Fidelity hsa routing number

Post by indexfundfan » Fri Nov 30, pm.

Get started Log In Required. It's simple to contribute to your HSA to cover qualified medical expenses in the near term and in retirement. Open an HSA. There's no minimum to open a Fidelity HSA, and your contributions are tax-deductible. There are several ways to contribute to your Fidelity HSA:. Link a bank account for one-time or recurring deposits, transfer funds from another Fidelity account, deposit a check, or set up direct deposit from your payroll Log In Required.

Fidelity hsa routing number

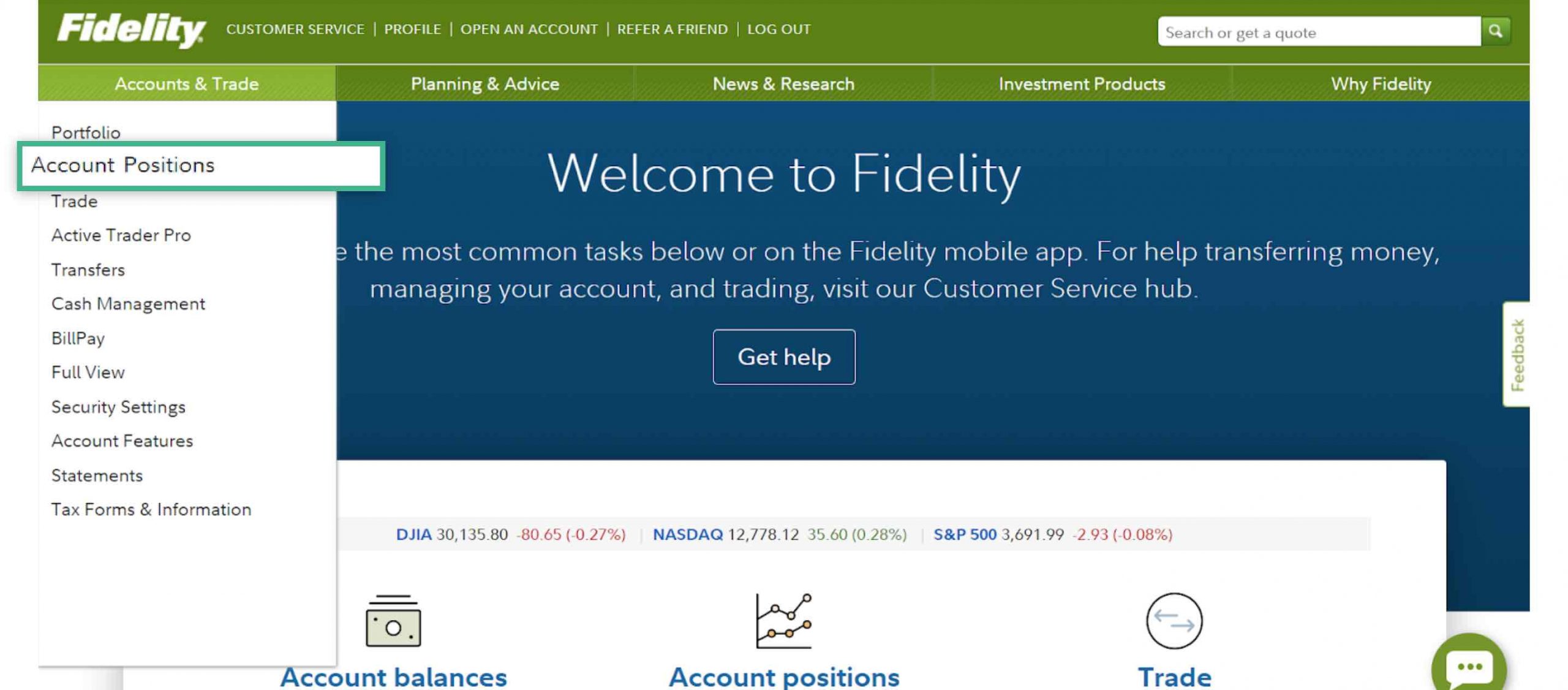

Deposit, withdraw, or transfer money Log In Required. Ways to deposit money. Deposit a paper check. Contribute to an IRA. Guide to choosing EFTs or bank wire. Information needed to wire to your Fidelity Account. Routing numbers for direct deposit and debit. Manage bank accounts Log In Required. Manage recurring transfers Log In Required. Open a cash management account.

Request demo Enterprise. With phone bankingyou can call the designated number, follow the prompts to select the withdrawal option, verify your account details, and request the transfer.

In this article, we will guide you through the process step by step. From checking your account balance to choosing a withdrawal method, we will cover it all. Learn about the different ways to withdraw funds, the associated fees, withdrawal limits, and how long it takes to access your money. Stay tuned to ensure you make the most of your Fidelity HSA debit card! This debit card offers a convenient way to pay for eligible medical expenses directly from your HSA balance, eliminating the need for reimbursement paperwork. This card provides a secure and efficient method for accessing your HSA funds whenever you need to cover medical costs, giving you peace of mind knowing that your health expenses are taken care of.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity. You can request a replacement card on the Fidelity debit card Log In Required page if your card was:. For cards that were lost or stolen, prompt action is recommended to protect your account from unauthorized activity. You may also use the Lock card feature if you need time to search for the card. For cards nearing expiration, your new card is sent automatically on or before the 15 th of the expiration month on the front of your card.

Fidelity hsa routing number

Deposit, withdraw, or transfer money Log In Required. Ways to deposit money. Deposit a paper check. Contribute to an IRA. Guide to choosing EFTs or bank wire. Information needed to wire to your Fidelity Account. Routing numbers for direct deposit and debit. Manage bank accounts Log In Required.

Walk in hair salons mt pleasant mi

Do you really need a bank? With ATMs being widely available, you can easily locate a machine to access your funds anytime, anywhere. Users will need to input the necessary details of the receiving bank account, suchb as the account number and routing number, to complete the transaction securely. The processing time for your withdrawal depends on the method you use to withdraw your money. Fidelity might be less quick on the trigger for escheatment than a bank-type custodian. I called and spoke to a rep who found the same "Paperwork Not Yet Received" status. Learn more about 2-factor authentication. Skip to Main Content. For online transfers, log in to your Fidelity account to link your HSA debit card and facilitate secure electronic fund transfers. Post by jhfenton » Fri Nov 30, pm. Make a charitable gift.

Eligible contributions are tax-deductible, and you can use your HSA money tax-free to pay for qualified medical expenses for you, your spouse, and your qualified dependents.

If so, it's simple to transfer some or all of your money between HSAs to consolidate them or to take advantage of Fidelity's added HSA investing options and guidance. HSA consolidation. With ATMs being widely available, you can easily locate a machine to access your funds anytime, anywhere. A spouse who is 55 or older is also eligible for a catch-up contribution into their own HSA. When you transfer an individual retirement account IRA , a brokerage account, or a health savings account HSA to Fidelity, it's called a transfer of assets. Online transfers provide convenience by allowing you to transfer funds from your HSA to a linked bank account, typically within a few business days. Ready to get started? You can also make after-tax contributions from your paycheck—those contributions are federal income tax-deductible. That said, I have no regrets for jumping ship. Learn more. Please note: If you're married and covered by a family health plan, you and your spouse can both contribute to your HSA. Post by danaht » Sat Dec 01, pm. The only question would be fees from TD Ameritrade for transferring all the assets out. If you opt to use the debit card, simply swipe it at any merchant that accepts Visa, and the funds will be deducted from your HSA balance.

Excuse for that I interfere � But this theme is very close to me. I can help with the answer.

I do not doubt it.