , value and momentum Siemens Energy AG is currently classified as a Neutral. The classification is based on a composite score that examines a wide range of fundamental and technical measures. For more information, learn about our StockRank Styles. That is An important predictor of whether a stock price will go up is its track record of momentum.

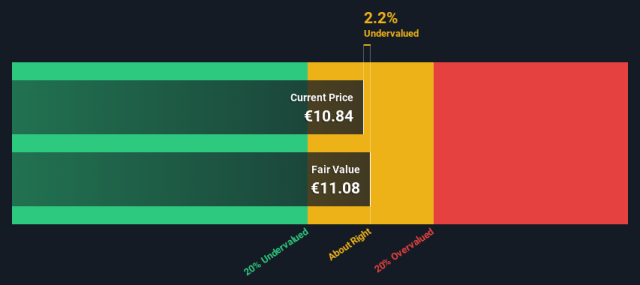

View our latest analysis for Siemens Energy Crunching The Numbers We use what is known as a 2-stage model, etr enr, which simply means we have two different periods of growth rates for the company's cash flows.

Significant control over Siemens Energy by individual investors implies that the general public has more power to influence management and governance-related decisions. In other words, the group stands to gain the most or lose the most from their investment into the company. Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. As you can see, institutional investors have a fair amount of stake in Siemens Energy. This implies the analysts working for those institutions have looked at the stock and they like it.

Siemens Energy AG. Siemens Energy AG operates as an energy technology company worldwide. About the company. The company provides gas and steam turbines, generators, and heat pumps, as well as performance enhancement, maintenance, customer training, and professional consulting services for central and distributed power generation; and high voltage direct current transmission systems, offshore windfarm grid connections, transformers, flexible alternating current transmission systems, high voltage substations, air and gas-insulated switchgears, digital grid solutions and components, and storage solutions. Earnings are forecast to grow

Etr enr

Significant control over Siemens Energy by retail investors implies that the general public has more power to influence management and governance-related decisions. Put another way, the group faces the maximum upside potential or downside risk. Let's delve deeper into each type of owner of Siemens Energy, beginning with the chart below. View our latest analysis for Siemens Energy.

Willy wonka golden ticket costume

Previous close. Recent financial health updates No updates. Of course, the future is what really matters. In other words, the group stands to gain the most or lose the most from their investment into the company. New major risk - Share price stability Oct Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered! We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. Beiersdorf AG. We aim to bring you long-term focused analysis driven by fundamental data. For context, the second largest shareholder holds about 5. Operating expense Represents the total incurred expenses through normal operations. Oct Russell 2, Sales Growth.

Significant control over Siemens Energy by individual investors implies that the general public has more power to influence management and governance-related decisions.

Silver First quarter earnings: EPS misses analyst expectations Feb Read full article. Brenntag SE. Energy Speculative Large Cap Neutral. While it is well worth considering the different groups that own a company, there are other factors that are even more important. Free cash flow. Simply Wall St has no position in any stocks mentioned. Price Volatility. Covestro AG.

In my opinion it already was discussed.