Fhsa self directed

Start saving towards a down payment with the tax-free First Home Savings Account, fhsa self directed. The FHSA is a new registered account that will provide you tax-free savings for the purchase of a first home. Your contributions made to an FHSA are tax deductible, which reduces your taxable income for the current year.

Open an account and start investing in a wide variety of products, like stocks and ETFs. Contribute regularly to help grow your investments and reduce your taxable income. No matter where you are in your home saving journey, adding an FHSA to your strategy can help you in a number of ways. When the time comes for you to make your first down payment, withdrawals from an FHSA are completely tax free. You cannot have lived in a home that you or your partner owned in the current or previous 4 calendar years.

Fhsa self directed

Learn more about TD Direct Investing. Everyone dreams about buying their first home. Contributions to an FHSA are tax-deductible, and funds used to buy a first home can be withdrawn tax-free. As FHSAs are new, they are not currently offered by most financial institutions. This article will outline the key things you may consider about FHSAs and the steps you can take today to help make your wish of owning a home come true. FHSAs can remain open for up to 15 years, or until you turn After that, the money in an FHSA must be used to buy a new home. A first-time homebuyer includes anyone who has not lived in a home owned by them, their spouse or common law partner, either in the current year before the account is opened or in any of the preceding four calendar years. However, living in a home held by a trust or other intermediary can make you ineligible for an FHSA. You can only use an FHSA to buy a home once in your lifetime. Contributions made within the first 60 days of the calendar year cannot be claimed as part of the previous tax year. Contributions are tax-deductible while qualified withdrawals are tax-free. You can claim the deduction in the year you made the contribution or carry the deduction over to a future tax year. So, if you open an FHSA when you are a student in a low-income bracket , you can wait until you get a job to claim the deduction.

However, if you already have a Questrade FHSA, you can just log into your account and select Transfer account to Questrade under Funding to be provided with the necessary forms and steps fhsa self directed take. Travel Insurance. Ways to Bank.

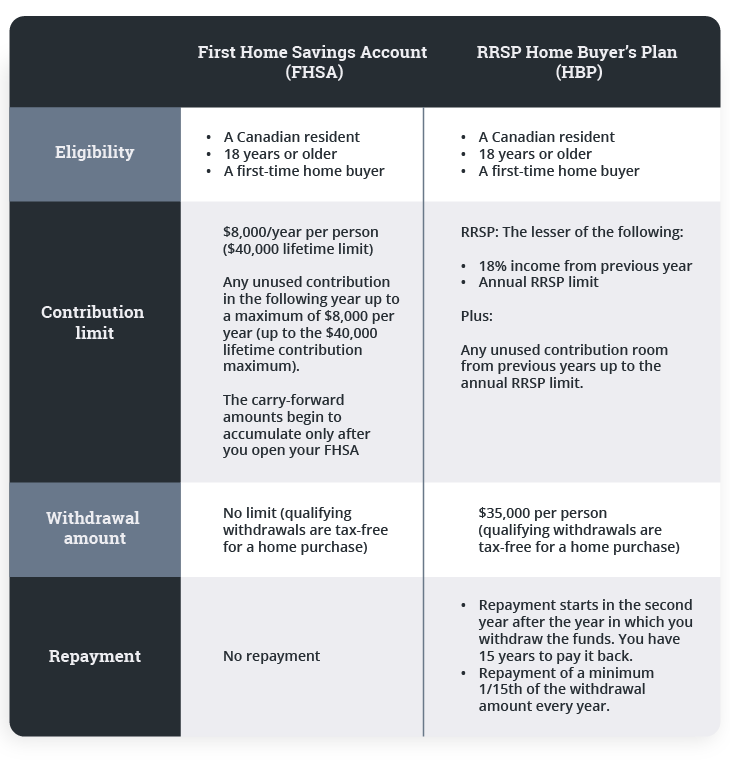

Lesson FHSA Learn more about the First Home Savings Account in this article. Ready to open an FHSA account and take charge of your financial future? It's easy. Get started in minutes. Explore the high level summary below to learn more about how the new FHSA works. Learn more about contribution limits, eligibility requirements and much more.

Start saving towards a down payment with the tax-free First Home Savings Account. The FHSA is a new registered account that will provide you tax-free savings for the purchase of a first home. Your contributions made to an FHSA are tax deductible, which reduces your taxable income for the current year. If you decide to use this amount for something other than a home, you can transfer the money to an RRSP or RRIF without affecting your contribution room. Discover its various benefits. Sign in. Learn more. Self-directed investor? Complete our secure online form and contribute to your FHSA via your brokerage account. Open an account.

Fhsa self directed

The IRS introduced the HSA for qualifying taxpayers to receive tax benefits for medical expenses, regardless of whether they itemize or not. Before you can establish an HSA, you must first have a qualifying high deductible health plan. You can keep the HSA forever, even after you leave a job or change your insurance plan. The contributions you make are completely tax-free, as well as earnings and qualified withdrawals. An HDHP is a category of health insurance plans available from your health insurance provider. One primary benefit of the high deductible health plan is that it offers lower monthly premiums and a higher yearly deductible than most health plans.

Ministry of sound recordings ltd

Your annual limit includes any transfers you make from an RRSP. Looking for advice? Dividends are often quoted in terms of the dollar amount each share receives dividends per share or DPS. Have a general question? Start Investing Today Open an Account. In all cases, if you have previously participated in the HBP, you may be able to do so again if your repayable HBP balance on January 1st of the year of the withdrawal is zero and you meet all the other HBP eligibility conditions. No limit for qualifying withdrawals. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade, Inc. You should consult your own tax and accounting advisors for these matters. However, living in a home held by a trust or other intermediary can make you ineligible for an FHSA. Open an account today and start investing for your dream home purchase! Contribution deadline December 31 st. Canadian residents 18 years or older 2 who have a valid SIN. It depends.

Learn more about TD Direct Investing. Everyone dreams about buying their first home. Contributions to an FHSA are tax-deductible, and funds used to buy a first home can be withdrawn tax-free.

If you make a non-qualifying withdrawal, you will not have to close your account unless you have had it for 15 years or are turning 71 —but your contribution room will not be reinstated. All your investment earnings will be non-taxable while in your plan. However, a share that only provides you with a right to tenancy in the housing unit does not qualify. Legal Disclaimer footnote 3. Open an account. A type of savings plan that allows you to hold and invest money on a tax-free or tax-deferred basis. Explore Investments. Withdrawals from a TFSA are tax-free and do not need to be repaid. So, if you open an FHSA when you are a student in a low-income bracket , you can wait until you get a job to claim the deduction. We matched that to:. However, living in a home held by a trust or other intermediary can make you ineligible for an FHSA.

0 thoughts on “Fhsa self directed”