Etr: vna

Big corporations are much sought after by risk-averse investors who find diversified revenue streams and strong capital returns attractive.

Vonovia SE. Vonovia SE operates as an integrated residential real estate company in Europe. About the company. The company offers property management services; property-related services; and value-added services, including maintenance and modernization of properties, craftsmen and residential environment organization, condominium administration, cable TV, metering, energy supply, and insurances services. Trading at

Etr: vna

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. But is this debt a concern to shareholders? Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together. See our latest analysis for Vonovia. You can click the chart for greater detail.

See Fair Value and valuation analysis. Weather Weather. Net cash used or generated for core business activities.

Key events shows relevant news articles on days with large price movements. MTX 0. Deutsche Lufthansa AG. LHA 1. FRE 0. Fresenius Medical Care AG. FME 1.

Today, we will estimate the stock's intrinsic value by estimating the company's future cash flows and discounting them to their present value. Don't get put off by the jargon, the math behind it is actually quite straightforward. We generally believe that a company's value is the present value of all of the cash it will generate in the future. However, a DCF is just one valuation metric among many, and it is not without flaws. If you want to learn more about discounted cash flow, the rationale behind this calculation can be read in detail in the Simply Wall St analysis model. See our latest analysis for Vonovia.

Etr: vna

Vonovia SE. Vonovia SE operates as an integrated residential real estate company in Europe. About the company.

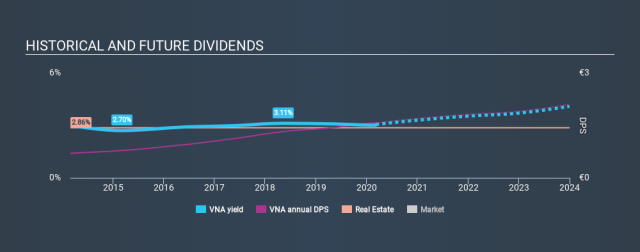

Neeko u gg

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. To buy shares in Vonovia SE you'll need a share-dealing account with an online or offline stock broker. First half earnings released Aug See The Free Research Report. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. What we care about is avoiding the permanent loss of capital. Net profit margin. Latest News for VNA. This share price information is delayed by 15 minutes. For VNA, the ratio of 3. Revenue and earnings miss expectations Mar Dividend of 3.

The company is inching closer to its yearly highs following the recent share price climb. But what if there is still an opportunity to buy?

Total assets. But is this debt a concern to shareholders? Past Performance. Key events shows relevant news articles on days with large price movements. The Conversation. Monday, May 20th, Operating expense Represents the total incurred expenses through normal operations. Second quarter earnings: EPS and revenues miss analyst expectations Aug Total equity The value of subtracting the total liabilities from the total assets of a company. The ratio of annual dividend to current share price that estimates the dividend return of a stock. Cashflow ps. Total assets The total amount of assets owned by a company. Stock Turnover. The PE ratio or price-to-earnings ratio is the one of the most popular valuation measures used by stock market investors. You may be interested in info This list is generated from recent searches, followed securities, and other activity.

0 thoughts on “Etr: vna”