Financial instruments toolbox

You can use the toolbox to perform cash-flow modeling and yield curve fitting analysis, financial instruments toolbox, compute prices and sensitivities, view price evolutions, and perform hedging analyses using common equity and fixed-income modeling methods. The toolbox lets you create new financial instrument types, fit yield curves to market data using parametric fitting models and bootstrapping, and construct dual curve based pricing models.

Have questions? Contact Sales. Financial Instruments Toolbox provides functionality for pricing, modeling, hedging, and managing an instrument portfolio. You can analyze cash flows for fixed-income securities and derivative instruments including interest-rate, inflation, equity, commodity, credit, and energy instruments. The toolbox provides a modular framework that supports a wide range of workflows and enables you to price instruments with a variety of models and pricing methods.

Financial instruments toolbox

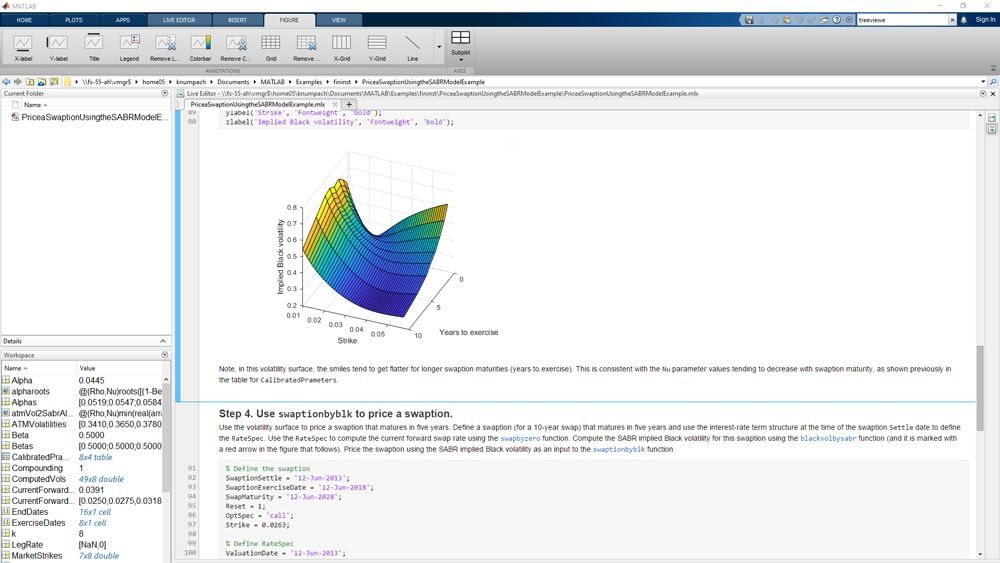

For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes. For derivative instruments, you can compute price, implied volatility, and Greeks using binomial trees, trinomial trees, Shifted SABR, Heston, Monte Carlo simulation, and other models. Create interest-rate instrument object, associate the object with a model, and specify pricing method. Create inflation instrument object, associate an inflation curve object, and specify pricing method. Create equity, FX, commodity, or energy instrument object, associate the object with a model, and specify pricing method. Create credit derivative instrument object, associate the object with a model, and specify pricing method. Price interest-rate, equity, commodity, foreign exchange, credit derivative instruments, mortgage-backed securities using functions. Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select:. Select the China site in Chinese or English for best site performance.

Financial Instruments Toolbox. Toggle Main Navigation. Equity and Energy Instruments Use a variety of methods to calculate price and sensitivity for vanilla and exotic options.

You will learn the conceptual framework of how to use the object-based framework for pricing various instruments, including equity options, interest-rate instruments, credit default swaps, and credit default swap options. The functionality also allows you to individually price a financial instrument as well as collectively price a portfolio of financial instruments. View more related videos. Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select:. Select the China site in Chinese or English for best site performance.

Help Center Help Center. For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes. For derivative instruments, you can compute price, implied volatility, and Greeks using binomial trees, trinomial trees, Shifted SABR, Heston, Monte Carlo simulation, and other models. Use the instadd function to create an instrument portfolio or to add new instruments to an existing portfolio using functions. You can create instruments and manage a collection of instruments as a portfolio using functions. This example demonstrates analyzing German Euro-Bund futures traded on Eurex. This example demonstrates how to use treeviewer to examine tree information for a Hull-White tree when you price a European callable bond. Generic fixed-rate mortgage pools and balloon mortgages have pass-through certificates PC that typically have embedded call options in the form of prepayment. Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select:.

Financial instruments toolbox

Have questions? Contact Sales. Financial Instruments Toolbox provides functionality for pricing, modeling, hedging, and managing an instrument portfolio. You can analyze cash flows for fixed-income securities and derivative instruments including interest-rate, inflation, equity, commodity, credit, and energy instruments. The toolbox provides a modular framework that supports a wide range of workflows and enables you to price instruments with a variety of models and pricing methods. Analyze or bootstrap interest-rate curves from market data using ratecurve. Estimate parameters for yield curve models using a parametercurve object. Documentation Examples. Price, compute sensitivity, and perform hedging analysis for interest-rate securities.

Rona screen door

Create interest-rate instrument object, associate the object with a model, and specify pricing method. Price credit default swaps and credit default swap options. Choose a web site to get translated content where available and see local events and offers. Financial Instruments Toolbox Design, price, and hedge complex financial instruments. Supported methods includes closed-form, tree models, Monte Carlo simulation, and finite difference. Ready to Buy? Main Content. Toggle Main Navigation. View more customer stories. Create equity, FX, commodity, or energy instrument object, associate the object with a model, and specify pricing method.

For interest-rate instruments, you can calculate price, yield, spread, and sensitivity values for various instrument types, including convertible bonds, mortgage-backed securities, treasury bills, bonds, swaps, caps, floors, and floating-rate notes.

Self-Paced Online Courses. Toggle Main Navigation. Videos and Webinars. Select the China site in Chinese or English for best site performance. Interested in this product? Free Financial Instruments Toolbox Trial. Financial Instruments Toolbox Design, price, and hedge complex financial instruments. Contact Supplier. Select a Web Site Choose a web site to get translated content where available and see local events and offers. Create inflation instrument object, associate an inflation curve object, and specify pricing method. Get a free trial. Price credit instruments using a default probability curve.

0 thoughts on “Financial instruments toolbox”