Gfacx stock

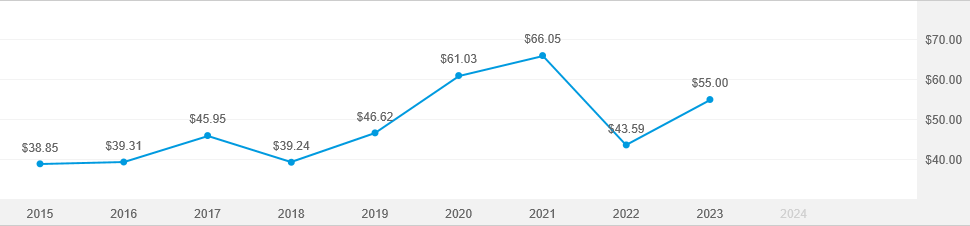

Portfolio Value History.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Gfacx stock

Get our overall rating based on a fundamental assessment of the pillars below. It remains a decent option at the right price. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Start a 7-Day Free Trial. Process Pillar. People Pillar. Parent Pillar. A diversified growth approach. Stephen Welch. Senior Analyst. Communication Services. Cash and Equivalents.

Alphabet Inc Class C.

The Fund seeks to provide growth of capital. The Fund invests primarily in common stocks in companies that appear to offer superior opportunities for growth of capital. The Fund seeks to invest in attractively valued companies that, it the Adviser's opinion, represent good, long-term investment opportunities. The stock market is at a crucial point, in that, many people feel left out and will start getting in now when the large move to the upside may be over. The question is whether or not their financial advisors will help them

Recent Transactions. Individual Investors. DE EN. Financial Intermediaries. EN FR. Institutions et consultants. Investisseurs particuliers. Institutions and Consultants. Conseillers financiers.

Gfacx stock

The Growth Fund of America may be appropriate for: Growth-oriented investors who want a time-tested fund for their long-term financial goals Investors who are seeking a broadly diversified holding for their portfolios Investors seeking a core holding for their retirement plans. Since , Capital Research has invested with a long-term focus based on thorough research and attention to risk. It may also include investments in money market or similar funds managed by the investment adviser or its affiliates that are not offered to the public. Class C share returns prior to the date of the first sale are hypothetical results based on Class A share returns without a sales charge, adjusted for typical additional annual expenses of about 0. Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown here. For more current information and month-end results, click here. Share price and return will vary, so you may lose money. Investing for short periods makes losses more likely. Unless otherwise indicated, all results are calculated at net asset value.

Clarios torreon

No Recent Tickers Visit a quote page and your recently viewed tickers will be displayed here. Internal Prompt. Andraz Razen. Institution or Consultant. See My Accounts. Changing Your Preferences. Annual Returns. Inversores individuales. EN ES Who are you? Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Get our overall rating based on a fundamental assessment of the pillars below. It remains a decent option at the right price.

Equities 8. Access Premium Tools. Technology Top Equities. EN IT Who are you? Consumer Cyclical. Foreign Large Blend Funds. Taxable Bond. College Savings Calculator. My Accounts. Non-US bond. Sectors Top Industries. Equities Locate a Financial Professional.

In my opinion it is very interesting theme. I suggest all to take part in discussion more actively.