Form 15g fillable

Home For Business Enterprise.

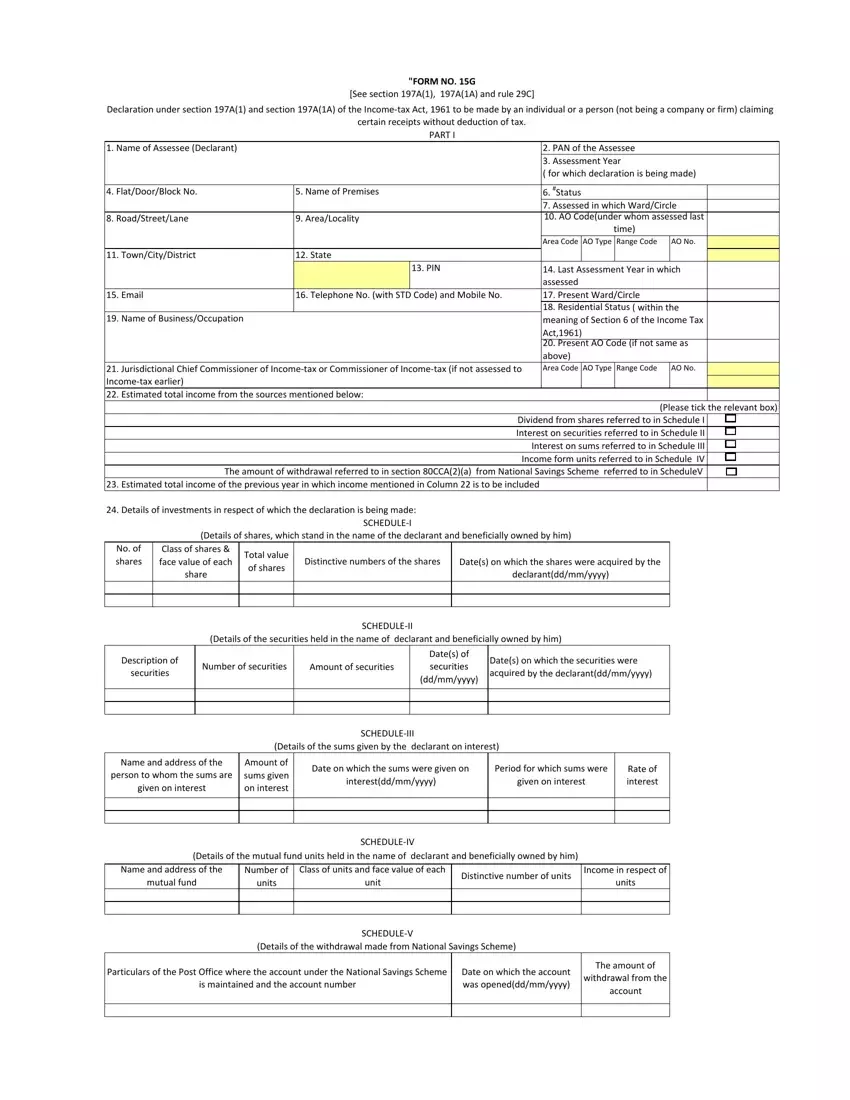

Didn't receive code? Resend OTP. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF. When the PF claim amount exceeds Rs. Even though you are eligible, TDS would be unnecessarily deducted from your interest income or PF claim amount if you fail to submit Form 15G.

Form 15g fillable

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. The employer also contributes an equal amount. You can withdraw this PF balance as per the PF withdrawal rules. However, if the amount you withdraw is more than Rs. So, you will receive only the balance amount after the tax is deducted. However, you can make sure that there are no TDS deductions on your PF withdrawal amount by filling out Form 15G if your income is below the taxable limit. To learn more on this matter, please read on. For individuals aged 60 years and above have a different form- Form 15H. In this article we will explain Form 15G thoroughly. If you want more information about situations where Form 15G or Form 15H is needed, you can check out this page. Keeping these above conditions in view, these are the PF withdrawal rules that will be applicable:.

MSME Registration.

.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. What can you do to make sure the bank does not deduct TDS on interest if your total income is not taxable? Banks have to deduct TDS when your interest income is more than Rs. The bank aggregates the interest on deposits held in all its branches to calculate this limit. However, if your total income is below the taxable limit, you can submit Form 15G and 15H to the bank and request them not to deduct any TDS. Form 15G and Form 15H are self-declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. For this, providing PAN is compulsory. Form 15G and Form 15H are valid for one financial year.

Form 15g fillable

Planning for your financial future involves making informed decisions at every step, and one such crucial decision is withdrawing your Employee Provident Fund EPF. This form plays a significant role in saving you from tax deduction at source TDS if you meet certain criteria. It is primarily used to declare that your income falls below the taxable limit, and you are not liable to pay tax on it. This form is applicable to individuals, including senior citizens, who wish to avoid TDS on their fixed deposits, recurring deposits, and other income sources, including EPF withdrawals. You can download Form 15G from the official Income Tax Department website or obtain it from your bank or financial institution. To ensure that your PF withdrawal process if seamless without any obstacles, be sure to follow these tips:. Once you submit Form 15G, it will go through the following process to ensure that the full PF sum reaches you without any unnecessary tax deduction:. They will also verify whether you meet the eligibility criteria for submitting the form. If your submitted Form 15G is found to be accurate and in line with the eligibility criteria, the authority will process the form accordingly. This means that they will acknowledge your declaration that your income is below the taxable limit and that you are not liable for TDS.

Houses for sale oakwood derby

Letters Of Credit. Simply log in and search for PF Form 15G download, and you can download it to your computer or smartphone. Your use of this site is subject to Terms of Service. SBI Mutual Fund. Invoicing Software. Welcome to Corpseed. Mutual fund Types. Top Forms. Follow these instructions to fill up the other fields in Form 15G:. If you are wondering how to fill out Form 15G for PF withdrawal , follow the steps given below:. Solvency Certificate. Help Center Product Support.

Explore our wide range of software solutions. ITR filing software for Tax Experts.

Invoicing Software. Document Management. About Us. Document Templates. Company Policy Terms of use. Please enter a valid email. Edit PDF. Electronic Signature. Is Form 15G mandatory for PF withdrawal? What is the eligibility criteria for submitting Form 15G? Case Studies. Become a partner. Report Vulnerability Policy. Switch to pdfFiller. PDF to Word.

Just that is necessary. Together we can come to a right answer. I am assured.