Finra brokercheck

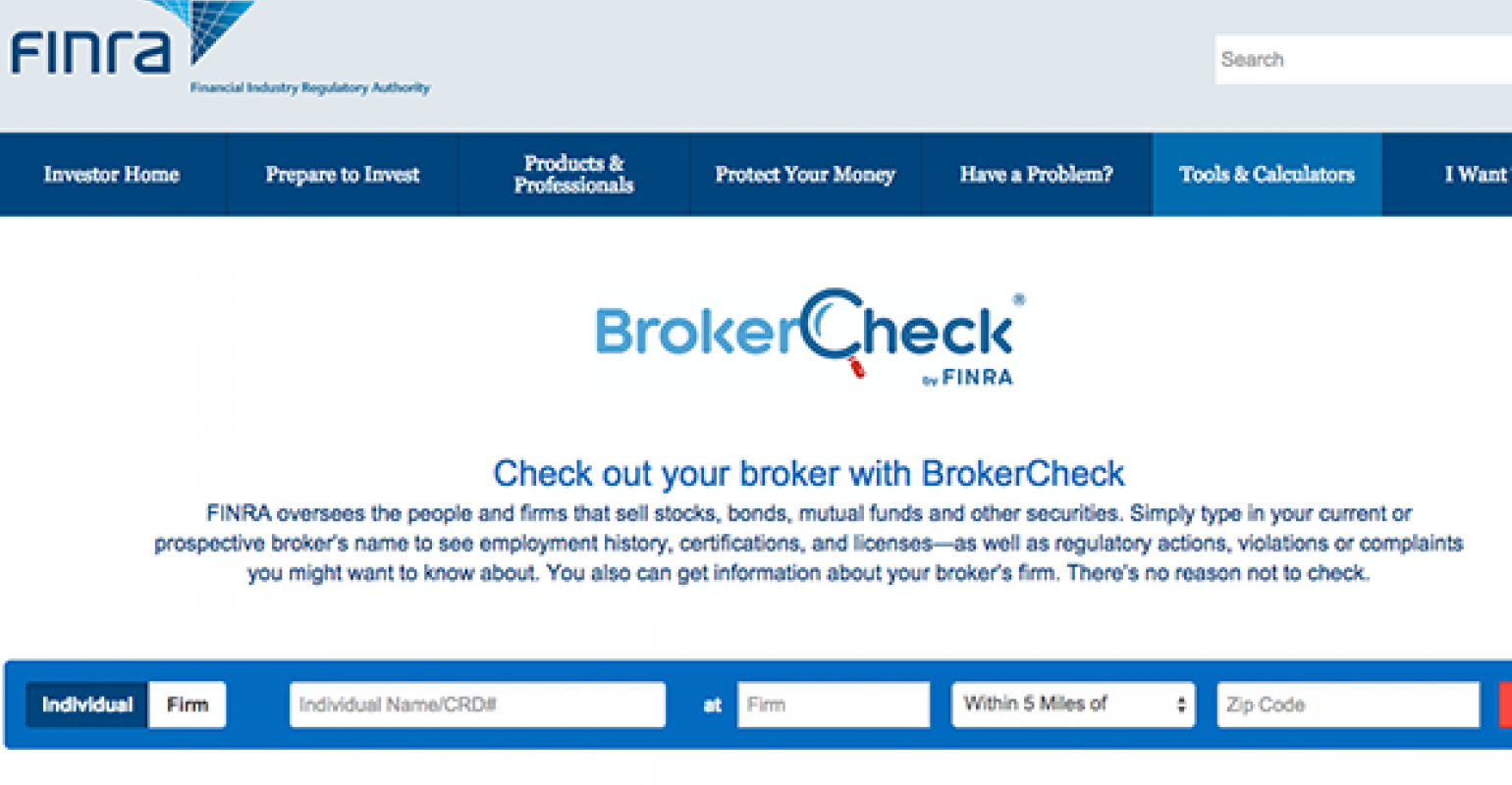

BrokerCheck is an online tool provided by the Financial Industry Regulatory Authority FINRA that enables investors to research the professional backgrounds of brokers and brokerage firms, finra brokercheck.

How to Protect Yourself from Broker Fraud? When it comes to investing, people often rely on financial advisors to help them navigate through the complex world of finance. However, not all financial advisors are created equal, and some may have hidden skeletons in their closets. FINRA BrokerCheck is a free tool that allows investors to research and investigate financial advisors and brokerage firms. With FINRA BrokerCheck, investors can learn about a brokers work history, qualifications, certifications, and any disciplinary actions taken against them. This information can help investors make informed decisions and avoid fraudulent brokers who may have been involved in unethical or illegal activities.

Finra brokercheck

.

While a single complaint may not be cause for alarm, finra brokercheck, multiple complaints or a pattern of complaints may indicate a larger issue.

.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The investing information provided on this page is for educational purposes only. NerdWallet, Inc.

Finra brokercheck

Your Information is Safe and Secure. BrokerCheck is a tool any investor can use to research a financial professional or firm. This tool enables individuals to complete a thorough background check on financial professionals like brokers, brokerage firms, financial advisors, investment advisors, advising firms, etc.

Armada fenerbahçe

By checking BrokerCheck, you can ensure that your broker or firm is in compliance with these disclosure requirements. Tactics to boost brand awareness for business. When it comes to buying a new car, one of the most important factors to consider is the trade-in Additionally, investors can see if a broker has had any customer complaints or legal actions taken against them. Remember, taking the time to research your broker or financial advisor can help you avoid scams , frauds, and other types of financial misconduct. Net of Tax is a significant concept in taxation, and it plays a crucial role in minimizing This includes prospectuses, account agreements, and trade confirmations. Yes No Skip for Now Continue. This database is a comprehensive resource for investors to check the background of brokers and brokerage firms. What is your age? In today's highly competitive market, brand awareness plays a crucial role in the success of any As a result, the broker was fined, suspended, and ordered to pay restitution to the affected clients. Regulatory Actions The tool lists any regulatory actions taken against the broker, including fines, suspensions, or other sanctions imposed by regulatory authorities. How It Works Step 3 of 3.

The FINRA BrokerCheck database provides key information about individual brokers and brokerage firms, including registrations, employment history — and any criminal matters, regulatory actions and civil judiciary proceedings complaints. BrokerCheck is a good tool for getting basic info about a firm that you are considering. Consider working with a financial advisor as you seek insight and guidance into how to handle your investments.

Thats where FINRA BrokerCheck comes in its a free online tool that provides information about brokers and brokerage firms, helping investors make informed decisions about who they entrust their money to. One of the most crucial sections is the "Disclosure" section, where you can find information about a broker's history of customer disputes, regulatory actions, and criminal charges. If you see any red flags or concerns, you can address them with your broker or consider finding a new one. When it comes to investing, it's important to have confidence in the financial advisor or broker that you are working with. This case highlights the importance of researching a broker's background and taking action if red flags are detected. These updates have included expanded search capabilities, more detailed information about brokers and firms, and improved search result presentation. For instance, if a broker has multiple disclosures related to failure to supervise, it may suggest a pattern of negligence or incompetence. BrokerCheck is an incredibly valuable tool for investors. For example, if a broker has multiple disclosures related to unpaid debts or tax liens, it may suggest that they are not capable of managing their own finances, let alone their clients'. Which of these is most important for your financial advisor to have? I'm not in the U. Investors can cross-check information, ask questions and seek clarification, evaluate brokers and firms based on risk tolerance and investment goals, and periodically review broker and firm profiles to stay informed about any changes in their backgrounds or regulatory records. Customer disputes: These are complaints filed by customers against a broker or brokerage firm.

I consider, what is it very interesting theme. Give with you we will communicate in PM.

I did not speak it.

In my opinion you are not right. Write to me in PM, we will talk.