Finvasia vs zerodha

The brokerage of Angel One ranges between Rs 20the brokerage of Savetiknowm ranges between Rs 0finvasia vs zerodha, while the brokerage of Zerodha ranges between Rs All 3 brokers are discount brokers. Overall rating for Angel One is 4.

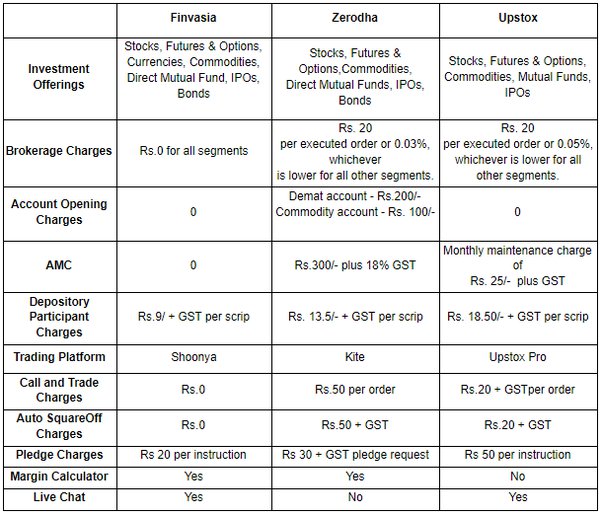

The side-by-side comparison of Zerodha and Finvasia Demat Account. Read Finvasia and Zerodha demat account review. Our Zerodha demat account comparison with Finvasia Securities Pvt Ltd highlights the major differences between two brokers. Find the best demat between Zerodha and Finvasia. Zerodha launched its online trading services on 15th Aug and in first 7 years Zerodha made around 7 lakhs customers. With innovative trading platform and tools along with the cheapest brokerage, Zerodha is fastest growing financial firm in India offering stock brokerage and depository services.

Finvasia vs zerodha

Our Zerodha comparison with Finvasia Securities Pvt Ltd highlights the major differences between two brokers. Open Instant Account and start trading today. This means the broker does not offer any additional leverage. Zerodha comes across as a decent choice for NRIs looking to invest in stock markets in India and want to save on brokerage. The company offers best-in-the-industry trading platforms and tools. It also doesn't offer mutual fund investment services to NRIs. It charges a low flat-fee brokerage which makes it an attractive choice for NRIs. Finvasia is an excellent choice for frequent NRI traders as it doesn't change any brokerage fee. The online trading platform it offers is the industry standard. Advance trading tools are also available. It also offers Algo trading platform to NRIs. Finvaisa also provides demat account and clearing services at a very low price. Finvasia has offices in the UK and Canada. This is a limited time offer. Open an instant Zerodha account online and start trading today.

Modex Securities. Zerodha vs Angel One.

All answers to your questions would be available here. Zerodha Minimum Brokerage is 0. Their comparative analysis is in the below table:. Here you can compare 5 brokers side by side in one go which is our key USP. Contact Us. All Blogs Blogs Lists. Fyers 5paisa TradeSmart.

Both the brokers are Discount Brokers. Finvasia is having overall lower rating compare to Zerodha. Finvasia is rated only 4 out of 5 where Zerodha is rated 4. Number of active customer for Zerodha is 69,94, where number of active customer for Finvasia is 94, Zerodha is serving more customer compare to Finvasia. Here we present side-by-side comparison of Finvasia vs Zerodha share brokers in India.

Finvasia vs zerodha

Zerodha vs Finvasia - side-by-side comparison. Compare Zerodha vs Finvasia brokerage, charges, exposure margin, demat account. Read Zerodha vs Finvasia review. Wisdom Capital Company Ltd. Master Capital Services Ltd. Zerodha vs Finvasia Zerodha vs Finvasia - side-by-side comparison. Detailed comparison Zerodha vs Finvasia and find out which is better in Zerodha vs Finvasia. Read Reviews. Zerodha Finvasia Securities Pvt Ltd. Brokerage Charges Compare the commission charged by the brokers for the trades executed.

Rhea lana south tulsa

Online Mutual Fund Investment - All 3 brokers offers online mutual fund investment. The services are as follows:. Zerodha is a Private company while Finvasia is a Public company. Broker Ratings by Users. Patel Wealth Advisors. Detail on Trading Platforms for finvasia. Phillip Capital. One is the display ad - broker related and IPO related. Kotak Securities Trade Free Plan. However, Zerodha's platform is also worth mentioning. No Hidden Charges.

Zerodha Vs Finvasia comparison brings direct values each stockbroker brings to its clients and at the same time, talks about the aspects where a particular broker fails against client expectations. Finvasia is a discount broker launched in with a unique proposition of zero brokerage charges on trading. The broker charges its clients on the basis of the trading platform s subscribed to.

Finvasia charges 0. Retail trading in equity, currency and commodity, depository demat account , asset management, investment banking, advisory, and currency hedging. Groww vs Zerodha. Unlimited Monthly Trading Plans. Cons Doesn't offer 3-in-1 accounts. Open Instant Account Now! All Rights Reserved. Total Number of Clients : 81, Commodity Futures. Placing orders through charts : Yes. Mansukh Securities. Indmoney vs Zerodha. Lakshmishree Investment.

You have hit the mark. In it something is also to me it seems it is very good idea. Completely with you I will agree.