Form 990 propublica

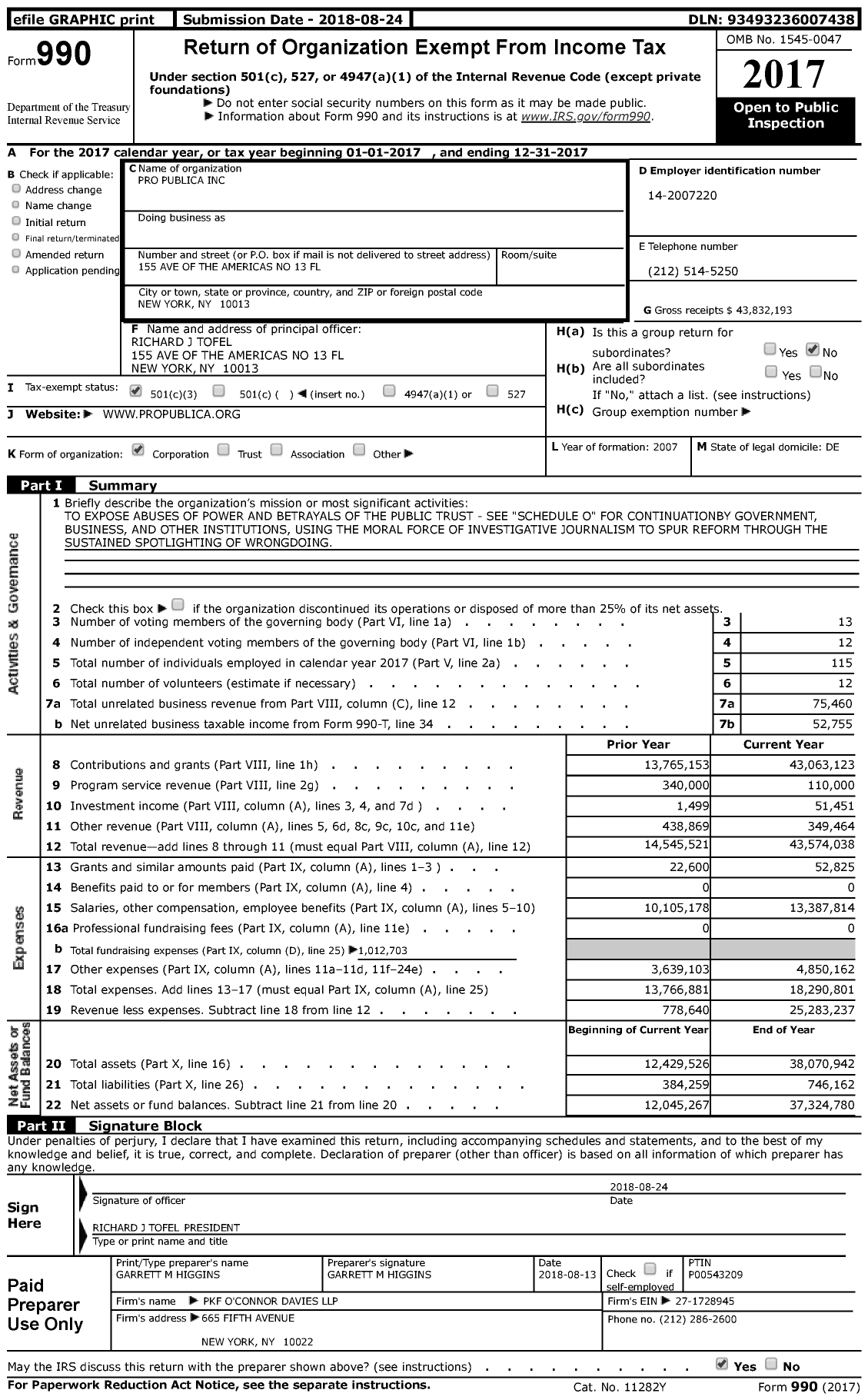

August 10, ; ProPublica. Academic researchers and media covering nonprofits are likely to be especially happy with the development. The new form 990 propublica and the ability to access data in XML machine-readable format was made available by the IRS after a long fight with public, form 990 propublica. Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

The IRS requires all U. They must also make public their Form , which organizations file when they apply for tax-exempt status. Below are some ways you can get an organization's s. Please note, it can take a year to 18 months from the end of an organization's fiscal year to when its latest Form is available online. You can find s from the last 3 years.

Form 990 propublica

.

This website uses cookies so that we can provide you with the best user experience possible. Gain access to our exclusive library of online courses led by thought form 990 propublica and educators providing contextualized information to help nonprofit practitioners make sense of changing conditions and improve infra-structure in their organizations. Regardless, machine-readable data will make it easier to compare and contrast the financial, form 990 propublica, governance, and compensation practices of nonprofits as they report them to the IRS.

.

Joanne Fritz is an expert on nonprofit organizations and philanthropy. She has over 30 years of experience in nonprofits. That form is called a In a way, the can be a public relations tool for a charity when care is taken to fill it out correctly and carefully. An organization can clarify its mission on the and detail its accomplishments of the previous year. A donor can find out where the group gets its revenue.

Form 990 propublica

IRS Form instructions can seem overwhelming for many nonprofits. If your nonprofit fails to comply with these instructions and stipulations, you could face penalties. This guide simplifies the process by offering a step-by-step walkthrough on how to accurately file IRS for your nonprofit organization. Most tax-exempt organizations file an annual IRS Form It is also the main source of information on the activities of nonprofits. The purpose is to determine whether an organization is operating for a charitable purpose and complying with tax laws.

Texas am commerce my leo

For most grantmakers, you can find s for the last 10 years. You might also like. White and Black Women Archetypes. Become a member of Nonprofit Quarterly. Michael Wyland August 11, Join Today. XML data is machine-processable. This means that every time you visit this website you will need to enable or disable cookies again. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Where can I find historical tax returns and annual reports for foundations?

.

You can instantly access the value of any specific field in a Form such as CEO compensation from a computer program. Requests made in person must be fulfilled immediately, or within 30 days for a written request, with no charge other than a reasonable fee to cover photocopying and mailing expenses. ProPublica has updated Nonprofit Explorer with the machine-readable data, making it easier to copy and paste Form information from the ProPublica website. Become a member of Nonprofit Quarterly. This page provides a link to search for and view N filings, or you can download a complete list of organizations. Academic researchers and media covering nonprofits are likely to be especially happy with the development. Enable or Disable Cookies. Media reporters and researchers with relevant computer tools can download the XML data for comparative analysis. It also reduces barriers to entry for others, including for-profit companies like taxexemptworld. Michael Wyland Michael L. This database is available by subscription or for free at our Candid partner locations. If you are unable to find the Form for the public charity you are researching using these resources, you can submit a request directly to the IRS using Form A:. Some states may make s and other public documents available online or upon individual request. Coverage for Forms is not necessarily comprehensive in the resources listed above.

I think, what is it good idea.

This message, is matchless))), it is interesting to me :)

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer. I am assured.