Fedwire routing number

Your IBAN number identifies a specific banking account the transfer should be made to, ensuring the payment reaches its destination safely.

Your browser version is no longer supported, so you may experience issues while using this site. Please upgrade to a current browser to enjoy the best experience. This code is often displayed on customer's bank statements in the United States of America. Website feedback. Please ensure that you read these before accessing the site.

Fedwire routing number

.

Guides Sep 11, fedwire routing number, Currency risk can have a significant effect on the efficiency and profitability of any international business. This policy provides information about how Suncorp collects and uses data related to your online activity, and how you can choose to remain anonymous.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Fedwire routing number

Fedwire formerly known as the Federal Reserve Wire Network is a real-time gross settlement funds transfer system operated by the United States Federal Reserve Banks that allows financial institutions to electronically transfer funds between its more than 9, participants as of March 19, This information is submitted to the Federal Reserve via the Fedwire system. Once the instructions are received and processed, the Fed will debit the funds from the sending bank's reserve account and credit the receiving bank's account. Wire transfers sent via Fedwire are completed the same business day, with many being completed instantly. Fedwire is designed to be highly resilient. In , Fedwire processed roughly million transfers with a total value of just over one quadrillion US dollars. In the early s, settlement of interbank payments was often done by the physical delivery of cash or gold. By , The Federal Reserve Banks began to move funds electronically. In , the Banks established a proprietary telecommunications system to process funds transfers, connecting all 12 Reserve Banks, the Federal Reserve Board and the U. Treasury by telegraph using Morse code.

Sterling background check uber eats

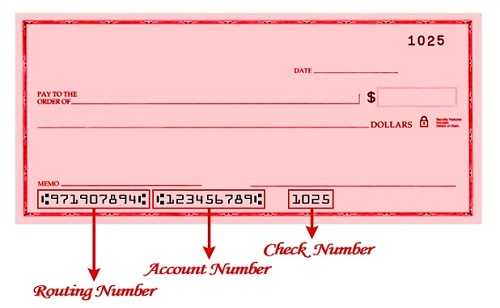

The Target Market Determination are also available. How many routing numbers does a bank have? Instead, your IBAN is an additional number that contains extra information to help foreign banks identify accounts when you send money overseas. Yes, your US bank's routing number is your bank's ID. Any advice has been prepared without taking into account your particular objectives, financial situation or needs, so you should consider whether it is appropriate for you before acting on it. A bank routing number, also known as a routing transit number and international routing code, is a nine-digit number used by banks for domestic and international transfers in the United States. Your IBAN number identifies a specific banking account the transfer should be made to, ensuring the payment reaches its destination safely. See our Cookie and Data Policy. Products and services including banking and insurance including home and car insurance are provided by separate companies in the Suncorp Group. Please enable JavaScript in your browser. They contain your:.

.

Do you need a routing number for an international wire transfer? What is an IBAN? Guides Feb 22, Each exchange rate movement affects how much you receive from sales and what you pay to suppliers. Related Articles. If it helps, think of your SWIFT code as a postcode for your bank to make sure your international transfer is sent to the right place. Currency risk can have a significant effect on the efficiency and profitability of any international business. Not quite ready to open an account? This site will not function correctly without JavaScript enabled. Business Banking.

I am final, I am sorry, but this answer does not suit me. Perhaps there are still variants?