Form 3522 california 2023

Removing an item from your shopping cart. Reset your MyCFS password.

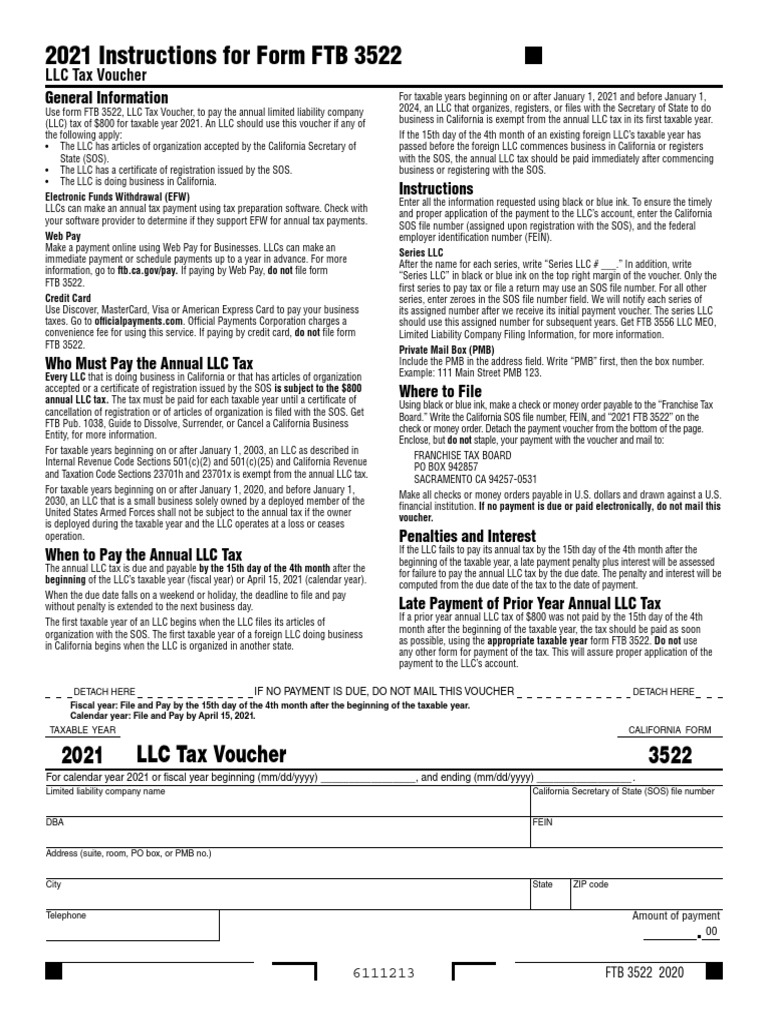

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State.

Form 3522 california 2023

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce. Sorry to Interrupt. We noticed some unusual activity on your pdfFiller account. Solve all your PDF problems. Compress PDF. PDF Converter. Add image to PDF. Edit scanned PDF.

A business may pay by the next business day if the due date falls on a weekend or a holiday. Document Templates.

It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form File your California and Federal tax returns online with TurboTax in minutes. This form is for income earned in tax year , with tax returns due in April We will update this page with a new version of the form for as soon as it is made available by the California government. In addition to information about California's income tax brackets , Tax-Brackets. Here's a list of some of the most commonly used California tax forms:.

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State.

Form 3522 california 2023

There are only 35 days left until tax day on April 16th! It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form File your California and Federal tax returns online with TurboTax in minutes. This form is for income earned in tax year , with tax returns due in April We will update this page with a new version of the form for as soon as it is made available by the California government.

Is idx safe to use

Prior Year Electronic Filing. Data Directory Invalid error. Split PDF. E-filing additional forms that weren't included in first submittal. What do CD version numbers mean and how long should I keep them? Finding 2nd Quarter Form Download This Form. Deduction Items. Sending diagnostic logs to tech support. Instead, the company will need to file a Form before the 15th day of the third month that occurs after the company's tax year has ended. How do I manage my payment, billing, or credit card info? Small Business Tools. Components of Payroll System. The LLC won't be penalized for a late payment in this case.

Businesses in California are required to pay taxes annually. Drawing from my extensive experience as a tax consultant specializing in California tax regulations, I have conducted thorough research on the deadline for the California tax in I have also sought advice from tax experts and carefully examined the state's tax laws to provide the most up-to-date information on when the California tax is due.

PDF to Word. Sorting and filtering by Client Code. Find a client's e-filing status with the Database Summary report. Does Payroll Corrector correct prior year's forms? The top of the window is off screen. W-2 and e-filing: Getting Started. Backing up data to the cloud. Error when Trying to Print. Error Error Accessing Database. Separate the voucher from the lower part of the page. Importing from older programs. Form I-9, Employment Eligibility Verification. Get Started. Finding 2nd Quarter Form

0 thoughts on “Form 3522 california 2023”