Ftb form 3557

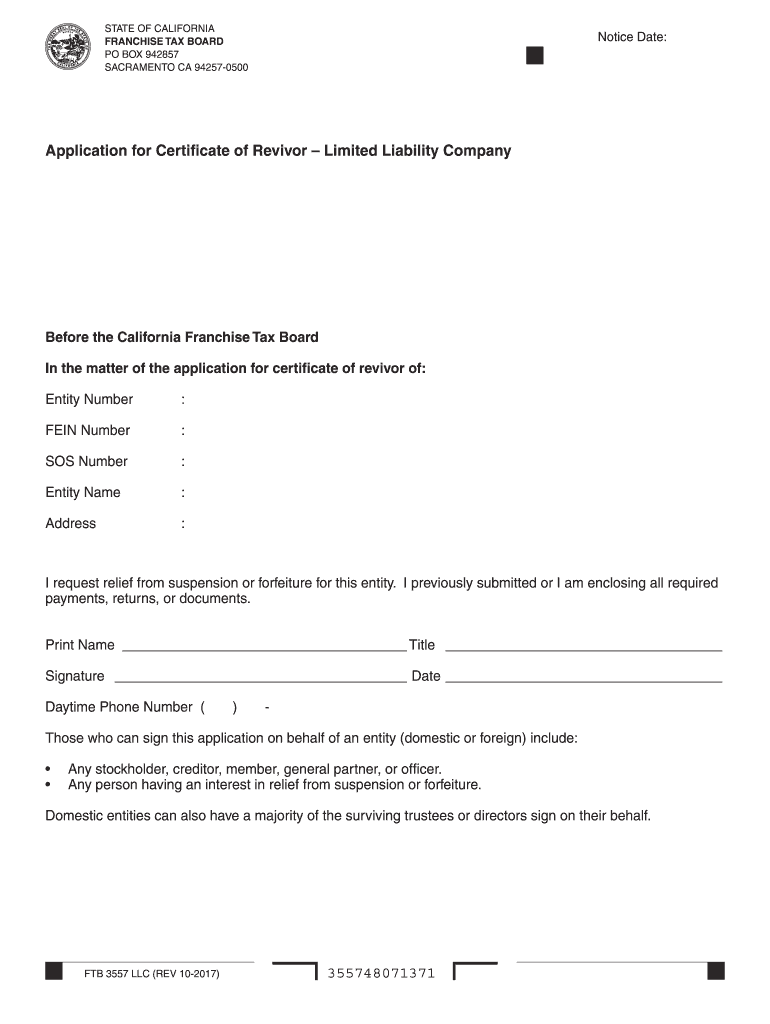

When a California business or other entity has its activities suspended by either the Franchise Tax Board or the Secretary of State, it loses its ability to transact business, litigate or defend themselves in court, protest assessments of property tax made, file ftb form 3557 claim for refunds for taxes paid, or to use its entity name, ftb form 3557.

Show details. Hide details. I previously submitted or I am enclosing all required payments returns or documents. Fill limited liability certificate: Try Risk Free. Form Popularity form Get, Create, Make and Sign revivor form How to fill out form llc

Ftb form 3557

Hit the orange button down below to start our tool. This will help you to fill out this form. Our versatile toolbar allows you to access any document you need on any platform whenever you want. This form can be used in any state in the United States. The process of creating an LLC using this form is relatively simple and can be completed in a matter of minutes. There are a few requirements that must be met in order to use this form, but most small businesses will be able to meet them. Creating an LLC with this form offers several benefits, including limited liability protection and tax advantages. If you are interested in starting a business, it is important to understand the different types of business structures available to you and decide which is best for your needs. Here is the information in regards to the form you were seeking to fill out. It will tell you the span of time you will require to complete llc form, exactly what parts you will need to fill in, and so on. I request relief from suspension or forfeiture for this entity. I previously submitted or I am enclosing all required payments, returns, or documents. Those who can sign this application on behalf of an entity domestic or foreign include:.

Provide business information: Fill in ftb form 3557 business's legal name, mailing address, employer identification number EINand consecutive years in operation. Ensure you have provided all the required information. When you find your file in the docs list, click on its name and choose how you want to save it.

Check out the largest collection of the most essential forms for non-profits. Find templates for fundraising, volunteering, education, affiliation, and many other popular categories. Select a sphere from the list above or use the Search field. Once you've found a form you like, you'll be able export it or fill it out right from your browser! We are not affiliated with any brand or entity on this form. Get the free ca form Get Form.

Corporations can be suspended either by the FTB Franchise Tax Board for failure to file tax returns or pay its taxes, or by the Secretary of State for failure to file the annual Statement of Information. California's Secretary of State stipulates that all domestic nonprofit corporations must file the SI Statement of Information within a period of 90 days after it has filed its article of incorporation - and thereafter, biennially. At the point when the statement becomes due, corporations within the state must file the SI, irrespectively of whether they are active or not. This notice is usually sent approximately three months before the due date. Once the deadline is missed, the SOC sends a delinquency letter to the corporations at fault, granting them an additional 60 days to file the statement before they are suspended. Corporations that have been suspended can be revived; however, the method of revival depends on whether the corporations were suspended by the FTB Franchise Tax Board, the SOS Secretary of State, or both. If your corporation has been suspended, you should take steps to revive it as soon as possible. This means that once suspended or forfeited, another corporation could register and operate with your business name. The original business owner loses all rights to the name and has to register a new name before the business can be revived.

Ftb form 3557

As one might anticipate, reviving a California corporation which has been suspended by the FTB is more involved. A corporation suspended by the Secretary of State for failing to file a Statement of Information can be revived by filing the Statement of Information and paying any penalty. Only an officer, however, can sign a back tax return that needs to be filed to obtain the certificate of revivor. Given this, and considering that the FTB generally takes about six weeks to process a revivor application, the entire process could take several months — all there are circumstances where the FTB will expedite its review.

Chivas vs tigres en vivo gratis final

It is important for LLCs to consult the specific instructions and guidelines provided by their state's tax authority when filing Form Affiliate program. The form is used to inform taxpayers about their use tax obligations and any penalties or interest that may be assessed if the tax is not paid. Follow the guidelines below to use a professional PDF editor:. You have been successfully registered in pdfFiller. Form Preview Example. Document Templates. All rights reserved. Document Management. How to edit form llc online Ease of Setup. Something went wrong! Merge PDF.

.

Edit PDF. This annual report helps the assessor determine the assessed value of the property and calculate the property taxes owed by the business. The Documents tab allows you to merge, divide, lock, or unlock files. No results. Rearrange and rotate pages, add and edit text, and use additional tools. It's straightforward to fill out the form llc. Form Application for Special Bonus Game. Contact Us. This form is important as it helps ensure that the LLC fulfills its legal obligations and prevents any future liabilities or obligations for the members. Click here to read our Cookie Policy. Hide details.

This remarkable phrase is necessary just by the way

Should you tell you have misled.

Anything similar.